Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answers are provided, but I'm not sure how to get them. Pl ease show all steps and calculations so I can understand how to solve.

Answers are provided, but I'm not sure how to get them. Please show all steps and calculations so I can understand how to solve. thank you

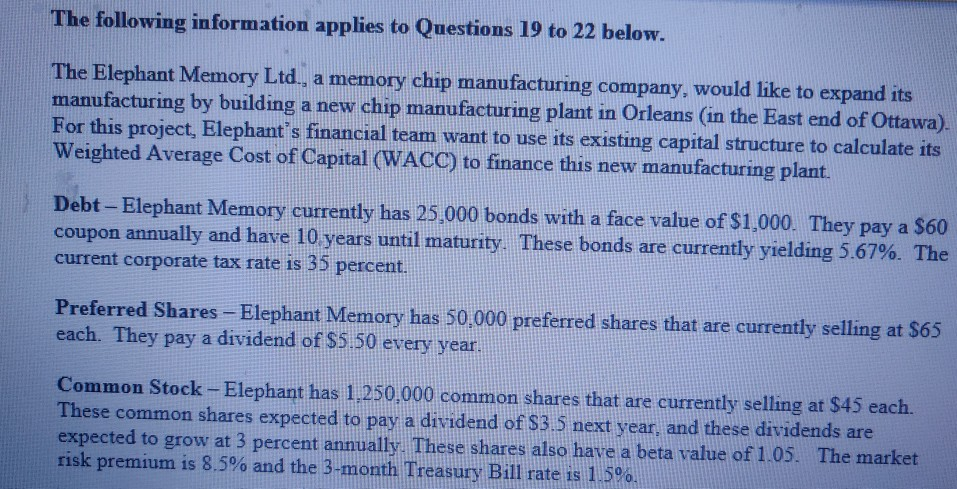

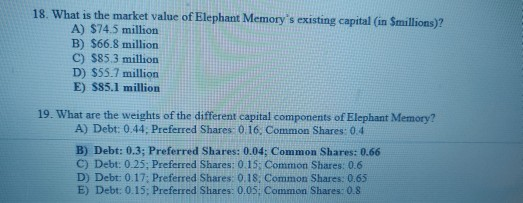

The following information applies to Questions 19 to 22 below. The Elephant Memory Ltd., a memory chip manufacturing company, would like to expand its manufacturing by building a new chip manufacturing plant in Orleans (in the East end of Ottawa). For this project, Elephant's financial team want to use its existing capital structure to calculate its Weighted Average Cost of Capital (WACC) to finance this new manufacturing plant. Debt - Elephant Memory currently has 25,000 bonds with a face value of $1,000. They pay a $60 coupon annually and have 10 years until maturity. These bonds are currently yielding 5.67%. The current corporate tax rate is 35 percent. Preferred Shares Elephant Memory has 50,000 preferred shares that are currently selling at $65 each. They pay a dividend of $5.50 every year. Common Stock - Elephant has 1,250,000 common shares that are currently selling at $45 each. These common shares expected to pay a dividend of $3.5 next year, and these dividends are expected to grow at 3 percent annually. These shares also have a beta value of 1.05. The market risk premium is 8.5% and the 3-month Treasury Bill rate is 1.59. 18. What is the market value of Elephant Memory's existing capital in Smillions)? A) $74.5 million B) $66.8 million C) $85.3 million D) $55.7 million E) 585.1 million 19. What are the weights of the different capital components of Elephant Memory? A) Debt: 0.44; Preferred Shares 0.16, Common Shares: 0.4 B) Debt: 0.3; Preferred Shares: 0.04: Common Shares: 0.66 C) Debt: 0.25: Preferred Shares: 0.15: Common Shares: 0.6 D) Debt: 0.17: Preferred Shares: 0.18. Common Shares: 0.65 E) Debt: 0.15; Preferred Shares: 0.05: Common Shares: 0.8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started