1. Prepare flexible budget for August

2.

3.

4.

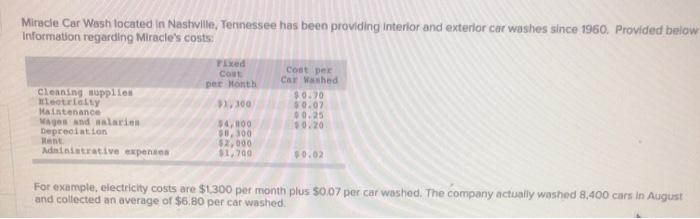

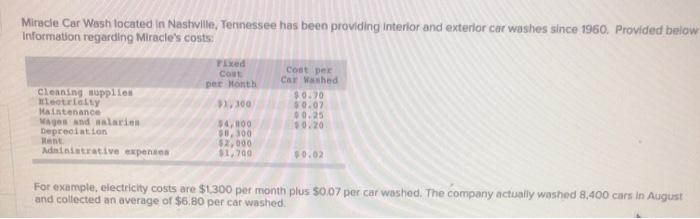

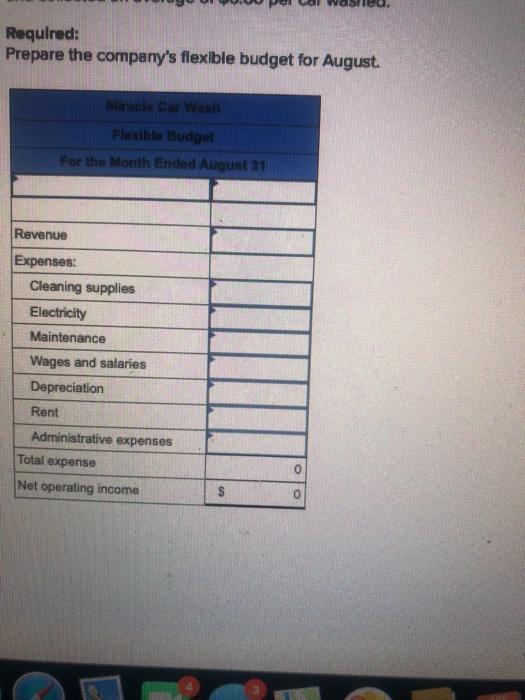

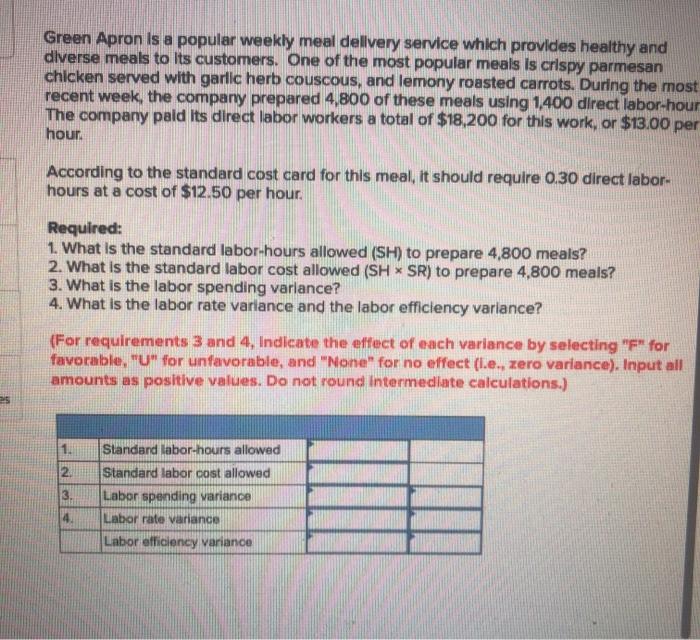

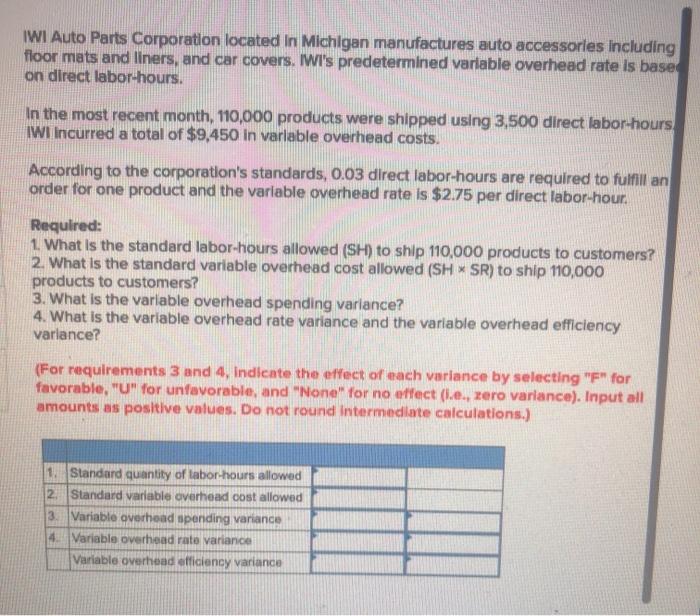

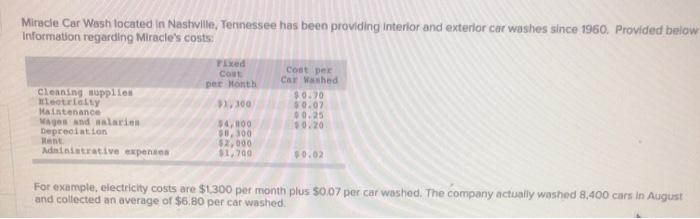

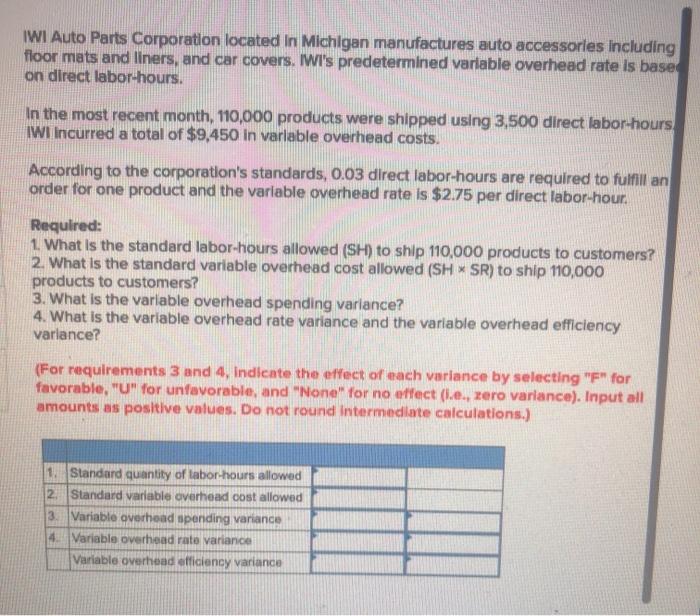

Miracle Car Wash located in Nashville, Tennessee has been providing interior and exterior car washes since 1960. Provided below Information regarding Miracle's costs Fixed Cout per month $2,100 Cleaning supplies Motraty Maintenance and waarin Depreciation Ndanistrative expenses cost per Car Washed 20.30 50.07 0.25 0.20 34,000 0,300 52,000 $1,700 $0.02 For example, electricity costs are $1300 per month plus 50.07 per car washed. The company actually washed 8,400 cars in August and collected an average of $6,80 per car washed Required: Prepare the company's flexible budget for August. Mirela Car Wash Flexible Budget For the Month Ended August 31 Revenue Expenses: Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent Administrative expenses Total expense 0 Net operating income $ Free Flight Corporation, located in Denver, Colorado, produces bicycle accessories, Including bicycle helmets which requires a rigid, crushable foam. During the quarter ending June 30, the company manufactured 3,600 helmets, using 2,520 kilograms of foam. The foam cost the company $19,152. According to the standard cost card, each helmet should require 0.62 kilograms of foam, at a cost of $8.00 per kilogram. Required: 1. What is the standard quantity of kllograms of foam (SQ) that is allowed to make 3,600 helmets? 2. What is the standard materials cost allowed (SQ * SP) to make 3,600 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Input all amounts as positive values. Do not round Intermediate calculations.) 2. 