Answer this:

Based on this:

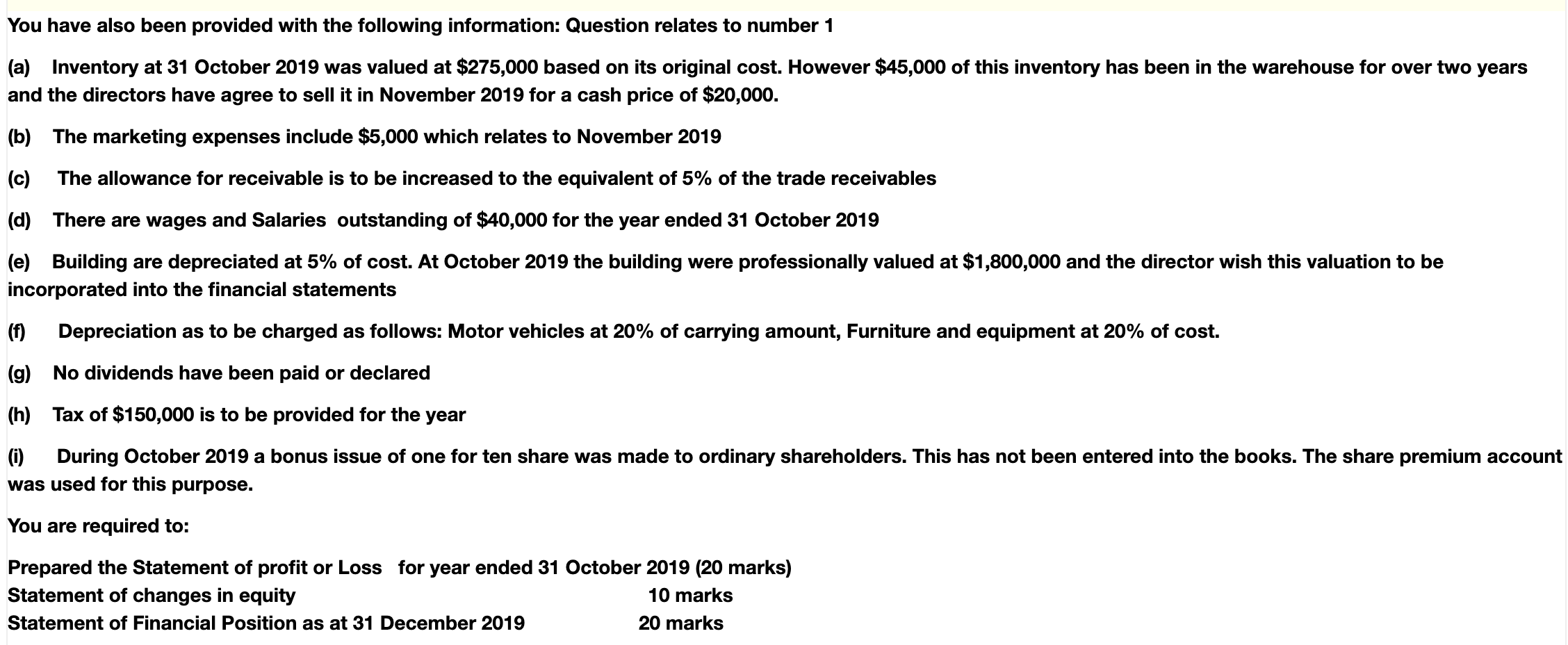

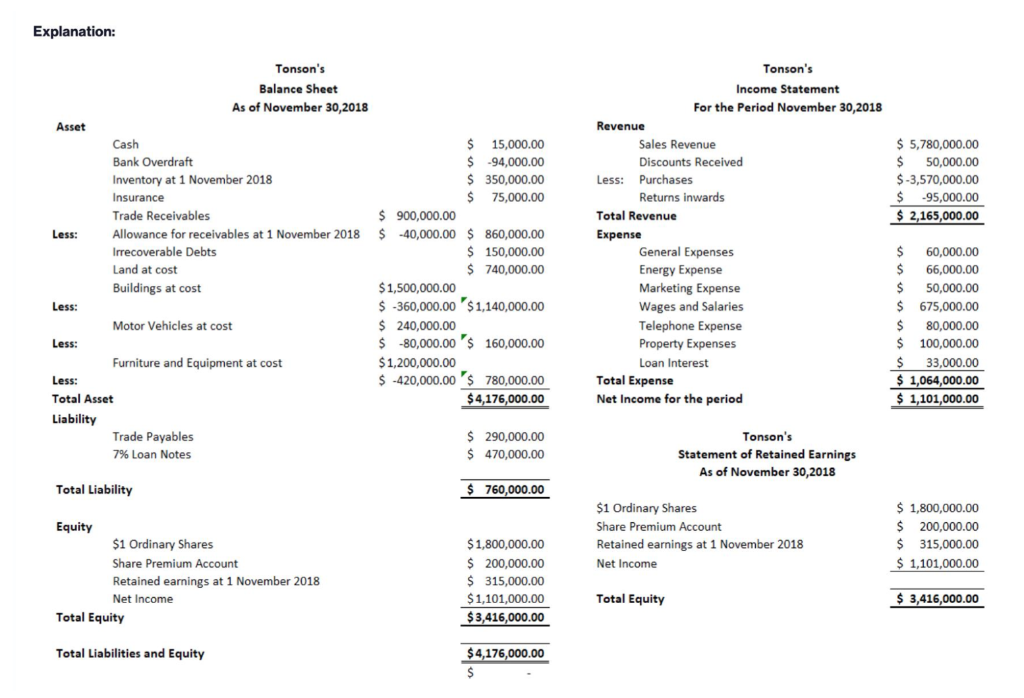

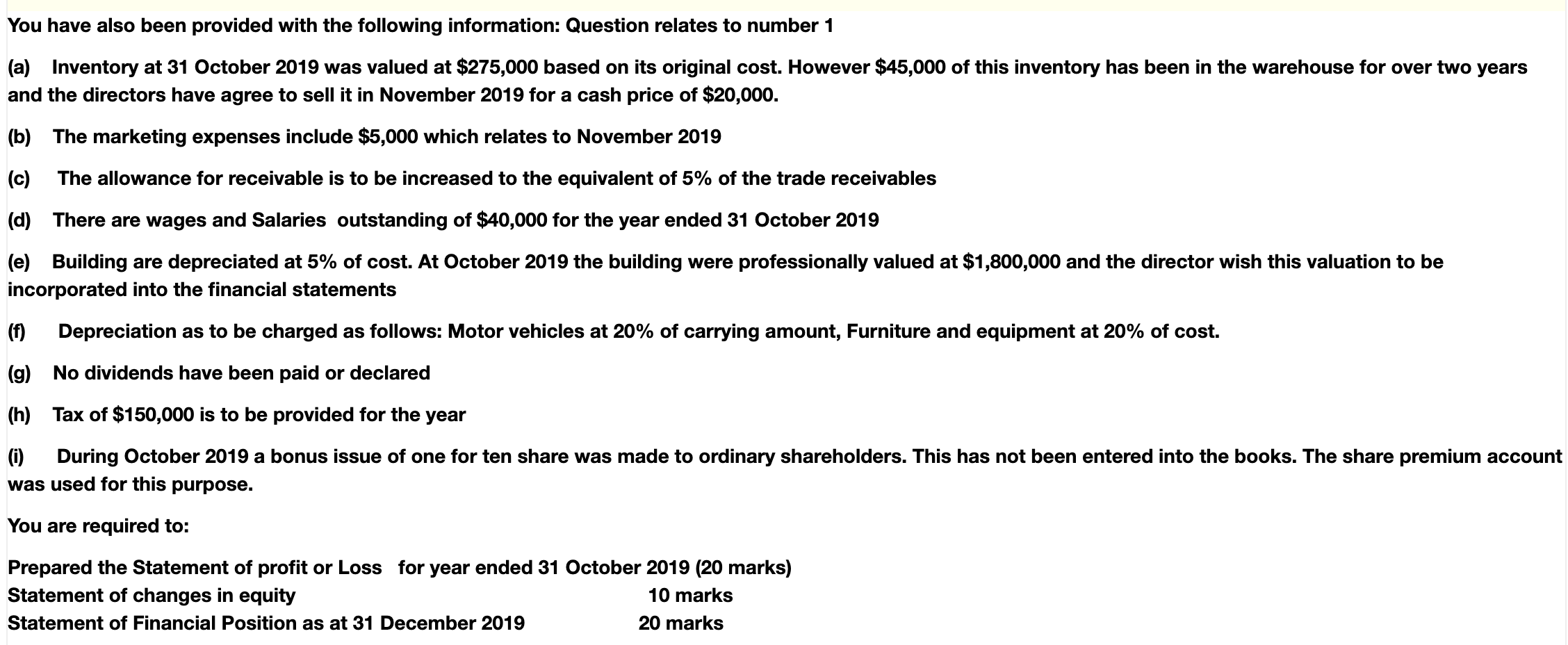

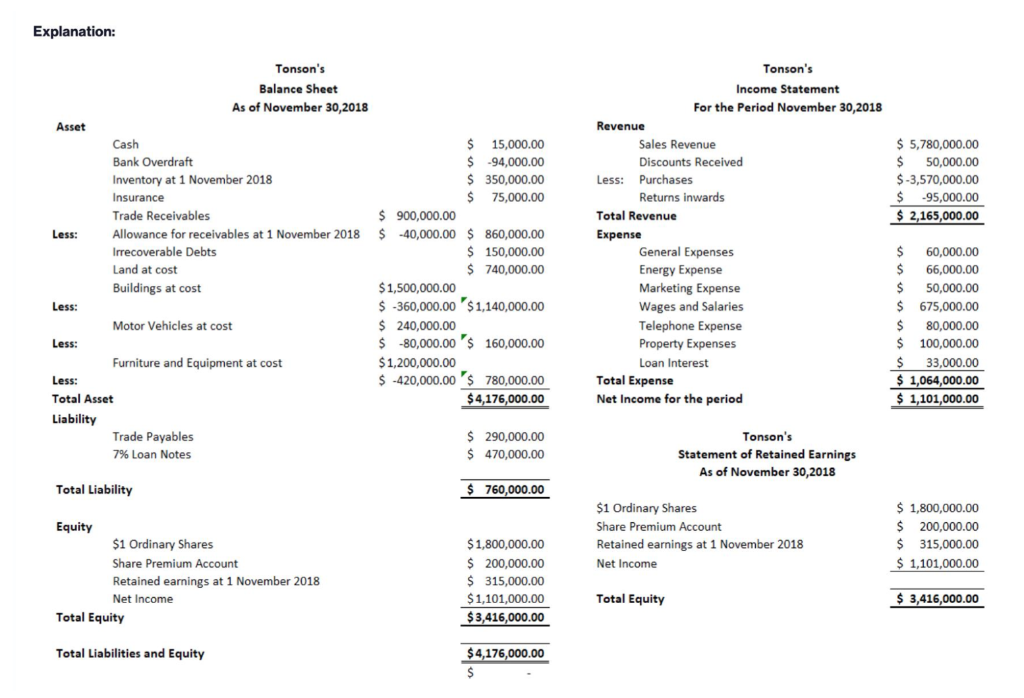

You have also been provided with the following information: Question relates to number 1 (a) Inventory at 31 October 2019 was valued at $275,000 based on its original cost. However $45,000 of this inventory has been in the warehouse for over two years and the directors have agree to sell it in November 2019 for a cash price of $20,000. (b) The marketing expenses include $5,000 which relates to November 2019 (c) The allowance for receivable is to be increased to the equivalent of 5% of the trade receivables (d) There are wages and Salaries outstanding of $40,000 for the year ended 31 October 2019 (e) Building are depreciated at 5% of cost. At October 2019 the building were professionally valued at $1,800,000 and the director wish this valuation to be incorporated into the financial statements (f) Depreciation as to be charged as follows: Motor vehicles at 20% of carrying amount, Furniture and equipment at 20% of cost. (g) No dividends have been paid or declared (h) Tax of $150,000 is to be provided for the year (0) During October 2019 a bonus issue of one for ten share was made to ordinary shareholders. This has not been entered into the books. The share premium account was used for this purpose. You are required to: Prepared the Statement of profit or Loss for year ended 31 October 2019 (20 marks) Statement of changes in equity 10 marks Statement of Financial