answer to q1a

answer to q1b

please help to answer q1c&d thank you

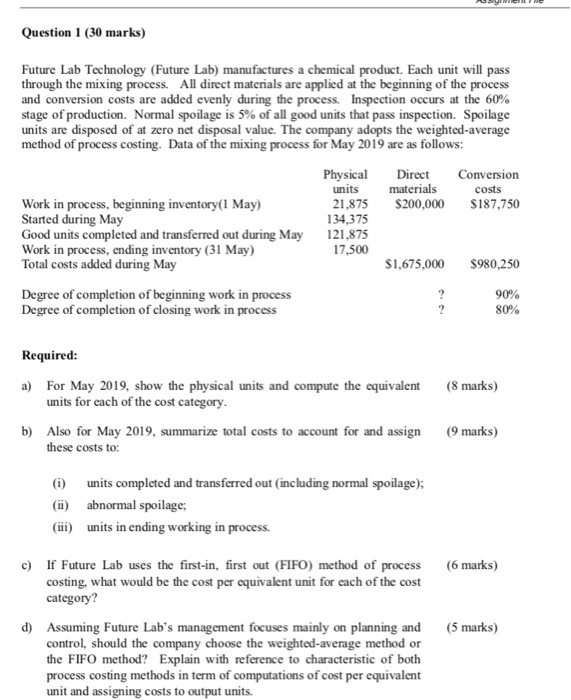

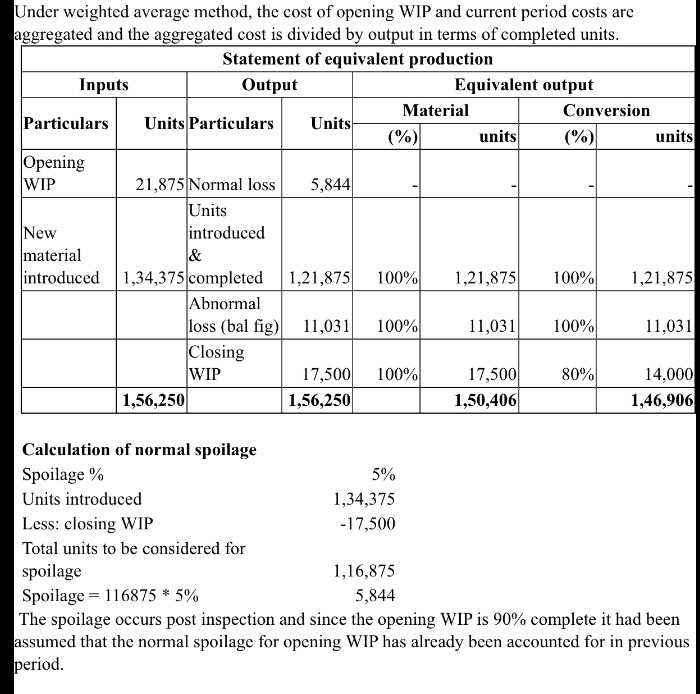

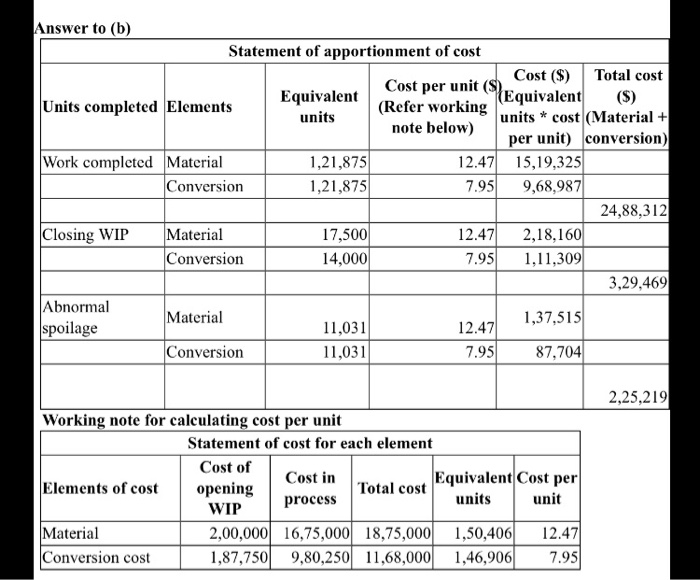

Question 1 (30 marks) Future Lab Technolo gy (Future Lab) manufactures a chemical product. Each unit will pass through the mixing process. All direct materials are applied at the beginning of the process and conversion costs are added evenly during the process. Inspection occurs at the 60% stage of production. Normal spoilage is 5% of all good units that pass inspection. Spoilage units are disposed of at zero net disposal value. The company adopts the weighted-average method of process costing. Data of the mixing process for May 2019 are as follows: Physical units Direct materials Conversion costs Work in process, beginning inventory( May) Started during May Good units completed and transferred out during May Work in process, ending inventory (31 May) Total costs added during May 21,875 134,375 121,875 $200,000 $187,750 17,500 $1,675,000 $980,250 Degree of completion of beginning work in process Degree of completion of closing work in process 7 90% 80% Required: For May 2019, show the physical units and compute the equivalent a) units for cach of the cost category. (8 marks) b) Also for May 2019, summarize total costs to account for and assign these costs to: (9 marks) units completed and transferred out (including normal spoilage); (i ()abnormal spoilage; (i units in ending working in process If Future Lab uses the first-in, first out (FIFO) method of process costing, what would be the cost per equivalent unit for cach of the cost category? (6 marks) c) d Assuming Future Lab's management focuses mainly on planning and control, should the company choose the weighted-average method or the FIFO method? Explain with reference to characteristic of both process costing methods in term of computations of cost per equivalent unit and assigning costs to output units (5 marks) Under weighted average method, the cost of opening WIP and current period costs are aggregated and the aggregated cost is divided by output in terms of completed units. Statement of eqquivalent production Inputs Output Equivalent output Material Conversion Particulars Units Particulars Units (%) (%) units units Opening WIP 21,875 Normal loss 5,844 Units introduced & New material introduced 1,34,375completed 100% 100% 1,21,875 1,21,875 1,21,875 Abnormal loss (bal fig) Closing WIP 100% 100% 11,03 11,03 11,03 100% 17,500 1,56,250 80% 17,500 1,50,406 14,000 1,46,906 1,56,250 Calculation of normal spoilage Spoilage % 5% Units introduced 1,34,375 Less: closing WIP -17,500 Total units to be considered for spoilage 1,16,875 Spoilage 16875* 5% The spoilage occurs post inspection and since the opening WIP is 90% complete it had been assumed that the normal spoilage for opening WIP has already been accounted for in previous period 5,844 Answer to (b) Statement of apportionment of cost Cost (S) Total cost Cost per unit (Equivalent (S) Equivalent(Refer workingnits * cost (Material + (S) Units completed Elements units note below) per unit) conversion) 12.4715,19,325 7.95 |Work completed Material Conversion 1,21,875 9,68,987 1,21,875 24,88,312 17,500 Closing WIP Material 2,18,160 1,11,309 12.47 Conversion 7.95 14,000 3,29,469 Abnormal spoilage Material 1,37,515 12.47 11,03 Conversion 7.95 87,704 11,03 2,25,219 Working note for calculating cost per unit Statement of cost for each element Cost of Total cost Equivalent Cost per units Cost in Elements of cost opening WIP unit process 2,00,00016,75,000 18,75,000 1,50,406 1,87,750 12.47 7.95 Material 9,80,25011,68,000|1,46,906| Conversion cost