answer this question

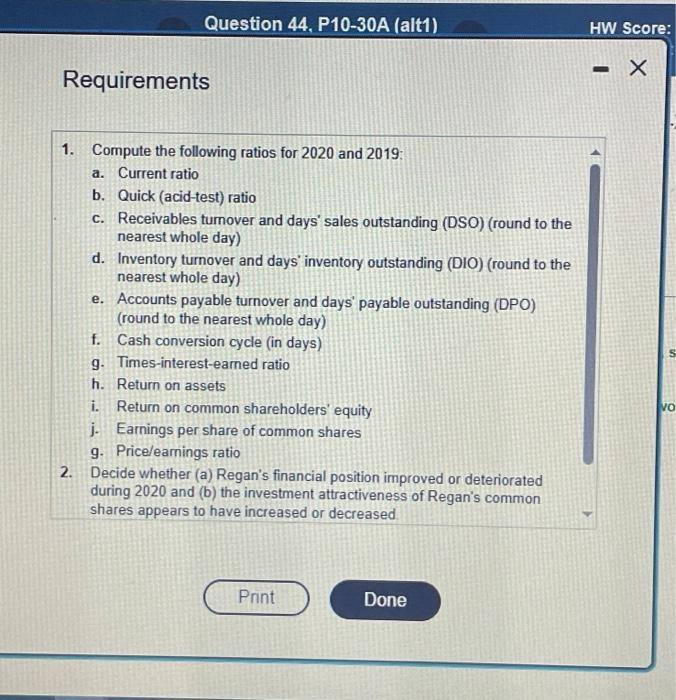

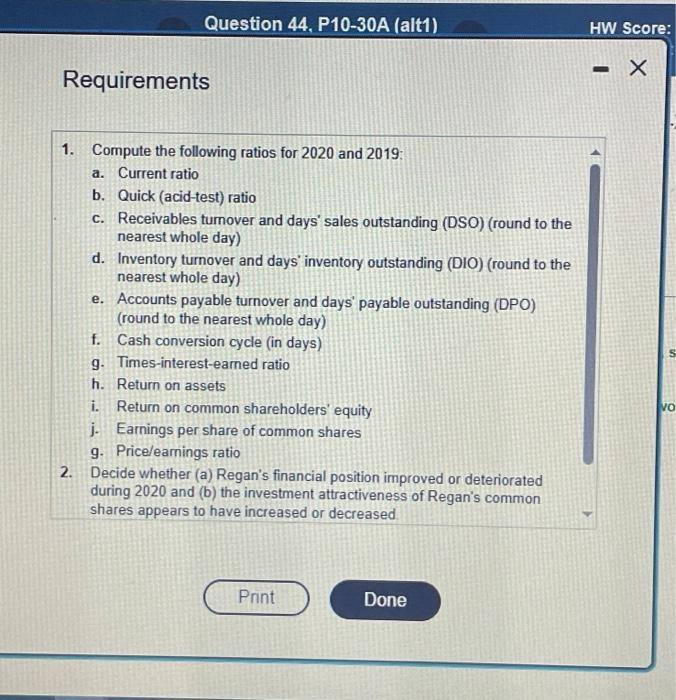

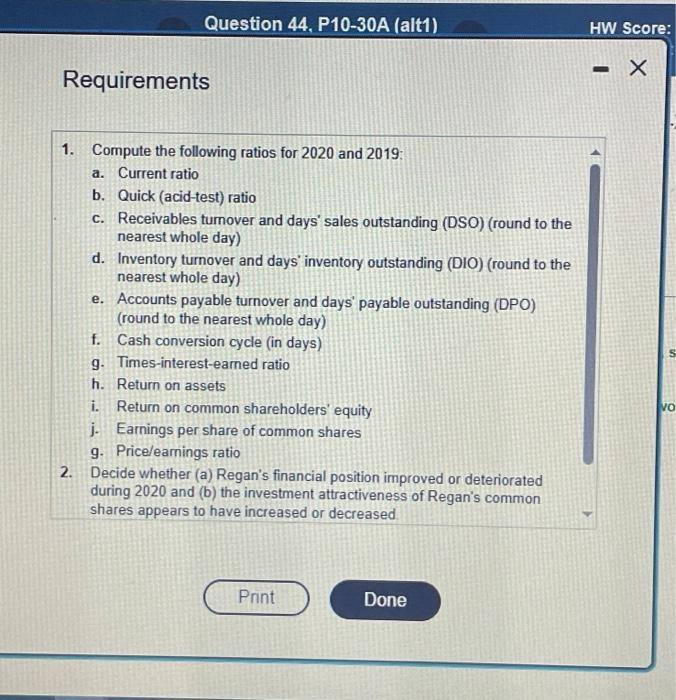

here it's requirements

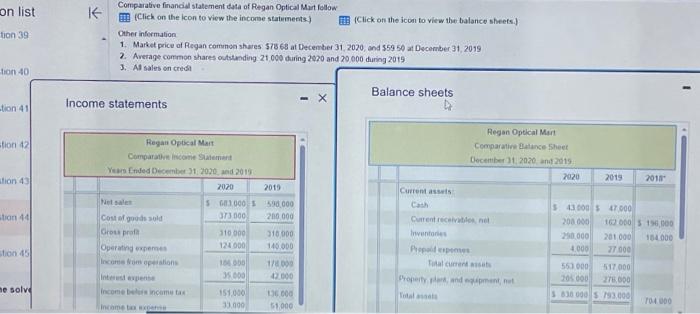

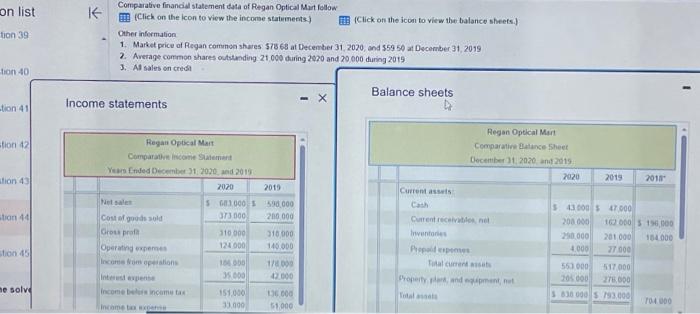

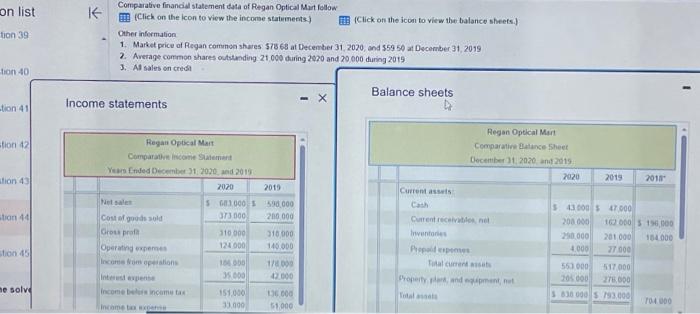

on list Comparative finandial statement data of Regan Optical Mart folow (Clich on the Icon to view the incoree staruments) (Click on the icon to view the balance sheets.) tion39 Other infermation 1. Market price of Regan common shures $7868 at December 31,2020 , and $5950 at Decomber 31,2019 2. Average comenon shares outstinding 21,000 during 2070 and 20,000 during 2019 3. At sales on credit Balance sheets Income statements A - tion40 K [Click on the icon to view the balance sheets.) 3. As sales on crest tion 41 Regan Optical Mart Regan Optcal Mart Comparaivin incotie Salemant Comparatine Autance Sheet Vus Enled Dicenber 71,2020 , ind 2019 Docentiber 11 . 2020 ant2uls. 1. Compute the following ratios for 2020 and 2019 : a. Current ratio b. Quick (acid-test) ratio c. Receivables turnover and days' sales outstanding (DSO) (round to the nearest whole day) d. Inventory turnover and days' inventory outstanding (DIO) (round to the nearest whole day) e. Accounts payable turnover and days' payable outstanding (DPO) (round to the nearest whole day) f. Cash conversion cycle (in days) g. Times-interest-earned ratio h. Return on assets i. Return on common shareholders' equity j. Earnings per share of common shares g. Price/earnings ratio 2. Decide whether (a) Regan's financial position improved or deteriorated during 2020 and (b) the investment attractiveness of Regan's common shares appears to have increased or decreased b. Quick (acid-test) ratio c. Receivables turnover and days' sales outstanding (DSO) (round to the nearest whole day) d. Inventory turnover and days' inventory outstanding (DIO) (round to the nearest whole day) e. 'Accounts payable turnover and days' payable outstanding (DPO) (round to the nearest whole day) f. Cash conversion cycle (in days) g. Times-interest-earned ratio h. Return on assets i. Return on common shareholders' equity j. Earnings per share of common shares g. Pricelearnings ratio 2. Decide whether (a) Regan's financial position improved or deteriorated during 2020 and (b) the investment attractiveness of Regan's common shares appears to have increased or decreased. 