Answered step by step

Verified Expert Solution

Question

1 Approved Answer

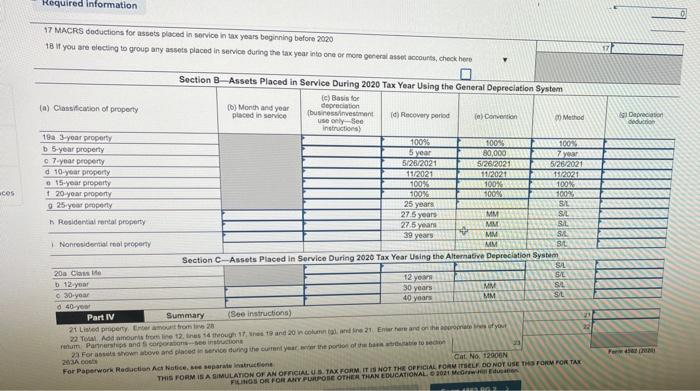

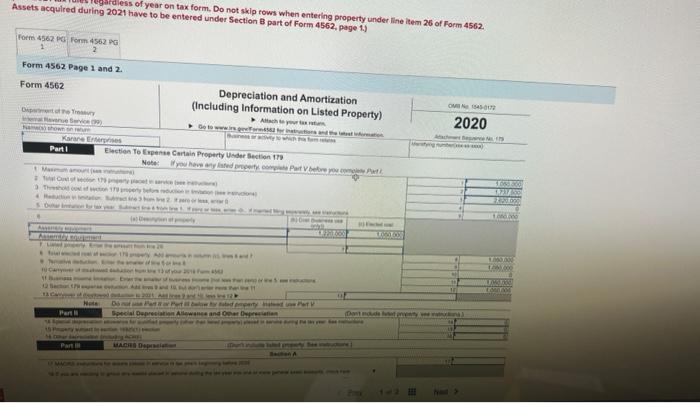

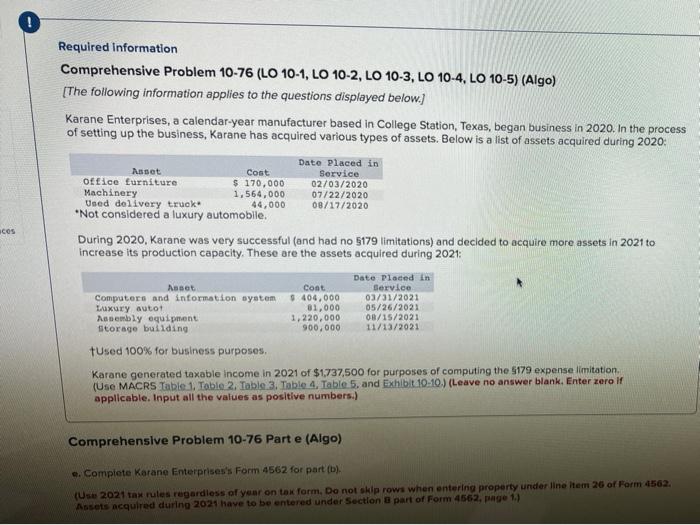

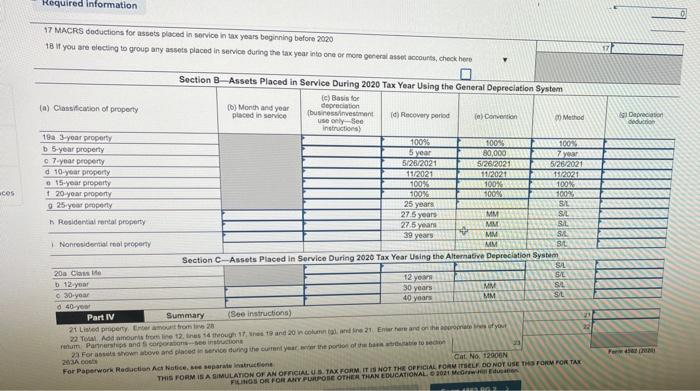

answer this questions please Required information 17 MACRS Coductions for assets placed in service in tax years beginning before 2020 18 If you are electing

