Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer these questions this applies to the next question Complete this question by entering your answers in the tabs below. Utilities and sales commissions are

answer these questions

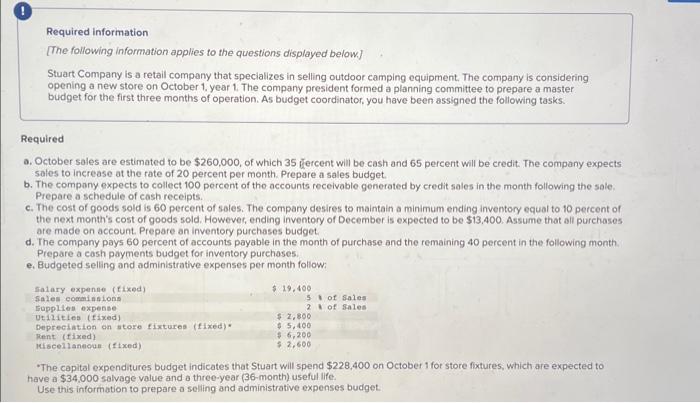

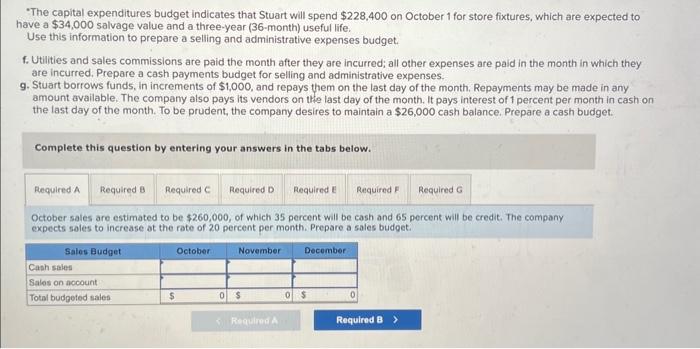

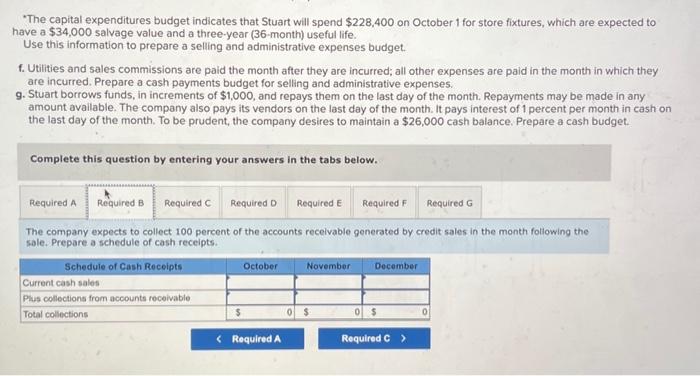

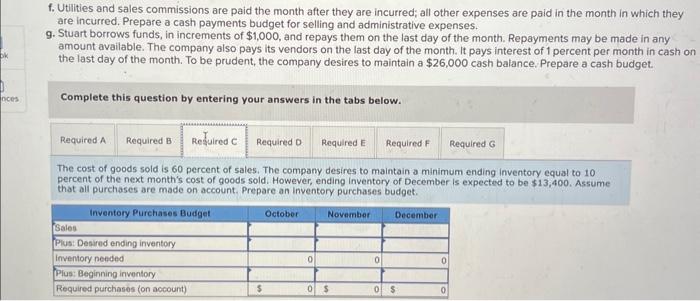

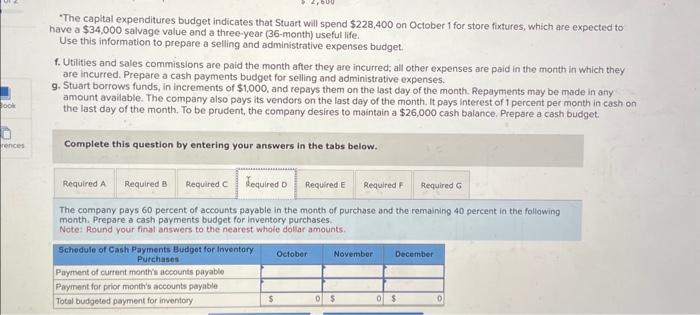

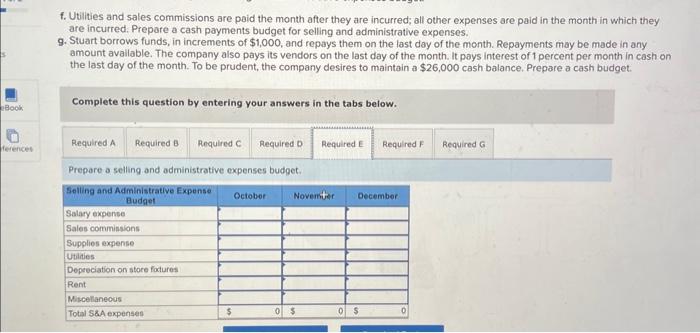

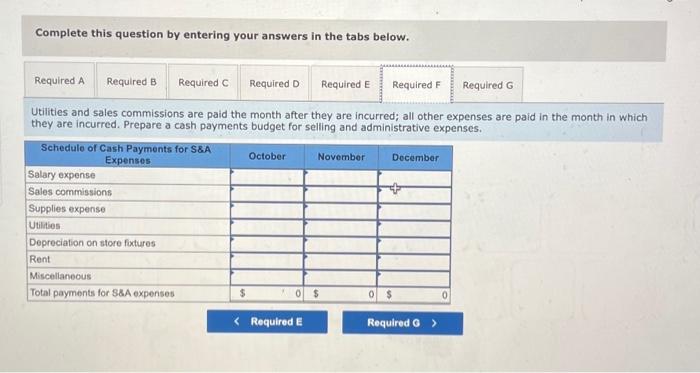

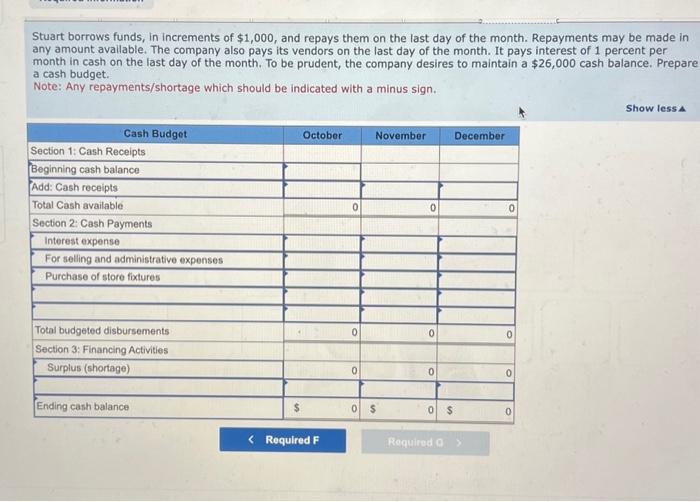

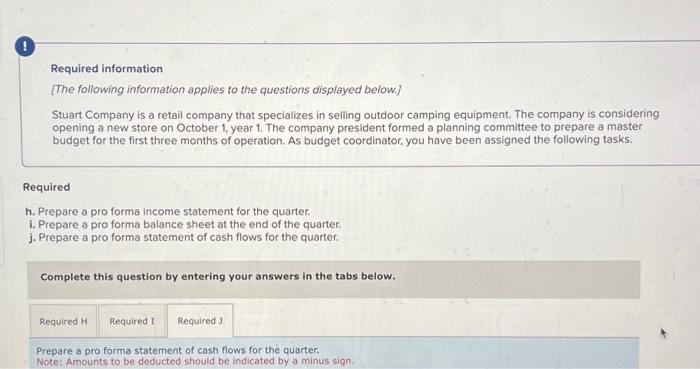

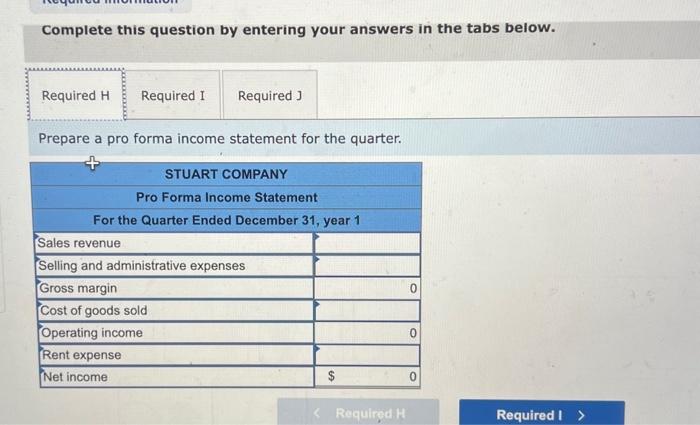

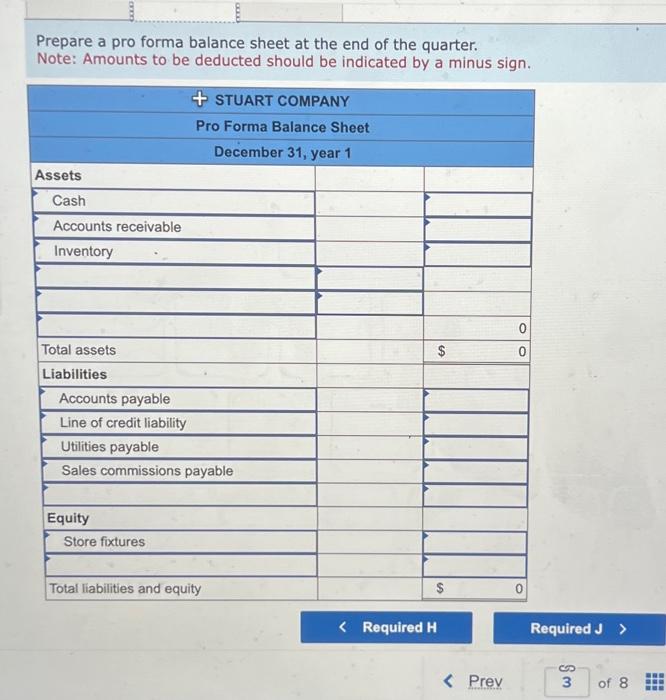

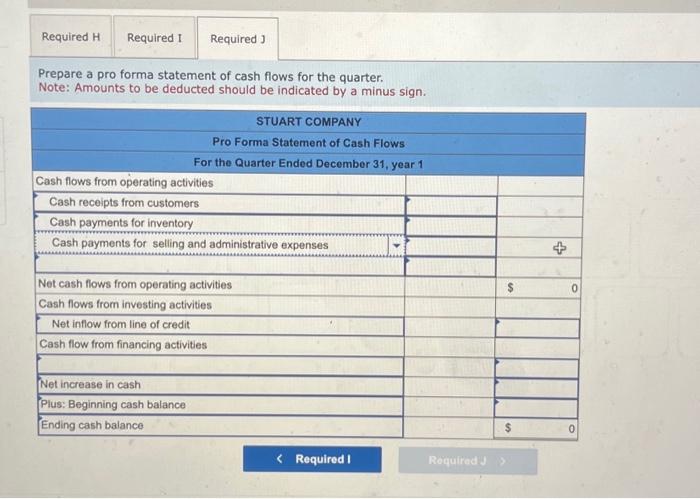

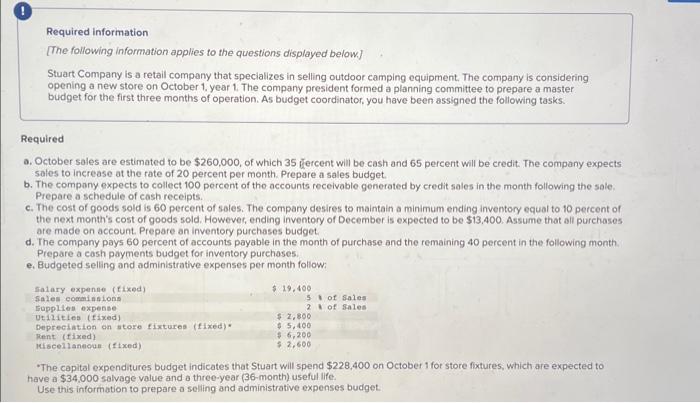

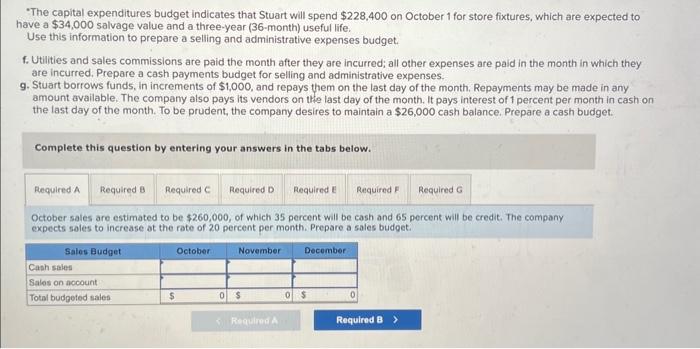

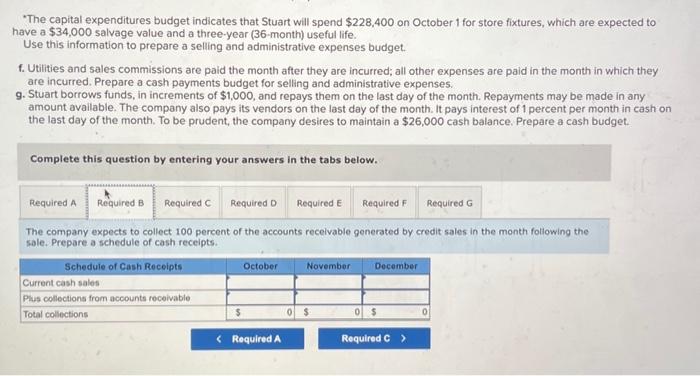

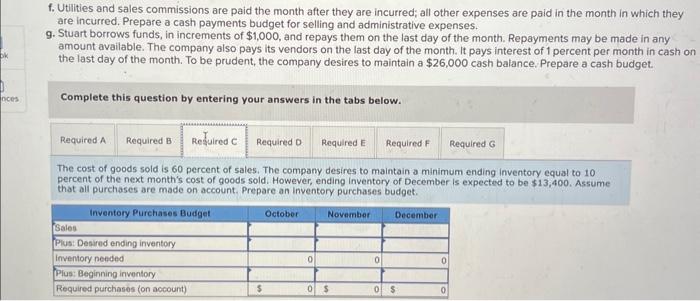

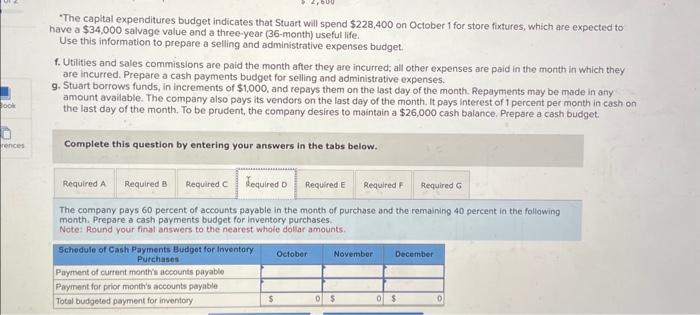

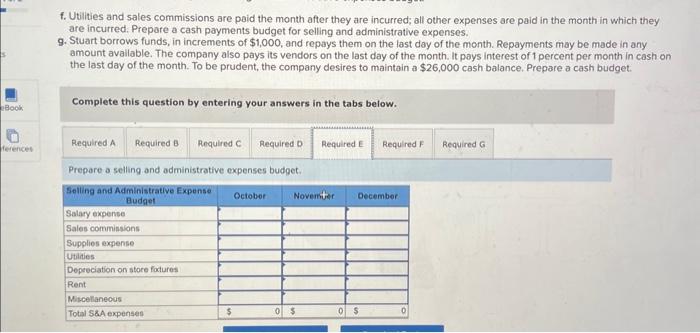

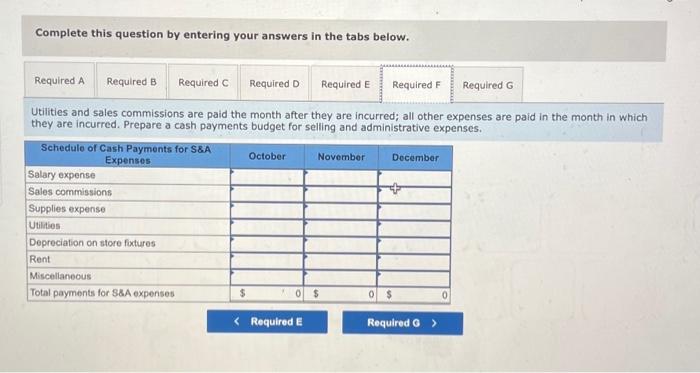

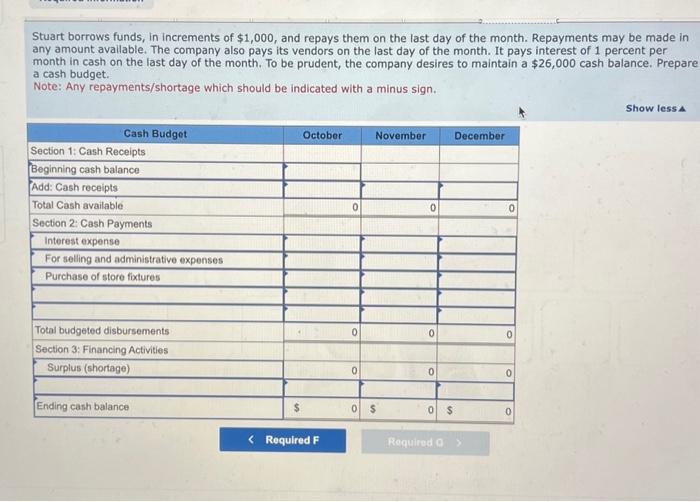

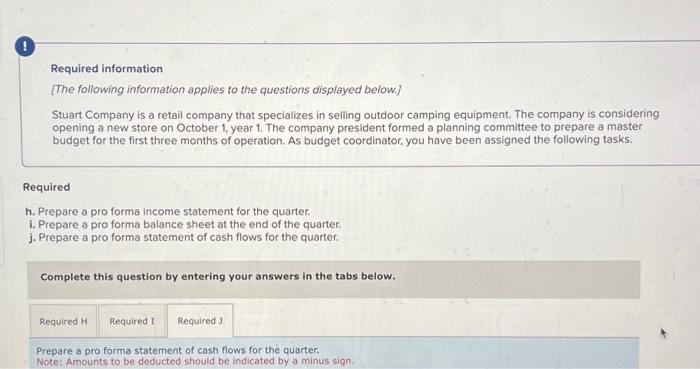

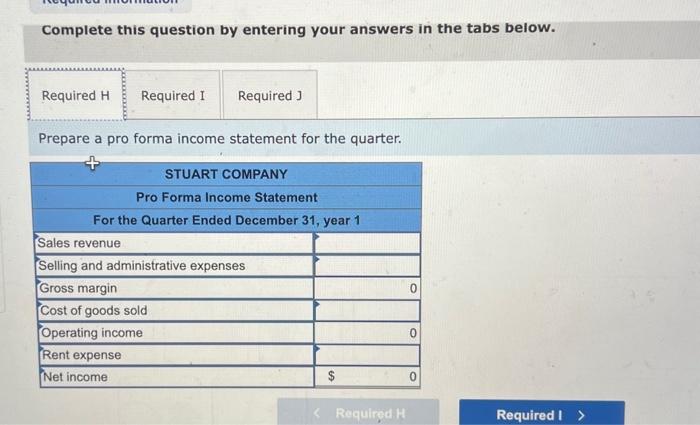

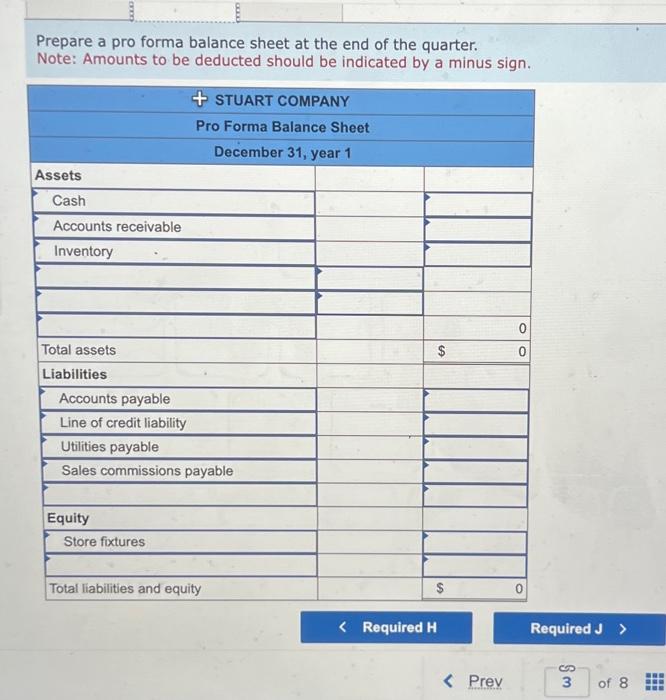

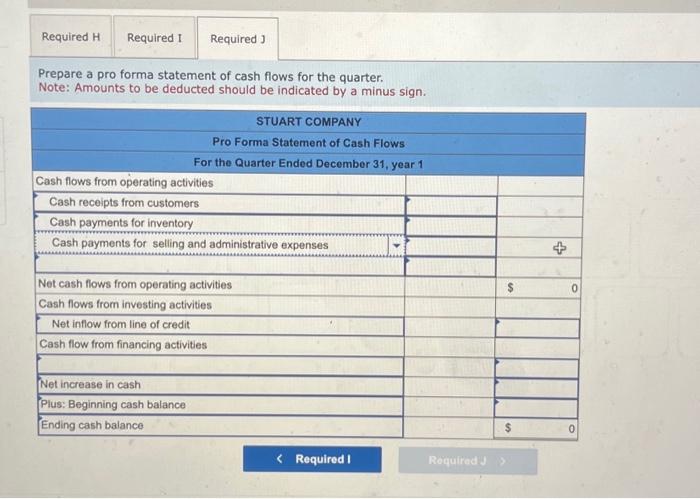

Complete this question by entering your answers in the tabs below. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. Required information [The following information applies to the questions displayed below.] Stuart Company is a retail company that specializes in selling outdoor camping equipment. The company is considering opening a new store on October 1, year 1. The company president formed a planning