Answered step by step

Verified Expert Solution

Question

1 Approved Answer

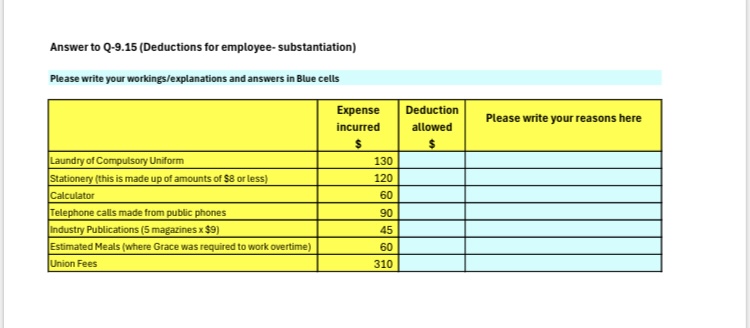

Answer to Q - 9 . 1 5 ( Deductions for employee - substantiation ) Please write your workings / explanations and answers in Blue

Answer to QDeductions for employee substantiation

Please write your workingsexplanations and answers in Blue cells

tabletableExpenseincurred$tableDeductionallowed$tablePlease write your reasons hereLaundry of Compulsory Uniform,Stationery this is made up of amounts of $ or lessCalculatorTelephone calls made from public phones,Industry Publications magazines times $Estimated Meals where Grace was required to work overtimeUnion Fees, QUESTION

Deductions for employee substantiation

Grace Marie is employed by Scattergun Telemarketing as an administrative

assistant.

During the tax year, Grace incurred the following expenditure:

Laundry of compulsory uniform supplied by Scattergun

Stationery amounts of $ or less

Calculator

Telephone calls made from public phones estimated

Industry publications magazines $

Estimated meals where Grace was required to work overtime

Union fees stated on Grace's Income Statement

Grace received overtime meal allowances under an industrial agreement

at $ per meal for meals.

Grace recorded the details relating to the stationery, calculator, and

magazines in a diary.

Giving reasons, state whether there are any amounts that Grace can

claim as a deduction. She has not retained receipts.prepare tax documentation for individuals edition solution to question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started