Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER THIS ASAPPP!! This quention has multiple parts. A farmer sows a certain crop. It costs $250,000 to buy the seed, prepare the ground, and

ANSWER THIS ASAPPP!!

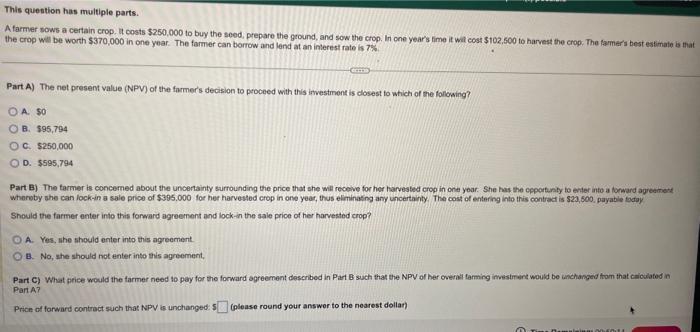

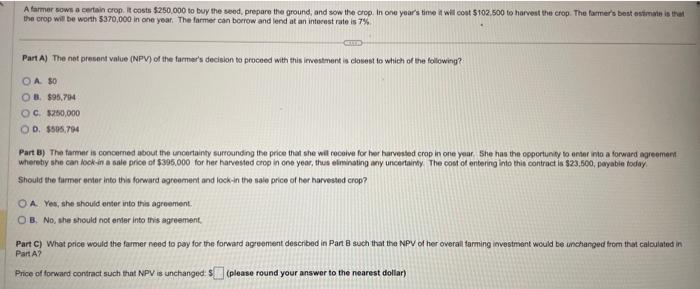

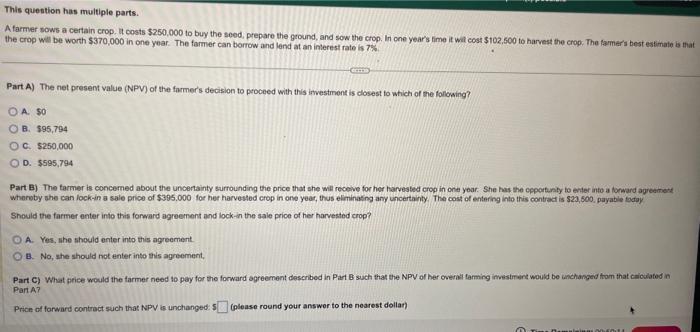

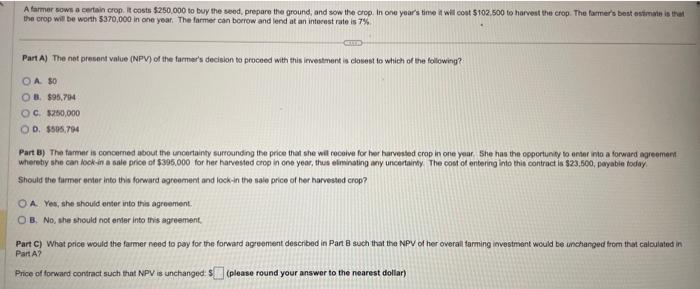

This quention has multiple parts. A farmer sows a certain crop. It costs $250,000 to buy the seed, prepare the ground, and sow the crop. In cone years fime it wit cost $102,500 to harvest the crop. The famer's best estimate is that the crop will be worth $370,000 in one year. The farmer can borrow and lend at an interest rate is 7%. Part A) The net present value (NPV) of the former's decision to proceed with this imvestment is closest to which of me follosing? A. 50 B. 595,794 C. $250,000 D. $595,794 Part B) The tarmer is concemed about the uncentainty surrounding the price that she will receve for her harvested crop in one year: She has the cpportunty to enter into a forward agreemeve Whareby she can lock-in a sale price of $395,000 for her harvestod crop in one yeac, thus eliminating any uncertainty. The coss of entering into this contrad is $22,500, payable todey Should the farmer anter into this fonward agreenent and lock-in the sale price of her harvested crop? A. Yes, she should enter into this agreement. B. No, she should not enter into this agrement, Part c) What pirice would the farmer need to pay for the forward agreement descrbed in Part 8 such that the NPV of her overnit larming imbistriare would be unchanged fiom that caiculatod in PariA? Price of forward contract such that NPV is unchanged: (please round your answer to the nearest dollar) A tarmer sows a certain cop. it cests $250,000 to buy the seod, prepare the ground, and sow the crop. In one yoars tine it will cost $102.500 to harvent the crop. The famer's best ostinain is than the crop wil be worth 5370,000 in coe year. The farmer can borrow and lend at an intocest rate is 7% Part A) The net present value (NPV) of the farmer's decision to proceed with this imestment is closest to which of the following? A. 80 0. 895,704 c. 5250,000 0. 5905,794 Part B) The famer is concemed about the uncartainty surrounding the price that she wil rocoive for her harvented crop in one year. She has the opportuniy to enter imo a forward agreement whereby she can look-in a sale price of $395.000 for her harvested crop in one yeog, thes eliminating any uncertainfy The cost of entering into this contract is $23.500, payabie today. Should the farmer enter into this forward agreement and lock-in the sale price of her harvested crop? A. Yes, she should enter into tha agreement. B. No, she should not enter into this agreement. Part c) What price would the farmer need to pay for the forward agreement described in Part B such that the NPV of her overall tarming investment would be unchanged trom that calculated in Part A? Price of forward contract such that NPV is unchanged:s (please found your answer to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started