Answers are given. please show steps for calculation. show step with calculator or using formulas below

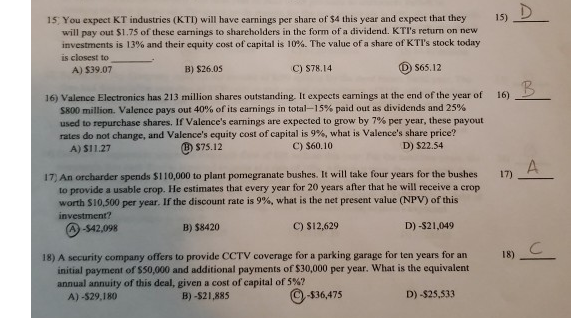

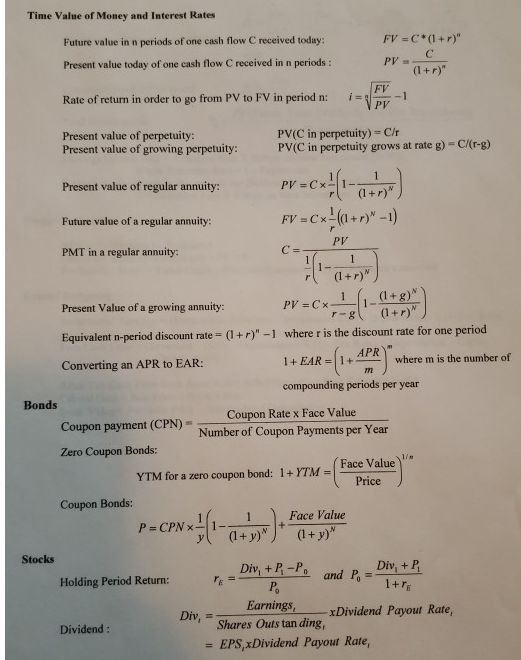

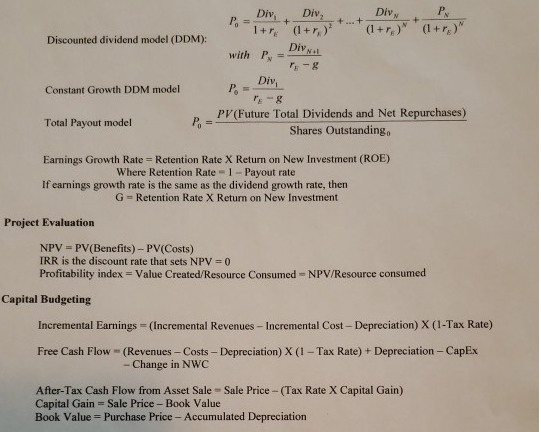

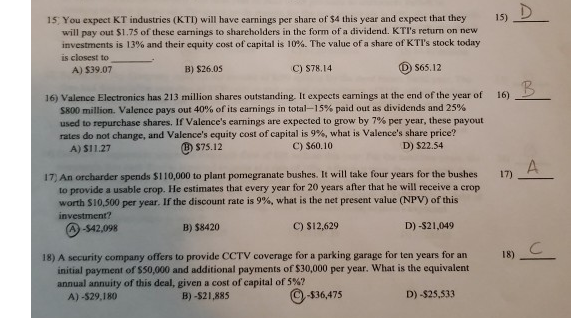

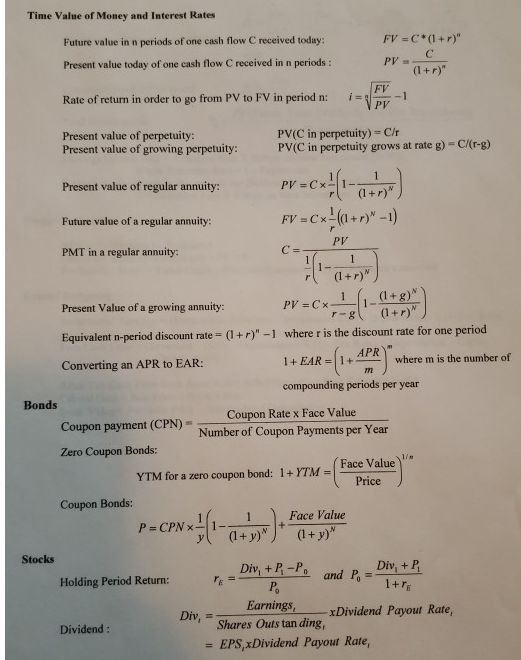

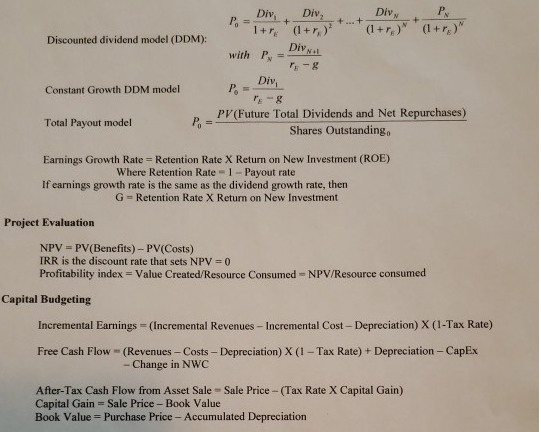

15, You expect KT industries (KTI) will have earnings per share of $4 this year and expect that they 15) will pay out $1.75 of these earnings to shareholders in the form of a dividend. KTI's return on new investments is 13% and their equity cost of capital is 10%. The value ofa share of KTI's stock today is closest to A) $39.07 B) $26.05 C) S78.14 D S65.12 16) Valence Electronics has 213 million shares outstanding. It expects earnings at the end of the year of 16) $800 million. Valence pays out 40% of its earnings in total-15% paid out as dividends and 25% used to repurchase shares. If Valence's earnings are expected to grow by 7% per year. these payout rates do not change, and Valence's equity cost of capital is 9%, what is Valence's share price? A) S11.27 $75.12 C) $60.10 D) $22.54 17) An orcharder spends $110,000 to plant pomegranate bushes. It will take four years for the bushes 17) to provide a usable crop. He estimates that every year for 20 years after that he will receive a crop worth S 10.500 per year. If the discount rate is 9%, what is the net present value (NPV) of this investment? $42,098 B) $8420 C) $12,629 D)-$21,049 18) A security company offers to provide CCTV coverage for a parking garage for ten years for an 18) initial payment of $50,000 and additional payments of $30,000 per year. What is the equivalent annual annuity of this deal, given a cost of capital of 5%? A) -529,180 B) -$21,885 $36,475 D)-$25,533 Time Value of Money and Interest Rates Future value in n periods