Answer these

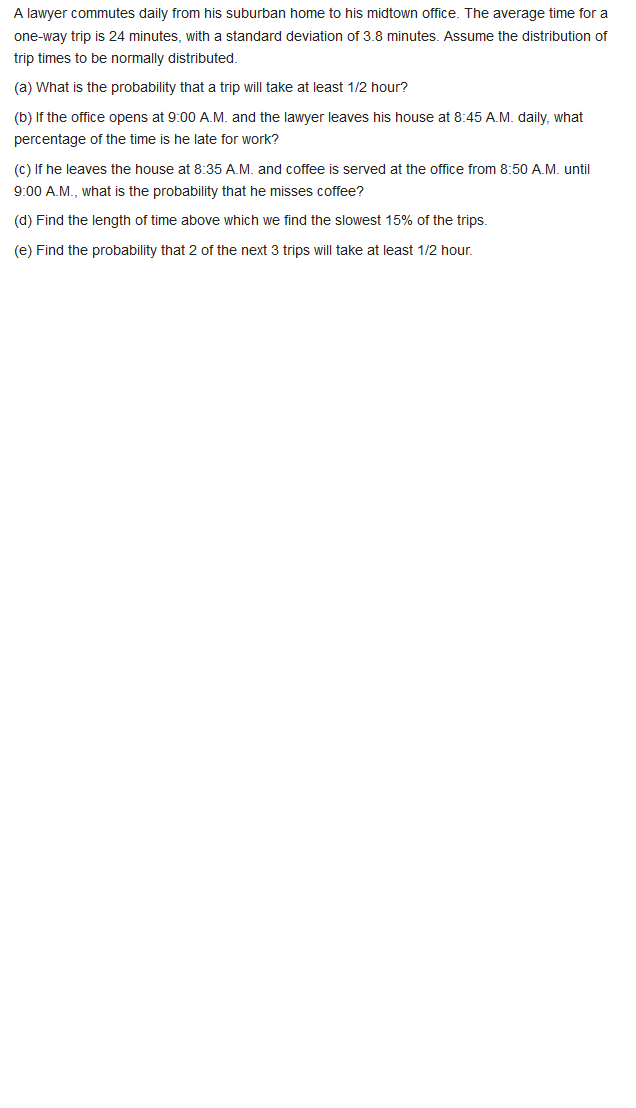

The independent project estimates below have been developed by the engineering and finance managers. The corporate MARR is 8%% per year, and the capital investment limit is $4 million. Se- lect the economically best projects using the PW method and (a) hand solution and (b) spreadsheet solution. Project NCF, Project Cost, 5 M Life, Years $ per Year -15 360,00D -3.0 10 600,000 -13 520,000 -20 820,GOD Use the PW method to evaluate four independent projects. Select as many as three of the four proj- ects. The MARR is 12% per year, and up to $16,000 in capital investment fiands are available. Project ment, 5 -5000 -8,000 -9,000 - 10,000 cars 5 NOF Estimates, $ per Wear 1000 500 50DO 1700 SODO 2400 500 2000 3000 500 17,00D 3900 10,500Guardian is a national manufacturing company of home health care appliances. It is faced with a make-or-buy decision. A newly engineered lift can be installed in a car trunk to raise and lower a wheelchair. The steel arm of the lift can be purchased internationally for $3.50 per unit or made in-house. If manufactured on site, two machines will be requi Machine A is esti- iated to cost $18,000, have a life of 6 years, and machine B will cost $12,000, have a life of 4 years, and have a $-500 salvage value (carry-away cost). Ma- chine A will require an overhaul after 3 years costing $3000. The annual operating cost for machine A is expected to be $6000 per year and for machine B is $5000 per year. A total of four 's at a rate of $12 30 per hour per operator. In a normal 8-hour period, the operator an produce parts sufficient to manufact ture 1000 units. Use a MARR of 15%% per year to determine the following- (a) Number of units to manufacture each year to justify the in-house (make) option. (b) The maximum capital expense justifiable to purchase machine A, assuming all other esti- mates for machines A and B are as stated. The company expects to produce 10,000 units per year.For the last 2 years, The Health Company has experienced a fixed cost of $850,000 per year and an (r - v) value of $1.25 per unit for its multivitamin line of products. International competition has become severe enough that some financial changes must be made to keep market share at the current level. (a) Perform a spreadsheet-based graphical anal- ysis to estimate the effect on the breakeven point if the differen etween revenue and variable cost per unit somewhere between 1% and 15% of its current value. (b) If fixed costs and revenue per unit remain at their current values, what type of change must take place to make the breakeven point go down? (This is an extension of Problem 13.15) Expand the analysis performed in Problem 13.15 by chang- ing the variable cost per unit. The financial man- ager estimates that fixed costs will fall to $730,000 when the required production rate to break even is at or below 600,000 units. What happens to the breakeven points over the (r - v) range of 1%: to 13%% increase as evaluated previously?\f\f