Answer These Questions:

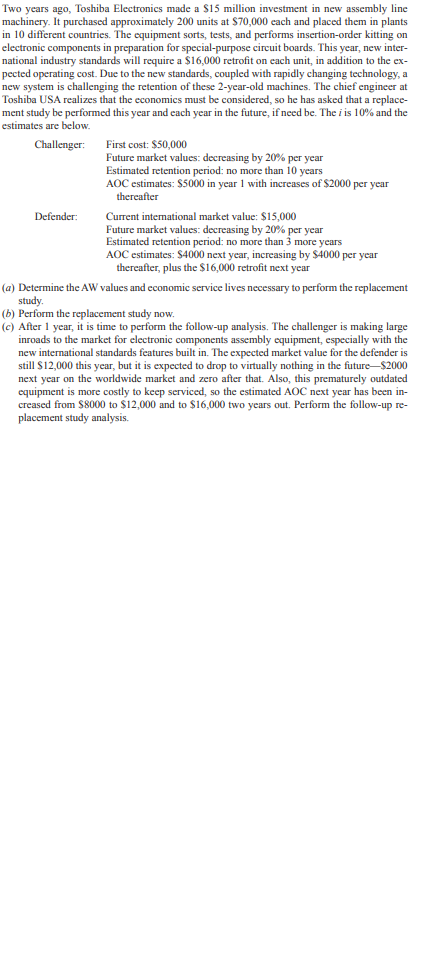

Two years ago, Toshiba Electronics made a $15 million investment in new assembly line machinery. It purchased approximately 200 units at $70,000 each and placed them in plants in 10 different countries. The equipment sorts, tests, and performs insertion-order kitting on electronic components in preparation for special-purpose circuit boards. This year, new inter- national industry standards will require a $16,000 retrofit on each unit, in addition to the ex- pected operating cost. Due to the new standards, coupled with rapidly changing technology, a new system is challenging the retention of these 2-year-old machines. The chief engineer at Toshiba USA realizes that the economics must be considered, so he has asked that a replace- ment study be performed this year and each year in the future, if need be. The i is 10% and the estimates are below. Challenger: First cost: $50,000 Future market values: decreasing by 20% per year Estimated retention period: no more than 10 years AOC estimates: $5000 in year I with increases of $2000 per year thereafter Defender: Current international market value: $15,000 Future market values: decreasing by 20% per year Estimated retention period: no more than 3 more years AOC estimates: $4000 next year, increasing by $4000 per year thereafter, plus the $16,000 retrofit next year (a) Determine the AW values and economic service lives necessary to perform the replacement study. (b) Perform the replacement study now. (c) After 1 year, it is time to perform the follow-up analysis. The challenger is making large inroads to the market for electronic components assembly equipment, especially with the new international standards features built in. The expected market value for the defender is still $12,000 this year, but it is expected to drop to virtually nothing in the future-$2000 next year on the worldwide market and zero after that. Also, this prematurely outdated equipment is more costly to keep serviced, so the estimated AOC next year has been in- creased from $8000 to $12,000 and to $16,000 two years out. Perform the follow-up re- placement study analysis.The annual worth values for a defender, which can be replaced with a similar used asset, and a chal. lenger are estimated. The defender should be re- placed: [a) Now (b) I year from now (c) 2 years from now () 3 years from now Number of AW Value, $ per Year Years Retained Defender Challenger -14,000 -21,000 OnC'EI- -16,900 -13,100 -17,000 -15 600 -18,000 - IT SOO\f\f\f