answer this questions please

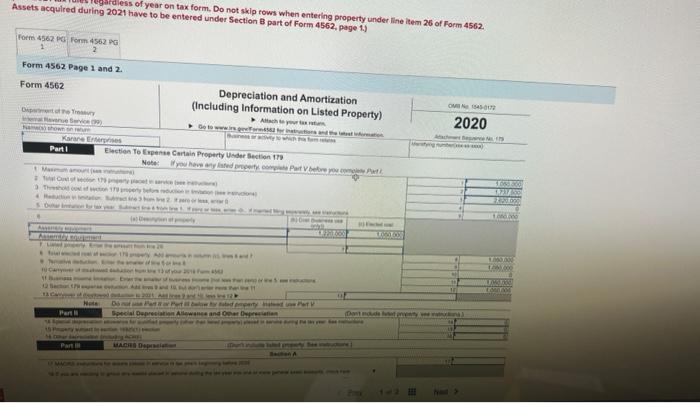

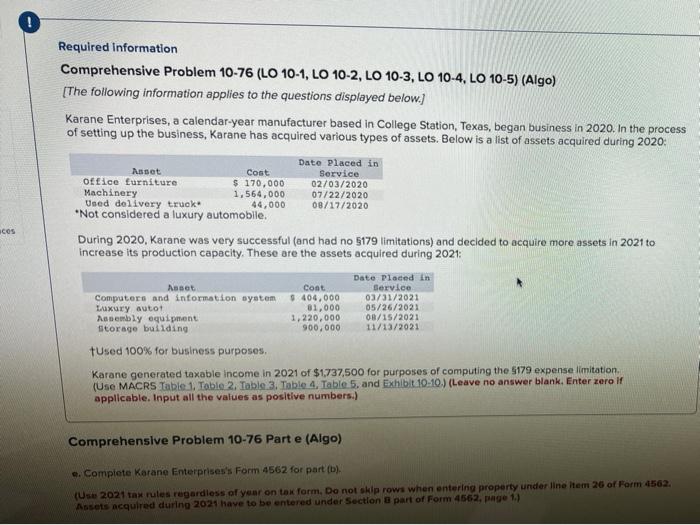

Required information 17 MACRS Coductions for assets placed in service in tax years beginning before 2020 18 If you are electing to group any assets placed in service during the tax year into one or more general seccounts, check here (a) Classification of property Depreciation con 19a 3-year property 5-year property 07ynor property d 10-year property 55year property + 20 year property g 25 your property Residential rental property Section B Assets Placed in Service During 2020 Tax Year Using the General Depreciation System (c) Basis for (o) Month and your depreciation placed in service (business investment (d) Recovery period la) Convention Method use only see instructions 10015 100% 100% 80,000 AZN 5/28/2021 5:26.2021 25/26/2021 11/2021 19/202115/2021 1005 100% 100% 100% P100% 100% 25 years SL 27.5 years MMSL 27.5 years MM UL 39 years MM MM SIL aces Nonresidential el property 12 year Section C-Assets Placed in Service During 2020 Tax Year Using the Alternative Depreciation System 20a Close SAL 12 year SAL o 30-year 30 years SIL d 40 year 40 years MM SL Part IV Summary (See instructions) 21 Lied property, tromi 28 22 Tol Admonisointines the 1st and 20 columna de 21 and on the road yout rum Partners and corporation 3 2 Forsson wove and place is during the current year we the portion of the 2016 Cat No. 12000 For Paperwork Reduction Act Notices separate instruction THIS FORM IS A SIMULATION OF AN OFFICIALUS TAX FORM, IT IS NOT THE OFFICIAL FOR THE DO NOT USE THIS FORM FOR TAK FILIMOS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2021 Meow dless of year on tax form. Do not skip rows when entering property under line item 26 of Form 4562. Assets acquired during 2021 have to be entered under Section 8 part of Form 4562. page 1) Form 4562 G Form 4562PG Form 4562 Page 1 and 2 Form 4562 Depreciation and Amortization (Including Information on Listed Property) your OMS4100 Det 2020 Karne Part1 Election To Expert Cartin Property Under Section 11 Note: you have any computer To The La Hate Part D Special Dupree Allowance 10. Part MARSD Required Information Comprehensive Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, LO 10-5) (Algo) [The following information applies to the questions displayed below.) Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2020. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2020: acor Date placed in Asset Cost Service office furniture $ 170,000 02/03/2020 Machinery 1,564,000 07/22/2020 Used delivery truck 44,000 08/17/2020 *Not considered a luxury automobile. During 2020, Karane was very successful (and had no 5179 limitations) and decided to acquire more assets in 2021 to increase its production capacity. These are the assets acquired during 2021: Date Placed in Asset Cont. Service Computers and information system $ 404,000 03/31/2021 Luxury autot 81,000 05/26/2021 Nopembly equipment 1,220,000 08/15/2021 storage building 900,000 11/13/2021 tused 100% for business purposes Karane generated taxable income in 2021 of $1737,500 for purposes of computing the 5179 expense limitation (Use MACRS Table 1. Table 2. Table 3. Table 4. Table 5. and Exhibit 10-10.) (Leave no answer blank. Enter zero If applicable. Input all the values as positive numbers.) Comprehensive Problem 10-76 Part e (Algo) e. Complete karane Enterprises's Form 4562 for part (b). (Use 2021 tax rules regardless of year on tax form. Do not skip rows when entering property under line ltem 26 of Form 4562. Assets acquired during 2021 have to be entered under Section