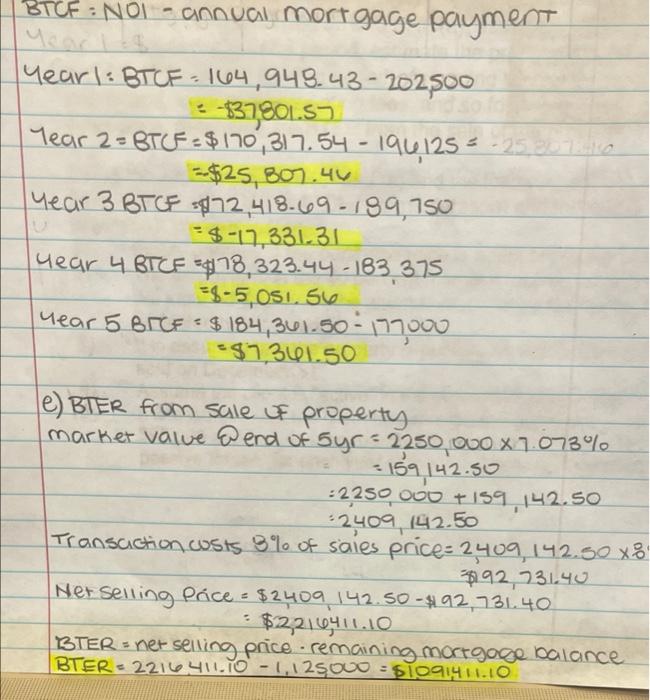

f. Using the information from (d) and (e) and the following assumptions, we next need to arrive at the ATCEs (from operation) and the ATER (from reversion). We can assume: 1) Eighty percent of the purchase price is attributed to the buildings 2) The taxpayer is in the 40 percent marginal income tax bracket and will incur no liability for the alternative minimum tax during the projected holding period! 3) It is assumed that the property is put into service on January 19 and sold on December 31" 4) Assume the client is "active" in the property management. 5) It is assumed that the client has an adjusted gross income of $95,000 and has no other passive income not offset by other passive losses (for each year of the anticipated holding period). BTCF : NOI - annual mortgage payment Mearl: BTCF - 164,948.43 - 202500 $37801.57 Year 2= BTCF = $170, 317.54 - 194125-25 =$25,807.44 Year 3 BTCF $72,418-69-199.750 $-17,331,31 Year 4 BTCF 5878,323.44-183 375 =8-5,051.56 Year 5 B/CF * $ 184,361.50-177000 $7,361.50 - e) BTER from sale of property market value Qend of syr = 2250 000 x 7.073% = 159 142.50 =2250 000 +159,142.50 Transaction costs 8% of sales prices 2409,142.50 X8 $92,731.40 Net Selling Pace - $2409142.50 -8.92,731.40 $2,216411.10 BIER = net selling price remaining mortgage balance BTER - 221641110 -1,129Ovo = $1091411.10 2409, 42.50 = f. Using the information from (d) and (e) and the following assumptions, we next need to arrive at the ATCEs (from operation) and the ATER (from reversion). We can assume: 1) Eighty percent of the purchase price is attributed to the buildings 2) The taxpayer is in the 40 percent marginal income tax bracket and will incur no liability for the alternative minimum tax during the projected holding period! 3) It is assumed that the property is put into service on January 19 and sold on December 31" 4) Assume the client is "active" in the property management. 5) It is assumed that the client has an adjusted gross income of $95,000 and has no other passive income not offset by other passive losses (for each year of the anticipated holding period). BTCF : NOI - annual mortgage payment Mearl: BTCF - 164,948.43 - 202500 $37801.57 Year 2= BTCF = $170, 317.54 - 194125-25 =$25,807.44 Year 3 BTCF $72,418-69-199.750 $-17,331,31 Year 4 BTCF 5878,323.44-183 375 =8-5,051.56 Year 5 B/CF * $ 184,361.50-177000 $7,361.50 - e) BTER from sale of property market value Qend of syr = 2250 000 x 7.073% = 159 142.50 =2250 000 +159,142.50 Transaction costs 8% of sales prices 2409,142.50 X8 $92,731.40 Net Selling Pace - $2409142.50 -8.92,731.40 $2,216411.10 BIER = net selling price remaining mortgage balance BTER - 221641110 -1,129Ovo = $1091411.10 2409, 42.50 =