Question

Anthony Stork (birthdate August 2, 1979) is a single taxpayer. Anthony's earnings and withholdings as the manager of a local casino for 2023 are reported

Anthony Stork (birthdate August 2, 1979) is a single taxpayer. Anthony's earnings and withholdings as the manager of a local casino for 2023 are reported on his Form W-2 (see separate tab).

Anthony pays his ex-spouse, Salty Pans, $3,900 per month in accordance with their February 12, 2020, divorce decree. When their 12-year-old child (in the ex-spouse's custody) reaches the age of 18, the payments are reduced to $2,800 per month. His ex-spouse's Social Security number is 554-44-5555.

In 2023, Anthony purchased a new car and so he kept track of his sales tax receipts during the year. His actual sales tax paid was $3,856 for the car and $925 for all other purchases. For purposes of completing this tax return*, you may assume that Anthony's actual sales tax exceeds the IRS estimated sales tax in 2023.

Anthony participates in a high-deductible health plan and is eligible to contribute to a health savings account. His HSA earned $75 in 2023.

During the year, Anthony paid the following amounts (all of which can be substantiated):

|

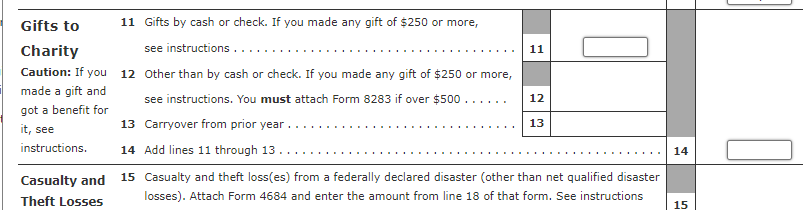

In 2023, Anthony inherited over $500,000 from his father, Howard, who died in 2023. Although Anthony invested a large portion, he also made a $50,000 cash donation to the Stork School of Engineering at Reno State University (see separate letter).

Anthony also received a Form 1098 and a combined Form 1099-DIV (see separate tabs).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started