answer using formulas for excel please

wendys 10k form

mcdonalds 10k form

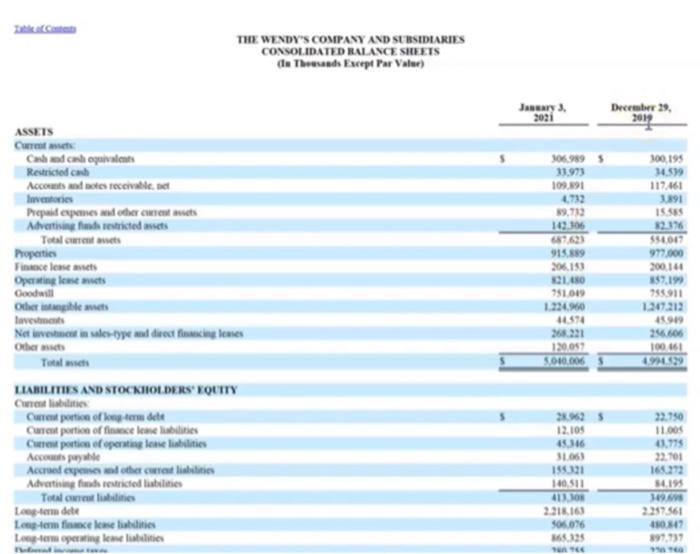

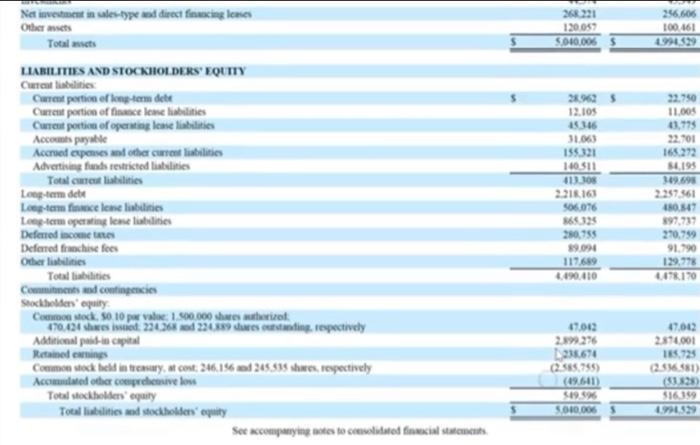

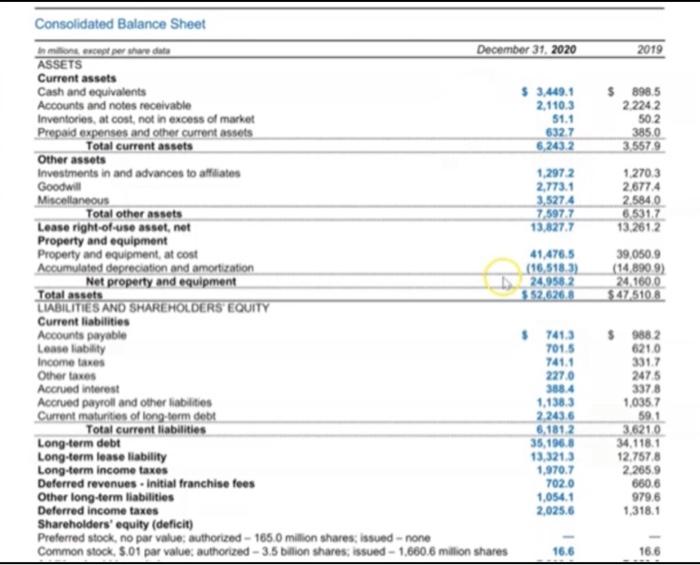

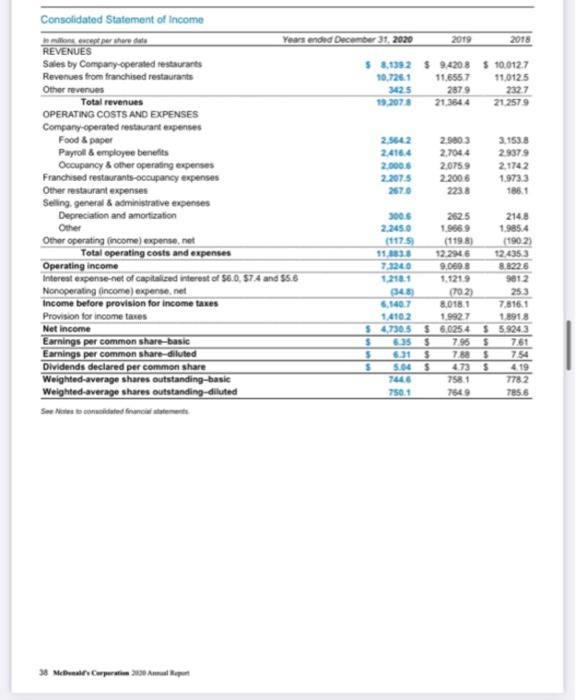

Evaluating profitability (Show results as a percentage) 7. Profit margin percentage 8. Return on assets 9. Return on equity THE WENDY'S COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In Thead Except Par Value) Jr. 2031 December 29, 2019 100.195 14.599 117461 3891 3069895 33.973 109.891 4.732 39.732 10.305 1623 915.889 206.153 10 951019 1.224.960 46594 S5601 977.000 200.14 57.199 755 911 1.347.212 ASSETS Crew Cash and can cavalos Restricted cache Accounts and to receivable, Investors Prepaid expenses and other counts Advertising fretricted its Totalcenie Properties celets Operating out Goods Other items Investments Net veta a le-type and direct focales Other Tool LIABILITIES AND STOCKHOLDERS YOUTTY Calistes Current portion of tem dete Current portion of finance come labilities Crew porties of operating sites Acope Accred experther credibilities Advertising fits restricted lisbilities Totales Lengte dete Lapte fese idites Long-term pewing lanes 120052 26.606 100461 29 5.080.006 2.23 12.105 45.366 31.05 1550321 140.511 413.JON 2.216.163 SO 076 8.135 sun 22.750 11.00 3.775 22.01 160272 54195 2259.561 480.42 897.737 268.221 120.059 SO10,0055 256.606 100 161 6529 22.750 11.00 41.775 22.01 SL193 Net investment in teyp al direct finding lemes Otheries Total wit LIABILITIES AND STOCKHOLDERS' EQUITY Charcotilities Current portion of term det Cremt portion office lenebilities Current porties of operating one abities Accounts payable Accred expenses of other relatiities Advertising funds restricted sites Total mediabilities Long-term dete Locom face le bites Letom operating emeltes Deferred income Deferred franchise fees Other Bibilities Total abilities Comments and contingencies Stackheaty Cowon Meck, So 10 per value: 100.000 shares where 170/60 hessed: 22036 d229 deres ting, respectively Additional capital Renders Commee stock helt in treasury, a cont: 246.156 and 245,135 wes respectively Accused other comprehensive Totalckholders at Toutes mod stockholdersity See accompanying out to created films 22 12.105 S 10 31.06 155321 140511 413 305 2.216.163 506.076 365325 280.755 19.00 117689 2.490.410 2257.561 180.547 97,719 270.799 91.790 129,778 478170 4700 2.899276 238.674 (2.585.755) (49.641 5-1956 SO10006 67012 2814001 185.725 256581) (1835) 516159 2019 $ 898.5 2 2242 50 2 3850 3.5579 1.2703 2.6774 2,5840 6.5317 13.2612 Consolidated Balance Sheet In nec per the date December 31, 2020 ASSETS