Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Antonio Romano, a Canadian resident, owns all of the issued and outstanding shares of Romano Limited. (RL), which is an importer and wholesaler of

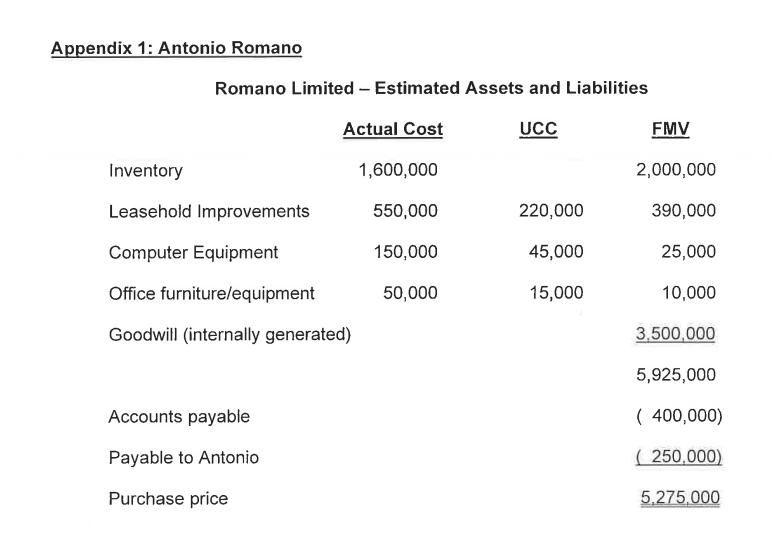

Antonio Romano, a Canadian resident, owns all of the issued and outstanding shares of Romano Limited. ("RL"), which is an importer and wholesaler of furniture and home accessories made in Italy. Although Antonio was born and raised in Canada, he has many relatives in Italy and has been able to profitably use those contacts to source high end products. RL sells to various high-end retail outlets across Canada. Antonio thinks the business may be adversely impacted by rising interest rates. Furthermore, he would like to retire so he and his wife can travel while they are still able to do so. As a result, he thinks it is the right time to sell RL. RL operates out of leased premises in Woodbridge, Ontario. The premises encompass office, showroom and warehouse space. There are 100 common shares outstanding with a total paid- up capital of $100 ($1 per share). Antonio inherited the shares from his father. At the time of his father's death, the shares were worth $100,000. Antonio is aware that he could sell assets or shares. He has been approached by an arm's length company that would like to purchase the business. The potential purchaser imports similar goods from a number of European countries, but not Italy, and accordingly RL would be a good "fit" for it to expand. Antonio has estimated the value of RL's assets at $5,925,000, based on values proposed by the purchaser. On the assumption that the purchaser would assume the liabilities of RL, the company would receive $5,275,000 on an asset sale. If the assets are sold, RL will pay its corporate taxes and invest the after-tax proceeds in marketable securities. RL has an August 31 year-end for tax purposes. Antonio anticipates a sale would take place on August 31, 2023. Antonio has provided projected financial information on the assets and liabilities of the company (see Appendix 1 at the end). The cost and UCC amounts are based on RL's projected August 31, 2023 information. It is projected that RL's 2023 taxable income, excluding the income/taxable capital gains generated from the asset sale, will be approximately $300,000 before CCA. Assume that this $300,000 taxable income figure is computed correctly and all of it will be eligible for the small business deduction. This income is not reflected in the asset information in Appendix 1. Antonio does not own shares of any other private corporations. He wants to know how much money RL will have to invest from the sale if the assets are sold. He would also like to know how much he could take out of the company as capital dividends and as eligible dividends. Per CRA, RL has no general rate income pool (GRIP) or capital dividend account (CDA) or eligible or non-eligible refundable dividend on hand (ERDTOH or NERDTOH) accounts as at August 31, 2022. Antonio is willing to accept an asset sale at the values in Appendix 1. However, as RL is a qualified small business corporation ("QSBC") and Antonio has used only $50,000 of his lifetime QSBC capital gains exemption entitlement (he claimed capital gains deduction of $25,000 in 2017), he would like to sell shares, if possible, to get his "free" capital gain. He knows that he will receive a lower price for a share sale than for an asset sale. Antonio thinks he might be able to sell the shares for $4,800,000. He would like to know if he would be better off selling the shares for $4,800,000 rather than selling the net assets for $5,275,000. Assume the combined federal/provincial corporate tax rate is 13% for active business income eligible for the small business deduction, 25% on active income not eligible for the small business deduction and 50.67% on investment income. Also, you can assume that the top combined federal/provincial personal marginal rate is 50% and that Antonio has sufficient other income to be in the top bracket. Also assume that the combined federal/provincial dividend tax credit is equal to the gross-up. Appendix 1: Antonio Romano Romano Limited - Estimated Assets and Liabilities Actual Cost Inventory Leasehold Improvements Computer Equipment Office furniture/equipment Goodwill (internally generated) Accounts payable Payable to Antonio Purchase price 1,600,000 550,000 150,000 50,000 UCC 220,000 45,000 15,000 FMV 2,000,000 390,000 25,000 10,000 3,500,000 5,925,000 (400,000) (250,000) 5,275,000

Step by Step Solution

★★★★★

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

It seems like youre looking for advice on the financial implications of selling shares versus selling assets for Antonio Romanos company Romano Limite...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started