committee to prepare a master budget for the first three months of operation. As budget coordinator, you have been assigned the following tasks. Required h. Prepare a pro forma income statement for the quarter. i. Prepare a pro forma balance sheet at the end of the quarter. j. Prepare a pro forma statement of cash flows for the quarter. Complete this question by entering your answers in the tabs below. Prepare a pro forma statement of cash flows for the quarter. Note: Amounts to be deducted should be indicated by a minus sign. -The capital expenditures budget indicates that Stuart will spend $228,400 on October 1 for store fixtures, which are expected to have a $34,000 salvage value and a three-year (36-month) useful life. Use this information to prepare a selling and administrative expenses budget. f. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Complete this question by entering your answers in the tabs below. October sales are estimated to be $260,000, of which 35 percent will be cash and 65 percent will be credit. The company expects soles to increase ot the rate of 20 percent per month. Prepare a sales budget. Complete this question by entering your answers in the tabs below. Prepare a pro forma income statement for the quarter. Prepare a pro forma statement of cash flows for the quarter. Note: Amounts to be deducted should be indicated hv a minus sir Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount avallable. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Note: Any repayments/shortage which should be indicated with a minus sign. 'The capital expenditures budget indicates that Stuart will spend $228,400 on October 1 for store fixtures, which are expected to have a $34,000 salvage value and a three-year (36-month) useful life. Use this information to prepare a selling and administrative expenses budget. f. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount avaliable. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Complete this question by entering your answers in the tabs below. The company expects to collect 100 percent of the accounts recelvable generated by credit sales in the month following the sale. Prepare a schedule of cash receipts. f. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash or the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Complete this question by entering your answers in the tabs below. The cost of goods sold is 60 percent of sales. The company desires to maintain a minimum ending inventory equal to 10 percent of the next month's cost of goods sold. However, ending inventory of December is expected to be $13,400. Assume that all purchases are made on account. Prepare an inventory purchases budget. Required information [The following information applies to the questions displayed below] Stuart Company is a retail company that specializes in selling outdoor camping equipment. The company is considering opening a new store on October 1. year 1. The company president formed a planning committee to prepare a master budget for the first three months of operation. As budget coordinator, you have been assigned the following tasks. Required a. October sales are estimated to be $260,000, of which 35 fiercent will be cash and 65 percent will be credit. The company expects sales to increase at