Answered step by step

Verified Expert Solution

Question

1 Approved Answer

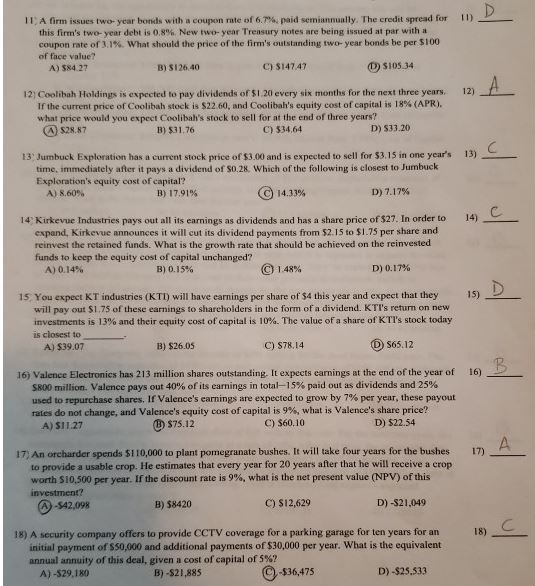

answers are given, please show calculations. 11. A firm, issues two-year bonds with a coupon rate of 6.7%. paid semiannually The credit spread for this

answers are given, please show calculations.

11. A firm, issues two-year bonds with a coupon rate of 6.7%. paid semiannually The credit spread for this firm's two-year debt is 0.8% New two-year Treasury notes are being issued at par with a coupon rate of 3.1%. what should the price of the firm's outstanding two-year bonds be per $100 of face value? C) $14747 D) S10534 A) $84.27 B) 3126.40 12) Coolibah Holdings is expected to pay dividends of $1.20 every six months for the next three years. 12) If the current price of Coolibah stock is $22 60, and Coolibah's equity cost of capital is l 8% (APR) what price would you expect Coolibah's stock to sell for at the end of three years? B) $31.76 C) 334,64 D) 533.20 13; Jumbuck Exploration has a current stock price of $3.00 and is expected to sell for $3.15 in one years 13) time, immediately after it pays a dividend of S0.28. Which of the following is closest to Jumbuck Exploration's equity cost of capital? A) 8.60% B) 17.91% C) 14.33% D) 7.17% C. 14 Kirkevue Industries pays out all its earnings as dividends and has a share price of $27. In order to 14) expand, Kirkevue announces it will cut its dividend payments from $2.15 to $1.75 per share and reinvest the retained funds. What is the growth rate that should be achieved on the reinvested funds to keep the equity cost of capital unchanged? A) 0.14% B)0.15% (C) 1.48% D) 0.17% 5 You expect KT industries (KTI) will have earnings per share of $4 this year and expect that they 15) will pay out S1.75 of these earnings to shareholders in the form of a dividend. KTI's return on new investments is 13% and their equity cost of capital is 10%. The value ofa share of KTI's stock today is closest to A) $39.07 B) $26.05 C) S78,14 S65.12 6) Valence Electronics has 213 million shares outstanding. It expects carnings at the end of the year of 16) S800 million. Valence pays out 40% of its earnings in total-15% paid out as dividends and 25% used to repurchase shares. If Valence's earnings are expected to grow by 7% per year, these payout rates do not change, and Valence's equity cost of capital is 9%, what is Valence's share price? A) S11.27 B) $75.12 C) $60.10 D) $22.54 17) An orcharder spends $110,000 to plant pomegranate bushes. It will take four years for the bushes 17) to provide a usable crop. He estimates that every year for 20 years after that he will receive a crop worth S 10,500 per year. If the discount rate is 9%, what is the net present value (NPV) of this vestment? $42,098 B) $8420 C) $12,629 D) -S21,049 A security company offers to provide CCTV coverage for a parking garage for ten years for an initial payment of $50,000 and additional payments of $30,000 per year. What is the equivalent annual annuity of this deal, given n cost of capital of 5%? 18) A)-529,180 B)-$21,885 $36,475 D)-$25,533Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started