Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answers to 1-6 please and explain why When a call has a strike price that is less than the market price of the underlying common

answers to 1-6 please and explain why

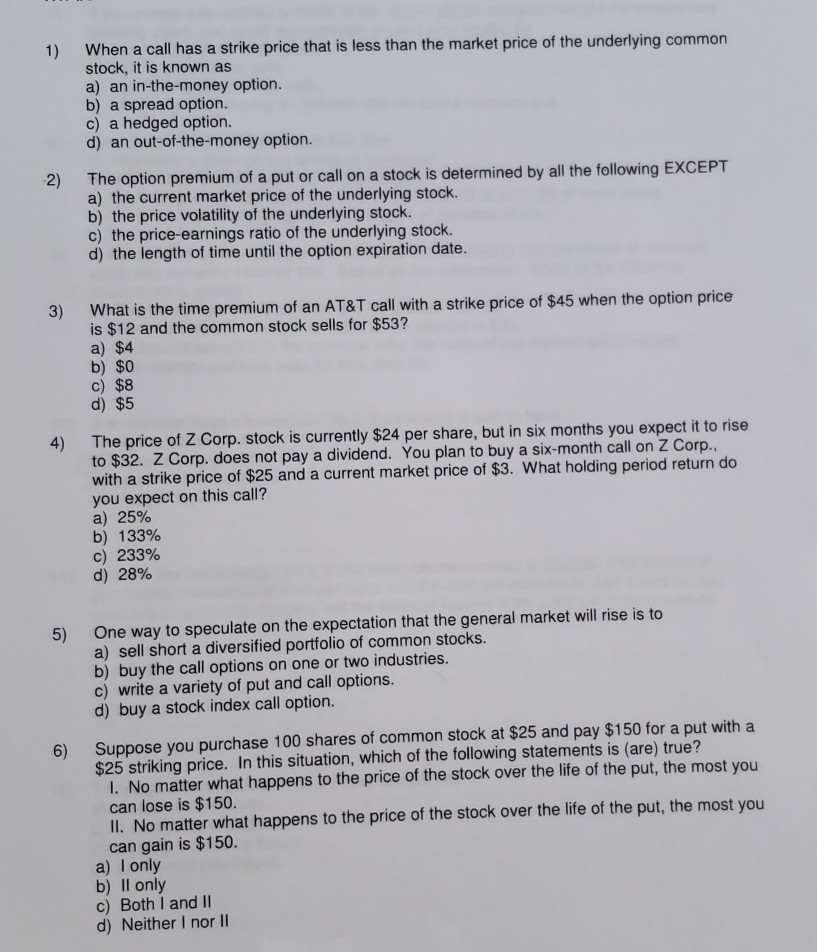

When a call has a strike price that is less than the market price of the underlying common stock, it is known as a) an in-the-money option. b) a spread option. c) a hedged option. d) an out-of-the-money option. 1) 2) The option premium of a put or call on a stock is determined by all the following EXCEPT a) the current market price of the underlying stock. b) the price volatility of the underlying stock. c) the price-earnings ratio of the underlying stock. d) the length of time until the option expiration date 3) What is the time premium of an AT&T call with a strike price of $45 when the option price is $12 and the common stock sells for $53? a) $4 b) $0 c) $8 d) $5 4) The price of Z Corp. stock is currently $24 per share, but in six months you expect it to rise to $32. Z Corp. does not pay a dividend. You plan to buy a six-month call on Z Corp with a strike price of $25 and a current market price of $3. What holding period return do you expect on this call? a) 25% b) 133% c) 233% d) 28% One way to speculate on the expectation that the general market will rise is to a) sell short a diversified portfolio of common stocks. b) buy the call options on one or two industries c) write a variety of put and call options d) buy a stock index call option 5) Suppose you purchase 100 shares of common stock at $25 and pay $150 for a put with a $25 striking price. In this situation, which of the following statements is (are) true? 6) I. No matter what happens to the price of the stock over the life of the put, the most you can lose is $150 Il. No matter what happens to the price of the stock over the life of the put, the most you can gain is $150. a) I only b) Il only c) Both I and lI d) Neither I nor lIStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started