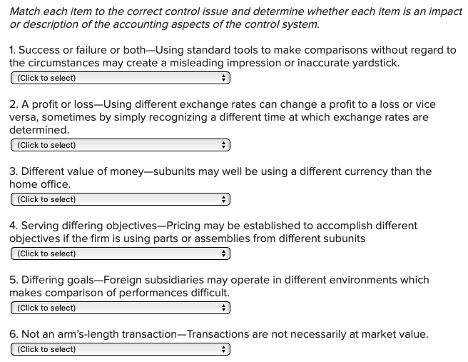

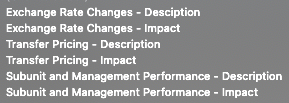

Answers to choose from:

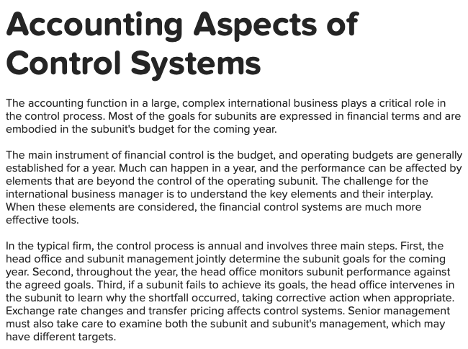

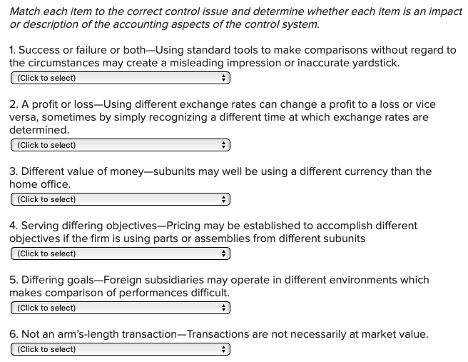

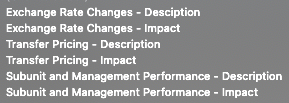

Accounting Aspects of Control Systems The accounting function in a large, complex international business plays a critical role in the control process. Most of the goals for subunits are expressed in financial terms and are embodied in the subunit's budget for the coming year. The main instrument of financial control is the budget, and operating budgets are generally established for a year. Much can happen in a year, and the performance can be affected by elements that are beyond the control of the operating subunit. The challenge for the international business manager is to understand the key elements and their interplay. When these elements are considered, the financial control systems are much more effective tools. In the typical firm, the control process is annual and involves three main steps. First, the head office and subunit management jointly determine the subunit goals for the coming year. Second, throughout the year, the head office monitors subunit performance against the agreed goals. Third, if a subunit fails to achieve its goals, the head office intervenes in the subunit to learn why the shortfall occurred, taking corrective action when appropriate. Exchange rate changes and transfer pricing affects control systems. Senior management must also take care to examine both the subunit and subunit's management, which may have different targets. Match each item to the correct control issue and determine whether each item is an impact or description of the accounting aspects of the control system. 1. Success or failure or both-Using standard tools to make comparisons without regard to the circumstances may create a misleading impression or inaccurate yardstick. (Click to select) 2. A profit or loss-Using different exchange rates can change a profit to a loss or vice versa, sometimes by simply recognizing a different time at which exchange rates are determined. Click to select) 3. Different value of money-subunits may well be using a different currency than the home office (Click to select) 4. Serving differing objectivesPricing may be established to accomplish different objectives if the firm is using parts or assemblies from different subunits (Click to select) 5. Differing goals-Foreign subsidiaries may operate in different environments which makes comparison of performances difficult. (Click to select) 6. Not an arm's-length transaction-Transactions are not necessarily at market value. (Click to select) Exchange Rate Changes - Desciption Exchange Rate Changes - Impact Transfer Pricing - Description Transfer Pricing - Impact Subunit and Management Performance - Description Subunit and Management Performance - Impact Accounting Aspects of Control Systems The accounting function in a large, complex international business plays a critical role in the control process. Most of the goals for subunits are expressed in financial terms and are embodied in the subunit's budget for the coming year. The main instrument of financial control is the budget, and operating budgets are generally established for a year. Much can happen in a year, and the performance can be affected by elements that are beyond the control of the operating subunit. The challenge for the international business manager is to understand the key elements and their interplay. When these elements are considered, the financial control systems are much more effective tools. In the typical firm, the control process is annual and involves three main steps. First, the head office and subunit management jointly determine the subunit goals for the coming year. Second, throughout the year, the head office monitors subunit performance against the agreed goals. Third, if a subunit fails to achieve its goals, the head office intervenes in the subunit to learn why the shortfall occurred, taking corrective action when appropriate. Exchange rate changes and transfer pricing affects control systems. Senior management must also take care to examine both the subunit and subunit's management, which may have different targets. Match each item to the correct control issue and determine whether each item is an impact or description of the accounting aspects of the control system. 1. Success or failure or both-Using standard tools to make comparisons without regard to the circumstances may create a misleading impression or inaccurate yardstick. (Click to select) 2. A profit or loss-Using different exchange rates can change a profit to a loss or vice versa, sometimes by simply recognizing a different time at which exchange rates are determined. Click to select) 3. Different value of money-subunits may well be using a different currency than the home office (Click to select) 4. Serving differing objectivesPricing may be established to accomplish different objectives if the firm is using parts or assemblies from different subunits (Click to select) 5. Differing goals-Foreign subsidiaries may operate in different environments which makes comparison of performances difficult. (Click to select) 6. Not an arm's-length transaction-Transactions are not necessarily at market value. (Click to select) Exchange Rate Changes - Desciption Exchange Rate Changes - Impact Transfer Pricing - Description Transfer Pricing - Impact Subunit and Management Performance - Description Subunit and Management Performance - Impact