Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anthony and Dorothy are both vice-presidents at a national merchandising company. Each of them is charged with the task of independently researching new ideas

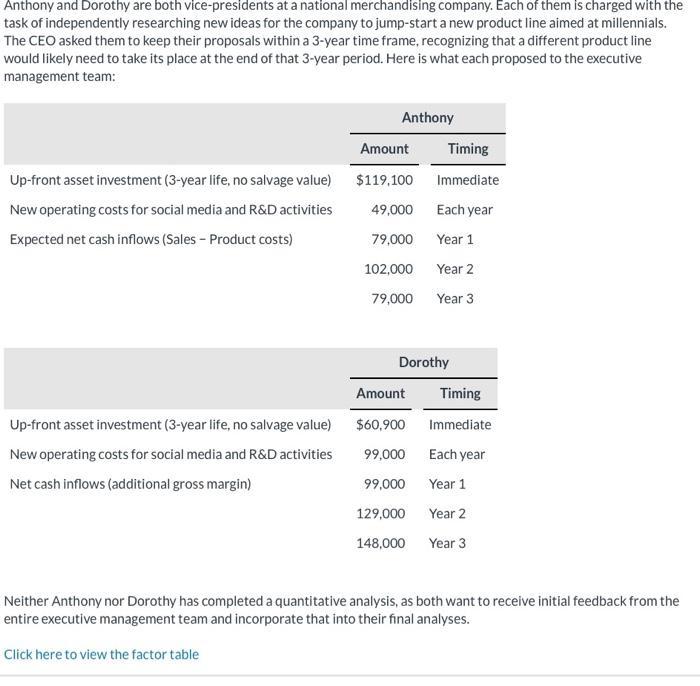

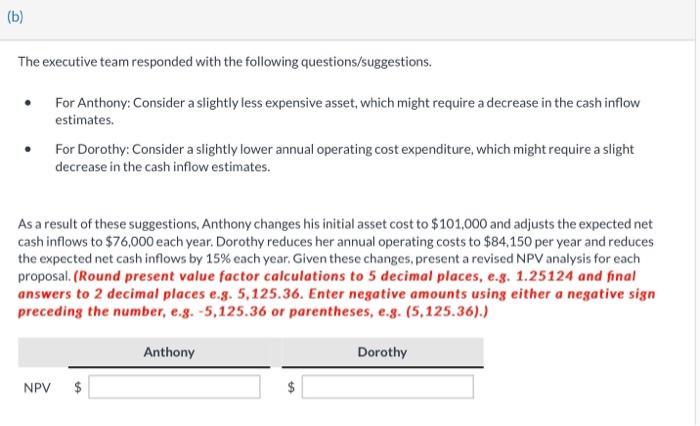

Anthony and Dorothy are both vice-presidents at a national merchandising company. Each of them is charged with the task of independently researching new ideas for the company to jump-start a new product line aimed at millennials. The CEO asked them to keep their proposals within a 3-year time frame, recognizing that a different product line would likely need to take its place at the end of that 3-year period. Here is what each proposed to the executive management team: Up-front asset investment (3-year life, no salvage value) New operating costs for social media and R&D activities Expected net cash inflows (Sales - Product costs) Up-front asset investment (3-year life, no salvage value) New operating costs for social media and R&D activities Net cash inflows (additional gross margin) Anthony Amount $119,100 49,000 79,000 102,000 79,000 Timing Immediate Amount $60,900 99,000 99,000 129,000 148,000 Each year Year 1 Year 2 Year 3 Dorothy Timing Immediate Each year Year 1 Year 2 Year 3 Neither Anthony nor Dorothy has completed a quantitative analysis, as both want to receive initial feedback from the entire executive management team and incorporate that into their final analyses. Click here to view the factor table (b) The executive team responded with the following questions/suggestions. For Anthony: Consider a slightly less expensive asset, which might require a decrease in the cash inflow estimates. NPV For Dorothy: Consider a slightly lower annual operating cost expenditure, which might require a slight decrease in the cash inflow estimates. As a result of these suggestions, Anthony changes his initial asset cost to $101,000 and adjusts the expected net cash inflows to $76,000 each year. Dorothy reduces her annual operating costs to $84,150 per year and reduces the expected net cash inflows by 15% each year. Given these changes, present a revised NPV analysis for each proposal. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 2 decimal places e.g. 5,125.36. Enter negative amounts using either a negative sign preceding the number, e.g. -5,125.36 or parentheses, e.g. (5,125.36).) $ Anthony Dorothy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started