Current assets Cash and equivalents $ 3,449.1 Accounts and notes receivable 2.110.3 Inventories, at cost, not in excess of market 51.1 Prepaid expenses and other current assets 6327 Total current assets 6,243.2 Other assets Investments in and advances to affiliates 1,2972 Goodwill 2,773.1 Miscellaneous 3,5274 Total other assets 7.5977 Lease right-of-use asset, net 13.827.7 Property and equipment Property and equipment, at cost 41.476.5 Accumulated depreciation and amortization (16,518.31 Net property and equipment 24,9582 Total assets $52.626.8 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable $ 741.3 Lease liability 7015 Income taxes 741.1 Other taxes 2270 Accrued interest 388.4 Accrued payroll and other liabilities 1.138.3 Current matunties of long-term debt 2 243.6 Total current liabilities 6.181 2 Long-term debt 35,196.8 Long-term lease liability 13.3213 Long-term income taxes 1,970.7 Deferred revenues. Initial franchise fees 702.0 Other long-term liabilities 1,054.1 Deferred income taxes 2,025.6 Shareholders' equity (deficit) Preferred stock, no par value authorized - 1650 million shares, issued -none Common stock. S.01 par values authorized - 3.5 billion shares, issued - 1,660.6 million shares 16.6 39,050,9 (14 8909) 24.1600 $47.510.8 $ 9882 6210 331.7 2475 3378 1,0357 59.1 3.6210 34.118.1 12.7578 2.265.9 660.6 9796 1,318.1 16.6 Consolidated Statement of Income ons were Years ended December 31, 2020 2019 2018 REVENUES Sales by Company operated restaurants $ 8.1392 $9.4208 $ 10,012.7 Revenues from franchised restaurants 10.7261 11.6557 11.0125 Other revenues 3425 2879 232.7 Total revenues 19. 2073 21.3544 21.2579 OPERATING COSTS AND EXPENSES Company operated restaurant expenses Food & paper 2.52 2.5803 3.153.8 Payroll & employee benefits 2.416.4 2.7044 2.9379 Occupancy & other operating expenses 2.000 6 2.0759 2. 1742 Franchised restaurants occupancy expenses 2.2075 2.2006 1.9733 Other restaurant expenses 2570 2238 185.0 Selling general & administrative expenses Depreciation and amortization 300.5 2525 2148 Other 2.245.0 1.9669 1.985.4 Other operating (income) expense.net (1175 (1198) (1902) Total operating costs and expenses 11330 12.2946 124353 Operating income 7,1240 9.000 8.8226 Interest expense net of capitated interest of $6.0 $7A and $5.6 1.218 1.1219 9012 Nonoperating income) expense net 048 (702) 253 Income before provision for income taxes 6.1407 8.018.1 7.816.1 Provision for income taxes 1.4102 1.9927 1.8918 Net income 54.730,5 $ 6.0254 $59243 Earnings per common share-basic $ 795 761 Earnings per common share-diluted $ 6.31 5 788 $ 7.54 Dividends declared per common share s 5.45 473 $ 419 Weighted average