3. How will what you learned in this problem help you evaluate an investment? on list Comparative finandial statement data of Regan Optical Mart folow (Clich on the Icon to view the incoree staruments) (Click on the icon to view the balance sheets.) tion39 Other infermation 1. Market price of Regan common shures $7868 at December 31,2020 , and $5950 at Decomber 31,2019 2. Average comenon shares outstinding 21,000 during 2070 and 20,000 during 2019 3. At sales on credit Balance sheets Income statements A - tion40 K [Click on the icon to view the balance sheets.) 3. As sales on crest tion 41 Regan Optical Mart Regan Optcal Mart Comparaivin incotie Salemant Comparatine Autance Sheet Vus Enled Dicenber 71,2020 , ind 2019 Docentiber 11 . 2020 ant2uls. 1. Compute the following ratios for 2020 and 2019 : a. Current ratio b. Quick (acid-test) ratio c. Receivables turnover and days' sales outstanding (DSO) (round to the nearest whole day) d. Inventory turnover and days' inventory outstanding (DIO) (round to the nearest whole day) e. Accounts payable turnover and days' payable outstanding (DPO) (round to the nearest whole day) f. Cash conversion cycle (in days) g. Times-interest-earned ratio h. Return on assets i. Return on common shareholders' equity j. Earnings per share of common shares g. Price/earnings ratio 2. Decide whether (a) Regan's financial position improved or deteriorated during 2020 and (b) the investment attractiveness of Regan's common shares appears to have increased or decreased b. Quick (acid-test) ratio c. Receivables turnover and days' sales outstanding (DSO) (round to the nearest whole day) d. Inventory turnover and days' inventory outstanding (DIO) (round to the nearest whole day) e. 'Accounts payable turnover and days' payable outstanding (DPO) (round to the nearest whole day) f. Cash conversion cycle (in days) g. Times-interest-earned ratio h. Return on assets i. Return on common shareholders' equity j. Earnings per share of common shares g. Pricelearnings ratio 2. Decide whether (a) Regan's financial position improved or deteriorated during 2020 and (b) the investment attractiveness of Regan's common shares appears to have increased or decreased. 3. How will what you learned in this problem help you evaluate an investment