Answers are in red

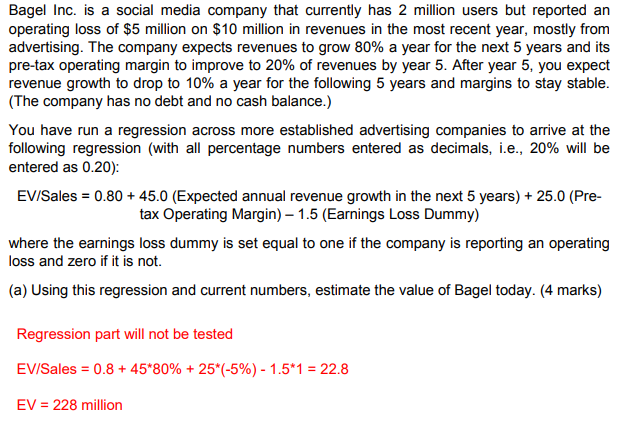

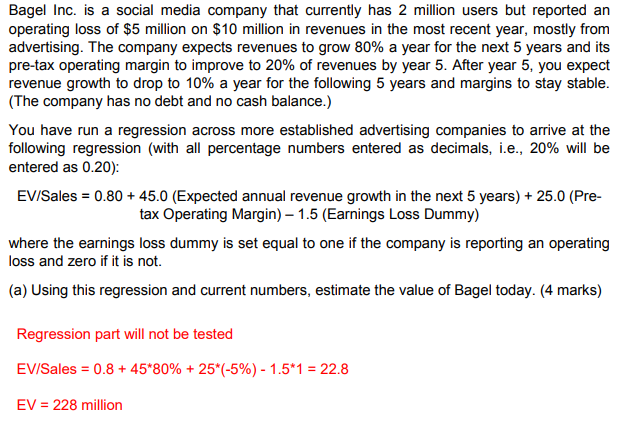

Bagel Inc. is a social media company that currently has 2 million users but reported an operating loss of $5 million on $10 million in revenues in the most recent year, mostly from advertising. The company expects revenues to grow 80% a year for the next 5 years and its pre-tax operating margin to improve to 20% of revenues by year 5. After year 5, you expect revenue growth to drop to 10% a year for the following 5 years and margins to stay stable. (The company has no debt and no cash balance.) You have run a regression across more established advertising companies to arrive at the following regression (with all percentage numbers entered as decimals, i.e., 20% will be entered as 0.20): EV/Sales = 0.80 + 45.0 (Expected annual revenue growth in the next 5 years) + 25.0 (Pre- tax Operating Margin) 1.5 (Earnings Loss Dummy) where the earnings loss dummy is set equal to one if the company is reporting an operating loss and zero if it is not. (a) Using this regression and current numbers, estimate the value of Bagel today. (4 marks) Regression part will not be tested EV/Sales = 0.8 +45*80% + 25*(-5%) - 1.5*1 = 22.8 EV = 228 million (b) Using the same regression, estimate the enterprise value of Bagel at the end of year 5, based upon your expectations for what the company will look like then. (6 marks) EV = 1946.26 Bagel Inc. is a social media company that currently has 2 million users but reported an operating loss of $5 million on $10 million in revenues in the most recent year, mostly from advertising. The company expects revenues to grow 80% a year for the next 5 years and its pre-tax operating margin to improve to 20% of revenues by year 5. After year 5, you expect revenue growth to drop to 10% a year for the following 5 years and margins to stay stable. (The company has no debt and no cash balance.) You have run a regression across more established advertising companies to arrive at the following regression (with all percentage numbers entered as decimals, i.e., 20% will be entered as 0.20): EV/Sales = 0.80 + 45.0 (Expected annual revenue growth in the next 5 years) + 25.0 (Pre- tax Operating Margin) 1.5 (Earnings Loss Dummy) where the earnings loss dummy is set equal to one if the company is reporting an operating loss and zero if it is not. (a) Using this regression and current numbers, estimate the value of Bagel today. (4 marks) Regression part will not be tested EV/Sales = 0.8 +45*80% + 25*(-5%) - 1.5*1 = 22.8 EV = 228 million (b) Using the same regression, estimate the enterprise value of Bagel at the end of year 5, based upon your expectations for what the company will look like then. (6 marks) EV = 1946.26