part of Form 4562, page 1.) Required information 17 MACRS Coductions for assets placed in service in tax years beginning before 2020 18 If you are electing to group any assets placed in service during the tax year into one or more general seccounts, check here (a) Classification of property Depreciation con 19a 3-year property 5-year property 07ynor property d 10-year property 55year property + 20 year property g 25 your property Residential rental property Section B Assets Placed in Service During 2020 Tax Year Using the General Depreciation System (c) Basis for (o) Month and your depreciation placed in service (business investment (d) Recovery period la) Convention Method use only see instructions 10015 100% 100% 80,000 AZN 5/28/2021 5:26.2021 25/26/2021 11/2021 19/202115/2021 1005 100% 100% 100% P100% 100% 25 years SL 27.5 years MMSL 27.5 years MM UL 39 years MM MM SIL aces Nonresidential el property 12 year Section C-Assets Placed in Service During 2020 Tax Year Using the Alternative Depreciation System 20a Close SAL 12 year SAL o 30-year 30 years SIL d 40 year 40 years MM SL Part IV Summary (See instructions) 21 Lied property, tromi 28 22 Tol Admonisointines the 1st and 20 columna de 21 and on the road yout rum Partners and corporation 3 2 Forsson wove and place is during the current year we the portion of the 2016 Cat No. 12000 For Paperwork Reduction Act Notices separate instruction THIS FORM IS A SIMULATION OF AN OFFICIALUS TAX FORM, IT IS NOT THE OFFICIAL FOR THE DO NOT USE THIS FORM FOR TAK FILIMOS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2021 Meow dless of year on tax form. Do not skip rows when entering property under line item 26 of Form 4562. Assets acquired during 2021 have to be entered under Section 8 part of Form 4562. page 1) Form 4562 G Form 4562PG Form 4562 Page 1 and 2 Form 4562 Depreciation and Amortization (Including Information on Listed Property) your OMS4100 Det 2020 Karne Part1 Election To Expert Cartin Property Under Section 11 Note: you have any computer To The La Hate Part D Special Dupree Allowance 10. Part MARSD Required Information Comprehensive Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, LO 10-5) (Algo) [The following information applies to the questions displayed below.) Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2020. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2020: acor Date placed in Asset Cost Service office furniture $ 170,000 02/03/2020 Machinery 1,564,000 07/22/2020 Used delivery truck 44,000 08/17/2020 *Not considered a luxury automobile. During 2020, Karane was very successful (and had no 5179 limitations) and decided to acquire more assets in 2021 to increase its production capacity. These are the assets acquired during 2021: Date Placed in Asset Cont. Service Computers and information system $ 404,000 03/31/2021 Luxury autot 81,000 05/26/2021 Nopembly equipment 1,220,000 08/15/2021 storage building 900,000 11/13/2021 tused 100% for business purposes Karane generated taxable income in 2021 of $1737,500 for purposes of computing the 5179 expense limitation (Use MACRS Table 1. Table 2. Table 3. Table 4. Table 5. and Exhibit 10-10.) (Leave no answer blank. Enter zero If applicable. Input all the values as positive numbers.) Comprehensive Problem 10-76 Part e (Algo) e. Complete karane Enterprises's Form 4562 for part (b). (Use 2021 tax rules regardless of year on tax form. Do not skip rows when entering property under line ltem 26 of Form 4562. Assets acquired during 2021 have to be entered under Section part of Form 4562, page 1.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started