shares outstanding-basic 744 7581 7782 Weighted average shares outstanding-diluted 7501 785.6 Sweet franchement > McCorm Evaluating profitability (Show results as a percentage) 7. Profit margin percentage 8. Return on assets 9. Return on equity THE WENDY'S COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In Thead Except Par Value) Jr. 2031 December 29, 2019 100.195 14.599 117461 3891 3069895 33.973 109.891 4.732 39.732 10.305 1623 915.889 206.153 10 951019 1.224.960 46594 S5601 977.000 200.14 57.199 755 911 1.347.212 ASSETS Crew Cash and can cavalos Restricted cache Accounts and to receivable, Investors Prepaid expenses and other counts Advertising fretricted its Totalcenie Properties celets Operating out Goods Other items Investments Net veta a le-type and direct focales Other Tool LIABILITIES AND STOCKHOLDERS YOUTTY Calistes Current portion of tem dete Current portion of finance come labilities Crew porties of operating sites Acope Accred experther credibilities Advertising fits restricted lisbilities Totales Lengte dete Lapte fese idites Long-term pewing lanes 120052 26.606 100461 29 5.080.006 2.23 12.105 45.366 31.05 1550321 140.511 413.JON 2.216.163 SO 076 8.135 sun 22.750 11.00 3.775 22.01 160272 54195 2259.561 480.42 897.737 268.221 120.059 SO10,0055 256.606 100 161 6529 22.750 11.00 41.775 22.01 SL193 Net investment in teyp al direct finding lemes Otheries Total wit LIABILITIES AND STOCKHOLDERS' EQUITY Charcotilities Current portion of term det Cremt portion office lenebilities Current porties of operating one abities Accounts payable Accred expenses of other relatiities Advertising funds restricted sites Total mediabilities Long-term dete Locom face le bites Letom operating emeltes Deferred income Deferred franchise fees Other Bibilities Total abilities Comments and contingencies Stackheaty Cowon Meck, So 10 per value: 100.000 shares where 170/60 hessed: 22036 d229 deres ting, respectively Additional capital Renders Commee stock helt in treasury, a cont: 246.156 and 245,135 wes respectively Accused other comprehensive Totalckholders at Toutes mod stockholdersity See accompanying out to created films 22 12.105 S 10 31.06 155321 140511 413 305 2.216.163 506.076 365325 280.755 19.00 117689 2.490.410 2257.561 180.547 97,719 270.799 91.790 129,778 478170 4700 2.899276 238.674 (2.585.755) (49.641 5-1956 SO10006 67012 2814001 185.725 256581) (1835) 516159 2019 $ 898.5 2 2242 50 2 3850 3.5579 1.2703 2.6774 2,5840 6.5317 13.2612 Consolidated Balance Sheet In nec per the date December 31, 2020 ASSETS Current assets Cash and equivalents $ 3,449.1 Accounts and notes receivable 2.110.3 Inventories, at cost, not in excess of