Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer this and explain 3. New Mexico Income Taxes: How did income taxes change between 2004 and 2020? Explain how much someone earning $30,000 would

answer this and explain

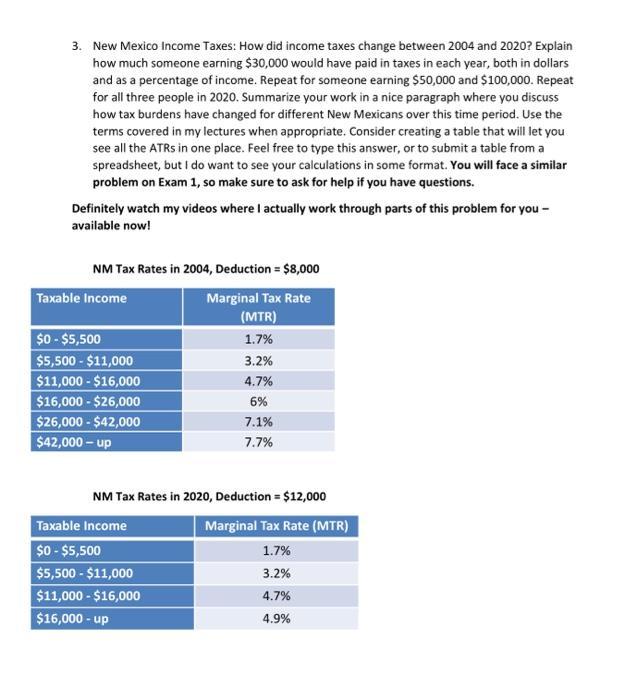

3. New Mexico Income Taxes: How did income taxes change between 2004 and 2020? Explain how much someone earning $30,000 would have paid in taxes in each year, both in dollars and as a percentage of income. Repeat for someone earning $50,000 and $100,000. Repeat for all three people in 2020. Summarize your work in a nice paragraph where you discuss how tax burdens have changed for different New Mexicans over this time period. Use the terms covered in my lectures when appropriate. Consider creating a table that will let you see all the ATRS in one place. Feel free to type this answer, or to submit a table from a spreadsheet, but I do want to see your calculations in some format. You will face a similar problem on Exam 1, so make sure to ask for help if you have questions. Definitely watch my videos where I actually work through parts of this problem for you - available now! NM Tax Rates in 2004, Deduction = $8,000 Taxable Income Marginal Tax Rate (MTR) $0 - $5,500 1.7% $5,500 - $11,000 3.2% $11,000 - $16,000 4.7% $16,000-$26,000 6% $26,000 - $42,000 7.1% $42,000-up 7.7% NM Tax Rates in 2020, Deduction = $12,000 Taxable Income $0-$5,500 $5,500 - $11,000 $11,000 - $16,000 $16,000-up Marginal Tax Rate (MTR) 1.7% 3.2% 4.7% 4.9%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started