of one cash flow C received today: Present value today of one cash flow C received in n periods : Rate of return in order to go from PV to FV in period n: Present value of perpetuity: FV PV PV(C in perpetuity) C/r PVC in perpetuity grows at rate g) Cr-g) Present value of growing perpetuity: Present value of regular annuity: Future value of a regular annuity: PMT in a regular annuity: PV-cr11-m) PV Present Value of a growing annuity: Equivalent n-period discount rate= (1 + r)"-1 where r is the discount rate for one period I+EAR-(1+Am where m is the number converting an APR to EAR: 772 compounding periods per year Bonds Coupon Rate x Face Value Coupon payment (CPN) - Number of Coupon Payments per Year Zero Coupon Bonds: YTM for a zero coupon bond: 1+YTM-Face Value Price Coupon Bonds: 1Face Value Stocks Holding Period Return: 2 Earnings, xDividend Payout Rate, Shares Outs tan ding, EPS Dividend Payout Rate, Dividend: Div, 0-1+ Div , (1 + r,()' Discounted dividend model (DDM): with PN-DlVN. Constant Growth DDM model PV (Future Total Dividends and Net Repurchases) Shares Outstandingo Total Payout model Earnings Growth Rate Retention Rate X Return on New Investment (ROE) Where Retention Rate-1-Payout rate If earnings growth rate is the same as the dividend growth rate, then G Retention Rate X Return on New Investment Project Evaluation NPV = PV(Benefits)-PV(Costs) IRR is the discount rate that sets NPV = 0 Profitability index = Value Created/Resource Consumed = NPV/Resource consumed Capital Budgeting Incremental Earnings = (Incremental Revenues-Incremental Cost-Depreciation) X (1-Tax Rate) Free Cash Flow (Revenues - Costs - Depreciation) X (1 - Tax Rate) + Depreciation CapEx - Change in NWC After-Tax Cash Flow from Asset Sale Sale Price-(Tax Rate X Capital Gain) Capital Gain = Sale Price-Book Value Book Value Purchase Price-Accumulated Depreciation