market 51.1 Prepaid expenses and other current assets 6327 Total current assets 6,243.2 Other assets Investments in and advances to affiliates 1,2972 Goodwill 2,773.1 Miscellaneous 3,5274 Total other assets 7.5977 Lease right-of-use asset, net 13.827.7 Property and equipment Property and equipment, at cost 41.476.5 Accumulated depreciation and amortization (16,518.31 Net property and equipment 24,9582 Total assets $52.626.8 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable $ 741.3 Lease liability 7015 Income taxes 741.1 Other taxes 2270 Accrued interest 388.4 Accrued payroll and other liabilities 1.138.3 Current matunties of long-term debt 2 243.6 Total current liabilities 6.181 2 Long-term debt 35,196.8 Long-term lease liability 13.3213 Long-term income taxes 1,970.7 Deferred revenues. Initial franchise fees 702.0 Other long-term liabilities 1,054.1 Deferred income taxes 2,025.6 Shareholders' equity (deficit) Preferred stock, no par value authorized - 1650 million shares, issued -none Common stock. S.01 par values authorized - 3.5 billion shares, issued - 1,660.6 million shares 16.6 39,050,9 (14 8909) 24.1600 $47.510.8 $ 9882 6210 331.7 2475 3378 1,0357 59.1 3.6210 34.118.1 12.7578 2.265.9 660.6 9796 1,318.1 16.6 Consolidated Statement of Income ons were Years ended December 31, 2020 2019 2018 REVENUES Sales by Company operated restaurants $ 8.1392 $9.4208 $ 10,012.7 Revenues from franchised restaurants 10.7261 11.6557 11.0125 Other revenues 3425 2879 232.7 Total revenues 19. 2073 21.3544 21.2579 OPERATING COSTS AND EXPENSES Company operated restaurant expenses Food & paper 2.52 2.5803 3.153.8 Payroll & employee benefits 2.416.4 2.7044 2.9379 Occupancy & other operating expenses 2.000 6 2.0759 2. 1742 Franchised restaurants occupancy expenses 2.2075 2.2006 1.9733 Other restaurant expenses 2570 2238 185.0 Selling general & administrative expenses Depreciation and amortization 300.5 2525 2148 Other 2.245.0 1.9669 1.985.4 Other operating (income) expense.net (1175 (1198) (1902) Total operating costs and expenses 11330 12.2946 124353 Operating income 7,1240 9.000 8.8226 Interest expense net of capitated interest of $6.0 $7A and $5.6 1.218 1.1219 9012 Nonoperating income) expense net 048 (702) 253 Income before provision for income taxes 6.1407 8.018.1 7.816.1 Provision for income taxes 1.4102 1.9927 1.8918 Net income 54.730,5 $ 6.0254 $59243 Earnings per common share-basic $ 795 761 Earnings per common share-diluted $ 6.31 5 788 $ 7.54 Dividends declared per common share s 5.45 473 $ 419 Weighted average shares outstanding-basic 744 7581 7782 Weighted average shares outstanding-diluted 7501 785.6 Sweet franchement > McCorm