Answered step by step

Verified Expert Solution

Question

1 Approved Answer

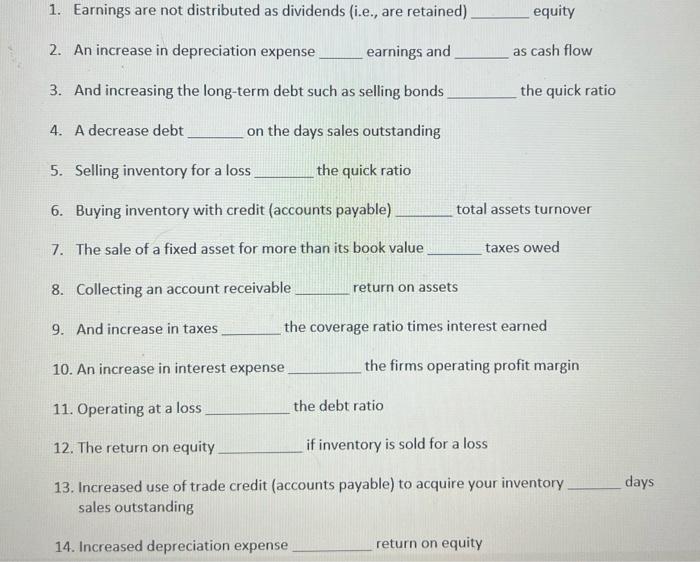

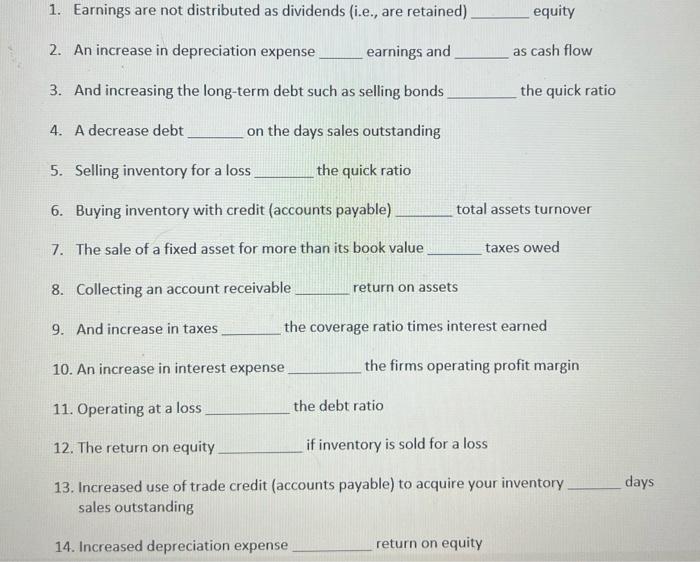

Answer with- Decrease, Increase or Does not affect. 1. Earnings are not distributed as dividends (i.e., are retained) equity 2. An increase in depreciation expense

Answer with- Decrease, Increase or Does not affect.

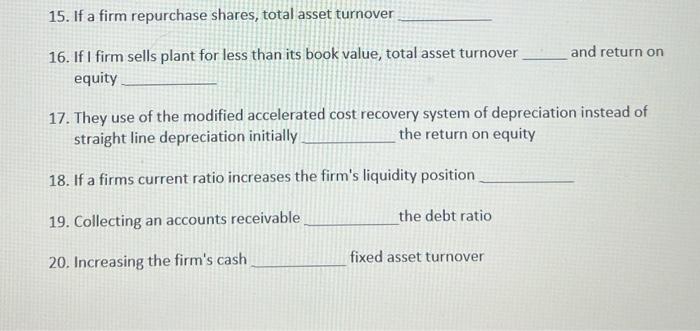

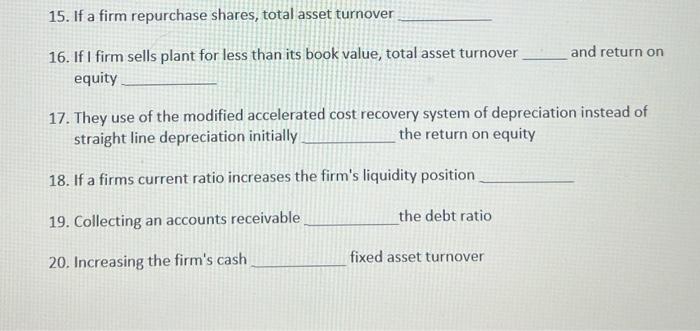

1. Earnings are not distributed as dividends (i.e., are retained) equity 2. An increase in depreciation expense earnings and as cash flow 3. And increasing the long-term debt such as selling bonds the quick ratio 4. A decrease debt on the days sales outstanding 5. Selling inventory for a loss the quick ratio 6. Buying inventory with credit (accounts payable) total assets turnover 7. The sale of a fixed asset for more than its book value taxes owed 8. Collecting an account receivable return on assets 9. And increase in taxes the coverage ratio times interest earned 10. An increase in interest expense the firms operating profit margin 11. Operating at a loss the debt ratio 12. The return on equity if inventory is sold for a loss 13. Increased use of trade credit (accounts payable) to acquire your inventory days sales outstanding 14. Increased depreciation expense return on equity 15. If a firm repurchase shares, total asset turnover 16. If I firm sells plant for less than its book value, total asset turnover and return on equity 17. They use of the modified accelerated cost recovery system of depreciation instead of straight line depreciation initially the return on equity 18. If a firms current ratio increases the firm's liquidity position 19. Collecting an accounts receivable the debt ratio 20. Increasing the firm's cash fixed asset turnover

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started