Position as at 31 December 2019 20 marks Explanation: $ 5,780,000.00 $ 50,000.00 $-3,570,000.00 $ -95,000.00 $ 2,165,000.00 Tonson's Balance Sheet As of November 30, 2018 Asset Cash $ 15,000.00 Bank Overdraft $ -94,000.00 Inventory at 1 November 2018 $ 350,000.00 Insurance $ 75,000.00 Trade Receivables $ 900,000.00 Less: Allowance for receivables at 1 November 2018 $ 40,000.00 $ 860,000.00 Irrecoverable Debts $ 150,000.00 Land at cost $ 740,000.00 Buildings at cost $1,500,000.00 Less: $ -360,000.00 $ 1,140,000.00 Motor Vehicles at cost $ 240,000.00 Less: $ -80,000.00'S 160,000.00 Furniture and Equipment at cost $1,200,000.00 Less: $ 420,000.00 $ 780,000.00 Total Asset $ 4,176,000.00 Liability Trade Payables $ 290,000.00 7% Loan Notes $ 470,000.00 Tonson's Income Statement For the Period November 30, 2018 Revenue Sales Revenue Discounts Received Less: Purchases Returns inwards Total Revenue Expense General Expenses Energy Expense Marketing Expense Wages and Salaries Telephone Expense Property Expenses Loan Interest Total Expense Net Income for the period $ 60,000.00 $ 66,000.00 $ 50,000.00 $ 675,000.00 $ 80,000.00 $ 100,000.00 $ 33,000.00 $ 1,064,000.00 $ 1,101,000.00 Tonson's Statement of Retained Earnings As of November 30,2018 Total Liability $ 760,000.00 $1 Ordinary Shares Share Premium Account Retained earnings at 1 November 2018 Net Income $ $ 1,800,000.00 $ 200,000.00 $ 315,000.00 $ 1,101,000.00 Equity $1 Ordinary Shares Share Premium Account Retained earnings at 1 November 2018 Net Income Total Equity $1,800,000.00 $ 200,000.00 $ 315,000.00 $ 