Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answers using excel with complementary explanations are preferred but it is not mandatory if you want to solve on paper(just write it readable) Mapleleaf Inc.

Answers using excel with complementary explanations are preferred but it is not mandatory if you want to solve on paper(just write it readable)

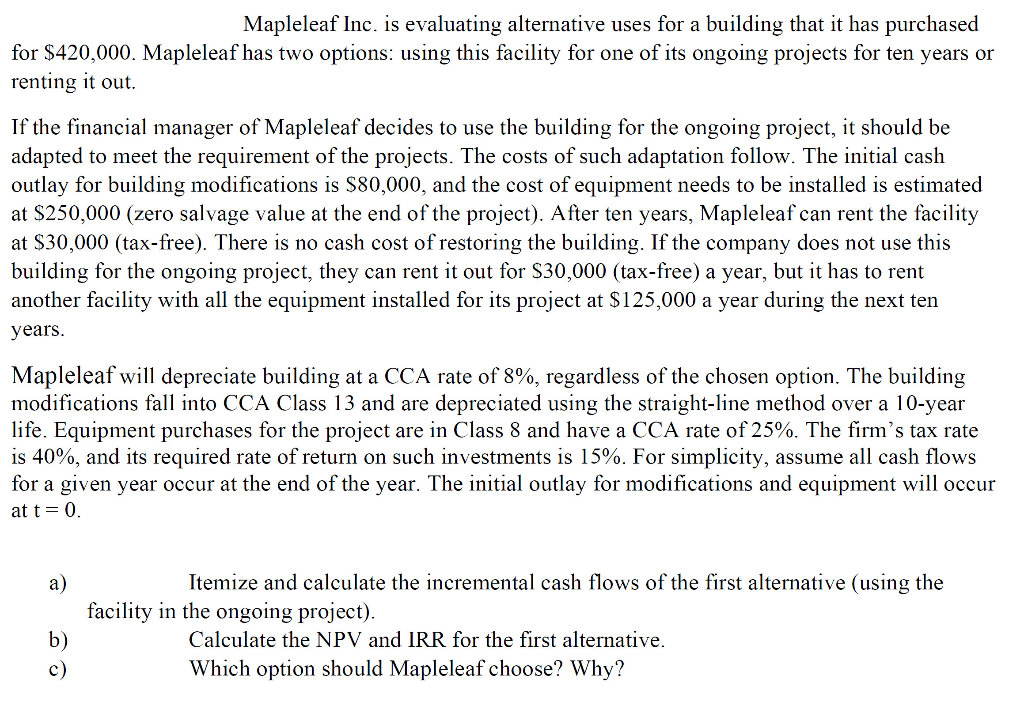

Mapleleaf Inc. is evaluating alternative uses for a building that it has purchased for $420,000. Mapleleaf has two options: using this facility for one of its ongoing projects for ten years or renting it out. If the financial manager of Mapleleaf decides to use the building for the ongoing project, it should be adapted to meet the requirement of the projects. The costs of such adaptation follow. The initial cash outlay for building modifications is $80,000, and the cost of equipment needs to be installed is estimated at $250,000 (zero salvage value at the end of the project). After ten years, Mapleleaf can rent the facility at $30,000 (tax-free). There is no cash cost of restoring the building. If the company does not use this building for the ongoing project, they can rent it out for $30,000 (tax-free) a year, but it has to rent another facility with all the equipment installed for its project at $125,000 a year during the next ten years. Mapleleaf will depreciate building at a CCA rate of 8%, regardless of the chosen option. The building modifications fall into CCA Class 13 and are depreciated using the straight-line method over a 10-year life. Equipment purchases for the project are in Class 8 and have a CCA rate of 25%. The firm's tax rate is 40%, and its required rate of return on such investments is 15%. For simplicity, assume all cash flows for a given year occur at the end of the year. The initial outlay for modifications and equipment will occur at t= 0. a) Itemize and calculate the incremental cash flows of the first alternative (using the facility in the ongoing project). Calculate the NPV and IRR for the first alternative. Which option should Mapleleaf choose? Why? b) c)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started