Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer this in 2 hours Q.5: Annual Financial Report data of Karachi Engineering Ltd. is provided bellow. Karachi Engineering Ltd. Balance Sheet Liabilities and Owners'

Answer this in 2 hours

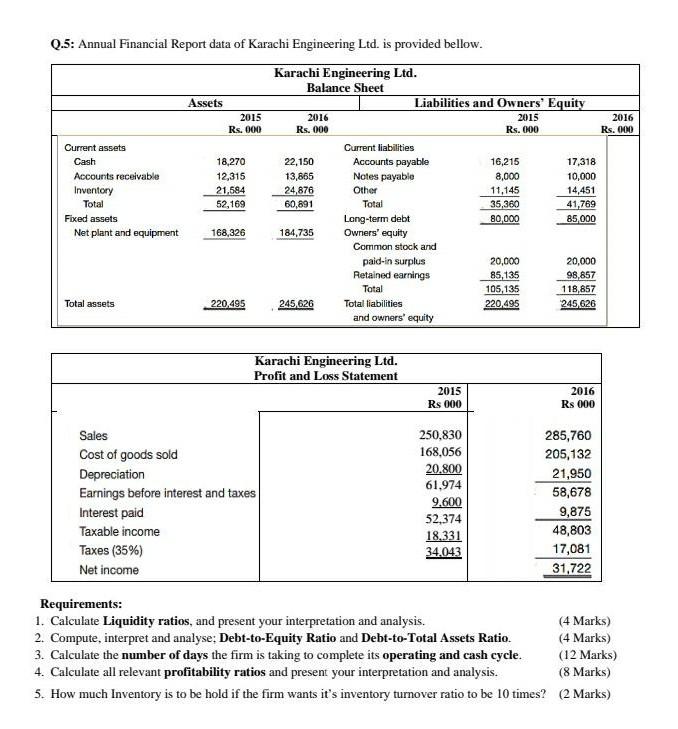

Q.5: Annual Financial Report data of Karachi Engineering Ltd. is provided bellow. Karachi Engineering Ltd. Balance Sheet Liabilities and Owners' Equity Assets 2015 Rs. 000 2016 Rs. 000 2015 Rs. 000 2016 Rs.000 Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment 18,270 12,315 21,584 52,169 22,150 13,865 24,876 60,891 16,215 8,000 11,145 35,360 80,000 17,318 10,000 14,451 41 769 85000 168,326 184,735 Current liabilities Accounts payable Notes payable Other Total Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total Total liabilities and owners' equity 20,000 85,135 105,135 220,495 20,000 98,857 118,857 245, 626 Total assets 220 495 245 626 Karachi Engineering Ltd. Profit and Loss Statement 2015 Rs 000 2016 Rs 000 Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (35%) Net income 250,830 168,056 20.800 61.974 9.600 52,374 18.331 34.043 285,760 205,132 21,950 58,678 9,875 48,803 17,081 31,722 Requirements: 1. Calculate Liquidity ratios, and present your interpretation and analysis. (4 Marks) 2. Compute, interpret and analyse: Debt-to-Equity Ratio and Debt-to-Total Assets Ratio. (4 Marks) 3. Calculate the number of days the firm is taking to complete its operating and cash cycle. (12 Marks) 4. Calculate all relevant profitability ratios and present your interpretation and analysis. (8 Marks) 5. How much Inventory is to be hold if the firm wants it's inventory turnover ratio to be 10 times? (2 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started