3. Standard quantity of kilograms allowed Standard cost allowed for actual output Materials spending variance Materials price variance Materials quantity variance Green Apron is a popular weekly meal delivery service which provides healthy and diverse meals to its customers. One of the most popular meals is crispy parmesan chicken served with garlic herb couscous, and lemony roasted carrots. During the most recent week, the company prepared 4.800 of these meals using 1.400 direct labor-hour The company paid its direct labor workers a total of $18,200 for this work, or $13.00 per hour. According to the standard cost card for this meal, it should require 0.30 direct labor- hours at a cost of $12.50 per hour. Required: 1. What is the standard labor-hours allowed (SH) to prepare 4,800 meals? 2. What is the standard labor cost allowed (SH SR) to prepare 4,800 meals? 3. What is the labor spending varlance? 4. What is the labor rate variance and the labor efficiency variance? (For requirements 3 and 4, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Input all amounts as positive values. Do not round Intermediate calculations.) 12 3 Standard labor-hours allowed Standard labor cost allowed Labor spending variance Labor rate variance Labor efficiency variance 4. IWI Auto Parts Corporation located in Michigan manufactures auto accessories including floor mats and liners, and car covers. Wi's predetermined variable overhead rate is based on direct labor-hours. In the most recent month, 110,000 products were shipped using 3,500 direct labor-hours IWI incurred a total of $9,450 in varlable overhead costs. According to the corporation's standards, 0.03 direct labor-hours are required to fulfill an order for one product and the variable overhead rate is $2.75 per direct labor-hour. Required: 1. What is the standard labor-hours allowed (SH) to ship 110,000 products to customers? 2. What is the standard variable overhead cost allowed (SHSR) to ship 110,000 products to customers? 3. What is the variable overhead spending variance? 4. What is the variable overhead rate variance and the variable overhead efficiency varlance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Input all amounts as positive values. Do not round Intermediate calculations.) 1. Standard quantity of labor-hours allowed 2. Standard variable overhead cost allowed 3. Variable overhead spending variance 4 Variable overhead rate variance Variable overhead officiency variance