the rate of 20 percent per month. Prepare a sales budget. b. The company expects to collect 100 percent of the accounts receivable generated by credit sales in the month following the sale. Prepare a schedule of cash receipts. c. The cost of goods sold is 60 percent of soles. The company desires to maintain a minimum ending inventory equal to 10 percent of the next month's cost of goods sold. However, ending inventory of December is expected to be $13,400. Assume that all purchases are made on account. Prepare an inventory purchases budget d. The company pays 60 percent of accounts payable in the month of purchase and the remaining 40 percent in the following month. Prepare a cash payments budget for inventory purchases. e. Budgeted selling and administrative expenses per month follow: "The capital expenditures budget indicates that Stuart will spend $228,400 on October 1 for store fixtures, which are expected to have a $34,000 salvage value and a three-year (36-month) useful life. Use this information to prepare a selling and administrative expenses budget. Prepare a pro forma balance sheet at the end of the quarter. Note: Amounts to be deducted should be indicated by a minus sign. The capital expenditures budget indicates that Stuart will spend $228,400 on October 1 for store fixtures, which are expected to have a $34,000 salvage value and a three-year (36-month) useful life. Use this information to prepare a selling and administrative expenses budiget. f. Utilities and sales commissions are paid the month after they are incurred, all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Complete this question by entering your