Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer this question please. Question 3 James Smith is a financial adviser at a reputable financial institution in Jamaica. He was the keynote speaker on

Answer this question please.

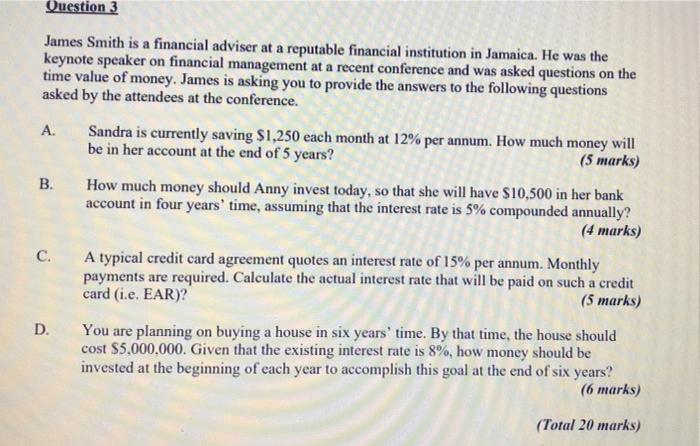

Question 3 James Smith is a financial adviser at a reputable financial institution in Jamaica. He was the keynote speaker on financial management at a recent conference and was asked questions on the time value of money. James is asking you to provide the answers to the following questions asked by the attendees at the conference. A. B. C. Sandra is currently saving $1,250 each month at 12% per annum. How much money will be in her account at the end of 5 years? (5 marks) How much money should Anny invest today, so that she will have $10,500 in her bank account in four years' time, assuming that the interest rate is 5% compounded annually? (4 marks) A typical credit card agreement quotes an interest rate of 15% per annum. Monthly payments are required. Calculate the actual interest rate that will be paid on such a credit card (i.e. EAR)? (5 marks) You are planning on buying a house in six years' time. By that time, the house should cost $5,000,000. Given that the existing interest rate is 8%, how money should be invested at the beginning of each year to accomplish this goal at the end of six years? (6 marks) D. (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started