Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer this question... as soon as possible.... with proper calculations and method Being a junior member of Tabasum and Co, Pass the relevant journal and

Answer this question... as soon as possible.... with proper calculations and method

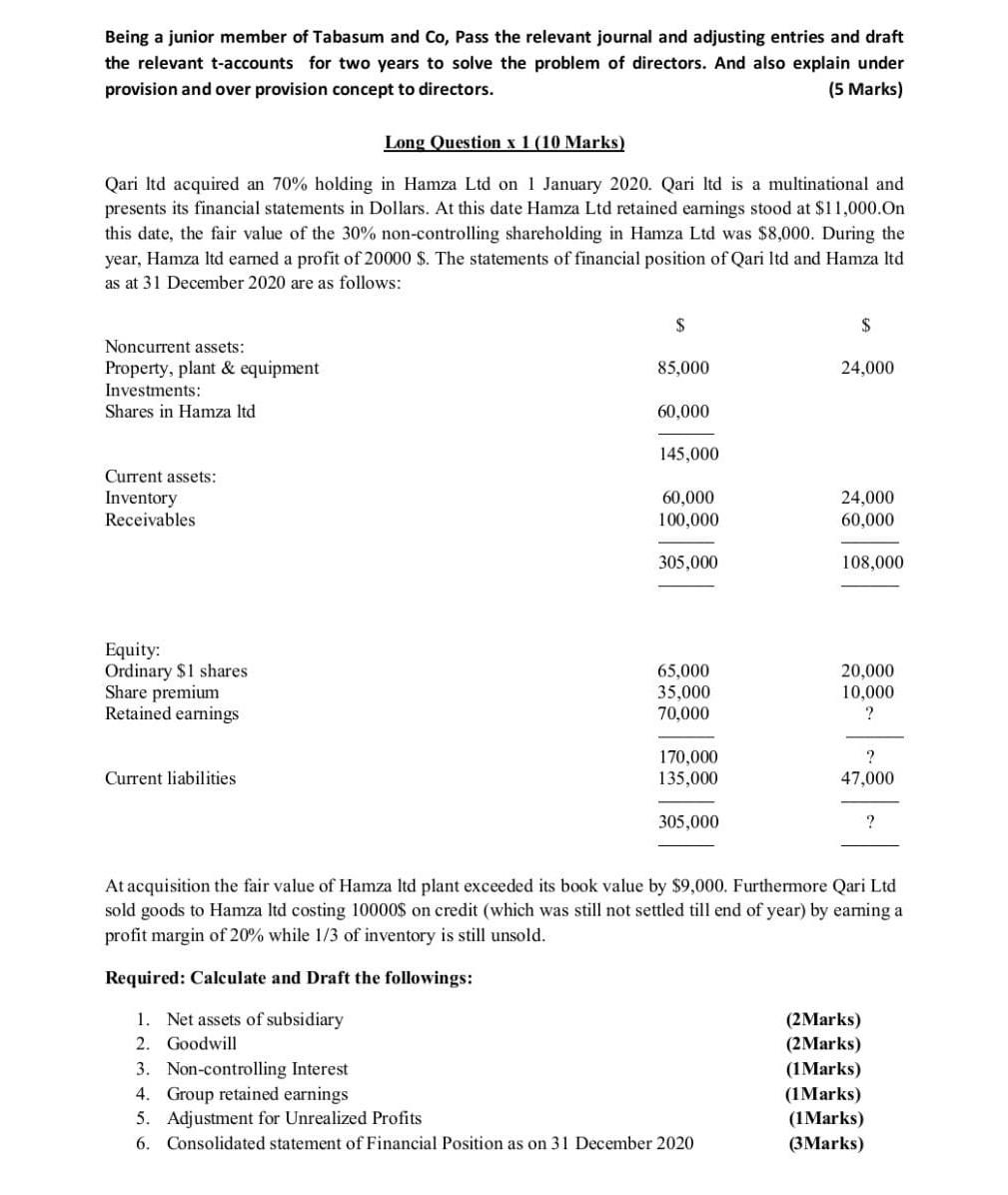

Being a junior member of Tabasum and Co, Pass the relevant journal and adjusting entries and draft the relevant t-accounts for two years to solve the problem of directors. And also explain under provision and over provision concept to directors. (5 Marks) Long Question x 1 (10 Marks) Qari Itd acquired an 70% holding in Hamza Ltd on 1 January 2020. Qari Itd is a multinational and presents its financial statements in Dollars. At this date Hamza Ltd retained earnings stood at $11,000.On this date, the fair value of the 30% non-controlling shareholding in Hamza Ltd was $8,000. During the year, Hamza Itd earned a profit of 20000 $. The statements of financial position of Qari ltd and Hamza Itd as at 31 December 2020 are as follows: $ $ 85,000 24,000 Noncurrent assets: Property, plant & equipment Investments: Shares in Hamza ltd 60,000 145,000 Current assets: Inventory Receivables 60,000 100,000 24,000 60,000 305,000 108,000 Equity: Ordinary $1 shares Share premium Retained earnings 65.000 35,000 70,000 20,000 10,000 ? 170,000 135,000 ? 47,000 Current liabilities 305,000 ? At acquisition the fair value of Hamza Itd plant exceeded its book value by $9,000. Furthermore Qari Ltd sold goods to Hamza Itd costing 10000$ on credit (which was still not settled till end of year) by eaming a profit margin of 20% while 1/3 of inventory is still unsold. Required: Calculate and Draft the followings: 1. Net assets of subsidiary 2. Goodwill 3. Non-controlling Interest 4. Group retained earnings 5. Adjustment for Unrealized Profits 6. Consolidated statement of Financial Position as on 31 December 2020 (2Marks) (2Marks) (1Marks) (1Marks) (1Marks) (3Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started