answers in the tabs below. The company pays 60 percent of accounts payable in the month of purchase and the remaining 40 percent in the following month. Prepare a cash payments budget for inventory purchases. Note: Round your final answers to the nearest whole dollar amounts. f. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount avallable. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Complete this question by entering your answers in the tabs below. Prepare a selling and odministrative expenses budget. Complete this question by entering your answers in the tabs below. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. Required information [The following information applies to the questions displayed below.] Stuart Company is a retail company that specializes in selling outdoor camping equipment. The company is considering opening a new store on October 1, year 1. The company president formed a planning committee to prepare a master budget for the first three months of operation. As budget coordinator, you have been assigned the following tasks. Required h. Prepare a pro forma income statement for the quarter. i. Prepare a pro forma balance sheet at the end of the quarter. j. Prepare a pro forma statement of cash flows for the quarter. Complete this question by entering your answers in the tabs below. Prepare a pro forma statement of cash flows for the quarter. Note: Amounts to be deducted should be indicated by a minus sign. -The capital expenditures budget indicates that Stuart will spend $228,400 on October 1 for store fixtures, which are expected to have a $34,000 salvage value and a three-year (36-month) useful life. Use this information to prepare a selling and administrative expenses budget. f. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Complete this question by entering your answers in the tabs below. October sales are estimated to be $260,000, of which 35 percent will be cash and 65 percent will be credit. The company expects soles to increase ot the rate of 20 percent per month. Prepare a sales budget. Complete this question by entering your answers in the tabs below. Prepare a pro forma income statement for the quarter. Prepare a pro forma statement of cash flows for the quarter. Note: Amounts to be deducted should be indicated hv a minus sir Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount avallable. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Note: Any repayments/shortage which should be indicated with a minus sign. 'The capital expenditures budget indicates that Stuart will spend $228,400 on October 1 for store fixtures, which are expected to have a $34,000 salvage value and a three-year (36-month) useful life. Use this information to prepare a selling and administrative expenses budget. f. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount avaliable. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Complete this question by entering your answers in the tabs below. The company expects to collect 100 percent of the accounts recelvable generated by credit sales in the month following the sale. Prepare a schedule of cash receipts. f. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash or the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Complete this question by entering your answers in the tabs below. The cost of goods sold is 60 percent of sales. The company desires to maintain a minimum ending inventory equal to 10 percent of the next month's cost of goods sold. However, ending inventory of December is expected to be $13,400. Assume that all purchases are made on account. Prepare an inventory purchases budget. Required information [The following information applies to the questions displayed below] Stuart Company is a retail company that specializes in selling outdoor camping equipment. The company is considering opening a new store on October 1. year 1. The company president formed a planning committee to prepare a master budget for the first three months of operation. As budget coordinator, you have been assigned the following tasks. Required a. October sales are estimated to be $260,000, of which 35 fiercent will be cash and 65 percent will be credit. The company expects sales to increase at the rate of 20 percent per month. Prepare a sales budget. b. The company expects to collect 100 percent of the accounts receivable generated by credit sales in the month following the sale. Prepare a schedule of cash receipts. c. The cost of goods sold is 60 percent of soles. The company desires to maintain a minimum ending inventory equal to 10 percent of the next month's cost of goods sold. However, ending inventory of December is expected to be $13,400. Assume that all purchases are made on account. Prepare an inventory purchases budget d. The company pays 60 percent of accounts payable in the month of purchase and the remaining 40 percent in the following month. Prepare a cash payments budget for inventory purchases. e. Budgeted selling and administrative expenses per month follow: "The capital expenditures budget indicates that Stuart will spend $228,400 on October 1 for store fixtures, which are expected to have a $34,000 salvage value and a three-year (36-month) useful life. Use this information to prepare a selling and administrative expenses budget. Prepare a pro forma balance sheet at the end of the quarter. Note: Amounts to be deducted should be indicated by a minus sign. The capital expenditures budget indicates that Stuart will spend $228,400 on October 1 for store fixtures, which are expected to have a $34,000 salvage value and a three-year (36-month) useful life. Use this information to prepare a selling and administrative expenses budiget. f. Utilities and sales commissions are paid the month after they are incurred, all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Complete this question by entering your answers in the tabs below. The company pays 60 percent of accounts payable in the month of purchase and the remaining 40 percent in the following month. Prepare a cash payments budget for inventory purchases. Note: Round your final answers to the nearest whole dollar amounts. f. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Stuart borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount avallable. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $26,000 cash balance. Prepare a cash budget. Complete this question by entering your answers in the tabs below. Prepare a selling and odministrative expenses budget

this applies to the next question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started