Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Through November, Cameron has received gross income of $82,500. For December, Cameron is considering whether to accept one more work engagement for the year.

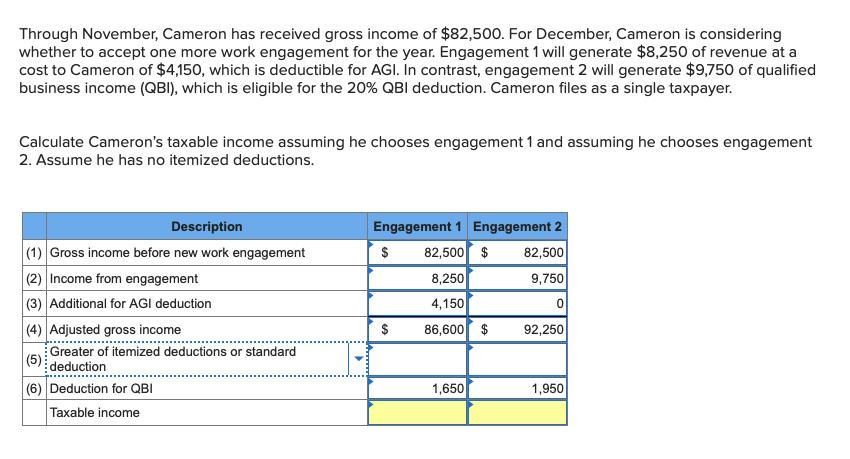

Through November, Cameron has received gross income of $82,500. For December, Cameron is considering whether to accept one more work engagement for the year. Engagement 1 will generate $8,250 of revenue at a cost to Cameron of $4,150, which is deductible for AGI. In contrast, engagement 2 will generate $9,750 of qualified business income (QBI), which is eligible for the 20% QBI deduction. Cameron files as a single taxpayer. Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has no itemized deductions. Description (1) Gross income before new work engagement (2) Income from engagement (3) Additional for AGI deduction (4) Adjusted gross income (5) Greater of itemized deductions or standard deduction (6) Deduction for QBI Taxable income > Engagement 1 Engagement 2 $ 82,500 $ 82,500 9,750 8,250 4,150 86,600 $ $ 1,650 0 92,250 1,950

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Engagement 1 Engagement 2 1 Gross income before new work engagement 82500 82500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started