1,101,000.00 $3,416,000.00 Total Equity $ 3,416,000.00 Total Liabilities and Equity $ 4,176,000.00 $ You have also been provided with the following information: Question relates to number 1 (a) Inventory at 31 October 2019 was valued at $275,000 based on its original cost. However $45,000 of this inventory has been in the warehouse for over two years and the directors have agree to sell it in November 2019 for a cash price of $20,000. (b) The marketing expenses include $5,000 which relates to November 2019 (c) The allowance for receivable is to be increased to the equivalent of 5% of the trade receivables (d) There are wages and Salaries outstanding of $40,000 for the year ended 31 October 2019 (e) Building are depreciated at 5% of cost. At October 2019 the building were professionally valued at $1,800,000 and the director wish this valuation to be incorporated into the financial statements (f) Depreciation as to be charged as follows: Motor vehicles at 20% of carrying amount, Furniture and equipment at 20% of cost. (g) No dividends have been paid or declared (h) Tax of $150,000 is to be provided for the year (0) During October 2019 a bonus issue of one for ten share was made to ordinary shareholders. This has not been entered into the books. The share premium account was used for this purpose. You are required to: Prepared the Statement of profit or Loss for year ended 31 October 2019 (20 marks) Statement of changes in equity 10 marks Statement of Financial Position as at 31 December 2019 20 marks Explanation: $ 5,780,000.00 $ 50,000.00 $-3,570,000.00 $ -95,000.00 $ 2,165,000.00 Tonson's Balance Sheet As of November 30, 2018 Asset Cash $ 15,000.00 Bank Overdraft $ -94,000.00 Inventory at 1 November 2018 $ 350,000.00 Insurance $ 75,000.00 Trade Receivables $ 900,000.00 Less: Allowance for receivables at 1 November 2018 $ 40,000.00 $ 860,000.00 Irrecoverable Debts $ 150,000.00 Land at cost $ 740,000.00 Buildings at cost $1,500,000.00 Less: $ -360,000.00 $ 1,140,000.00 Motor Vehicles at cost $ 240,000.00 Less: $ -80,000.00'S 160,000.00 Furniture and Equipment at cost $1,200,000.00 Less: $ 420,000.00 $ 780,000.00 Total Asset $ 4,176,000.00 Liability Trade Payables $ 290,000.00 7% Loan Notes $ 470,000.00 Tonson's Income Statement For the Period November 30, 2018 Revenue Sales Revenue Discounts Received Less: Purchases Returns inwards Total Revenue Expense General Expenses Energy Expense Marketing Expense Wages and Salaries Telephone Expense Property Expenses Loan Interest Total Expense Net Income for the period $ 60,000.00 $ 66,000.00 $ 50,000.00 $ 675,000.00 $ 80,000.00 $ 100,000.00 $ 33,000.00 $ 1,064,000.00 $ 1,101,000.00 Tonson's Statement of Retained Earnings As of November 30,2018 Total Liability $ 760,000.00 $1 Ordinary Shares Share Premium Account Retained earnings at 1 November 2018 Net Income $ $ 1,800,000.00 $ 200,000.00 $ 315,000.00 $ 1,101,000.00 Equity $1 Ordinary Shares Share Premium Account Retained earnings at 1 November 2018 Net Income Total Equity $1,800,000.00 $ 200,000.00 $ 315,000.00 $ 1,101,000.00 $3,416,000.00 Total Equity $ 3,416,000.00 Total Liabilities and Equity $ 4,176,000.00 $