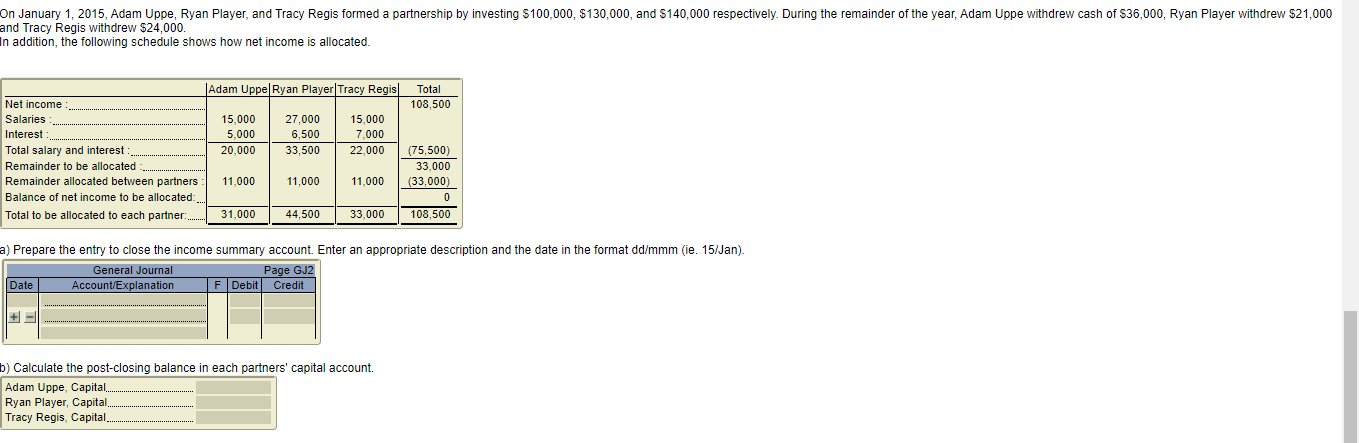

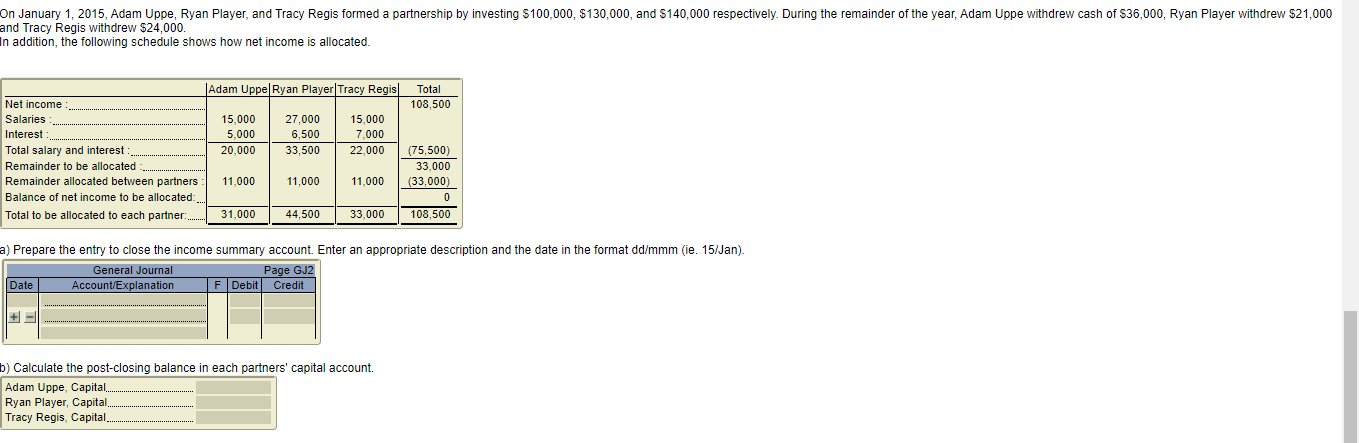

ANTEE On January 1, 2015, Adam Uppe, Ryan Player, and Tracy Regis formed a partnership by investing $100,000, $130,000, and $140,000 respectively. During the remainder of the year, Adam Uppe withdrew cash of $36,000, Ryan Player withdrew $21,000 and Tracy Regis withdrew $24,000. In addition, the following schedule shows how net income is allocated. Adam Uppe Ryan PlayerTracy Regis| Total 108,500 15,000 5.000 20,000 27,000 6,500 33,500 15,000 7,000 22.000 Net income Salaries: Interest Total salary and interest: Remainder to be allocated Remainder allocated between partners Balance of net income to be allocated: Total to be allocated to each partner: 11,000 11,000 11,000 (75.500) 33.000 (33.000) 0 108,500 31.000 44,500 33.000 a) Prepare the entry to close the income summary account. Enter an appropriate description and the date in the format dd/mmm (ie. 15/Jan). General Journal Page GJ2 Account/Explanation F Debit Credit Date b) Calculate the post-closing balance in each partners' capital account. Adam Uppe, Capital Ryan Player, Capital. Tracy Regis, Capital. ANTEE On January 1, 2015, Adam Uppe, Ryan Player, and Tracy Regis formed a partnership by investing $100,000, $130,000, and $140,000 respectively. During the remainder of the year, Adam Uppe withdrew cash of $36,000, Ryan Player withdrew $21,000 and Tracy Regis withdrew $24,000. In addition, the following schedule shows how net income is allocated. Adam Uppe Ryan PlayerTracy Regis| Total 108,500 15,000 5.000 20,000 27,000 6,500 33,500 15,000 7,000 22.000 Net income Salaries: Interest Total salary and interest: Remainder to be allocated Remainder allocated between partners Balance of net income to be allocated: Total to be allocated to each partner: 11,000 11,000 11,000 (75.500) 33.000 (33.000) 0 108,500 31.000 44,500 33.000 a) Prepare the entry to close the income summary account. Enter an appropriate description and the date in the format dd/mmm (ie. 15/Jan). General Journal Page GJ2 Account/Explanation F Debit Credit Date b) Calculate the post-closing balance in each partners' capital account. Adam Uppe, Capital Ryan Player, Capital. Tracy Regis, Capital