Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answers needed for each part with step by step solution thanks :) i) Explain why in a developing country the government may create an insurance

Answers needed for each part with step by step solution thanks :)

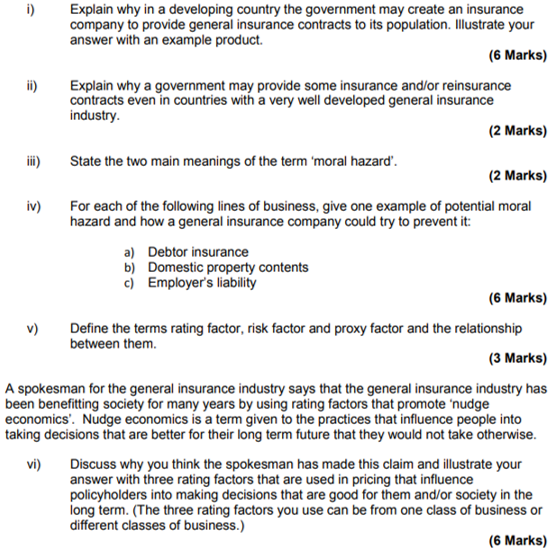

i) Explain why in a developing country the government may create an insurance company to provide general insurance contracts to its population. Illustrate your answer with an example product (6 Marks) ii) Explain why a government may provide some insurance and/or reinsurance contracts even in countries with a very well developed general insurance industry (2 Marks) State the two main meanings of the term 'moral hazard' (2 Marks) iv) For each of the following lines of business, give one example of potential moral hazard and how a general insurance company could try to prevent it Debtor insurance a) b) Domestic property contents c) Employer's liability (6 Marks) v) Define the terms rating factor, risk factor and proxy factor and the relationship between them (3 Marks) A spokesman for the general insurance industry says that the general insurance industry has been benefitting society for many years by using rating factors that promote 'nudge economics. Nudge economics is a term given to the practices that influence people into taking decisions that are better for their long term future that they would not take otherwise. vi) Discuss why you think the spokesman has made this claim and illustrate your answer with three rating factors that are used in pricing that influence policyholders into making decisions that are good for them and/or society in the ong term. (The three rating factors you use can be from one class of business or different classes of business.) (6 Marks) i) Explain why in a developing country the government may create an insurance company to provide general insurance contracts to its population. Illustrate your answer with an example product (6 Marks) ii) Explain why a government may provide some insurance and/or reinsurance contracts even in countries with a very well developed general insurance industry (2 Marks) State the two main meanings of the term 'moral hazard' (2 Marks) iv) For each of the following lines of business, give one example of potential moral hazard and how a general insurance company could try to prevent it Debtor insurance a) b) Domestic property contents c) Employer's liability (6 Marks) v) Define the terms rating factor, risk factor and proxy factor and the relationship between them (3 Marks) A spokesman for the general insurance industry says that the general insurance industry has been benefitting society for many years by using rating factors that promote 'nudge economics. Nudge economics is a term given to the practices that influence people into taking decisions that are better for their long term future that they would not take otherwise. vi) Discuss why you think the spokesman has made this claim and illustrate your answer with three rating factors that are used in pricing that influence policyholders into making decisions that are good for them and/or society in the ong term. (The three rating factors you use can be from one class of business or different classes of business.) (6 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started