Answered step by step

Verified Expert Solution

Question

1 Approved Answer

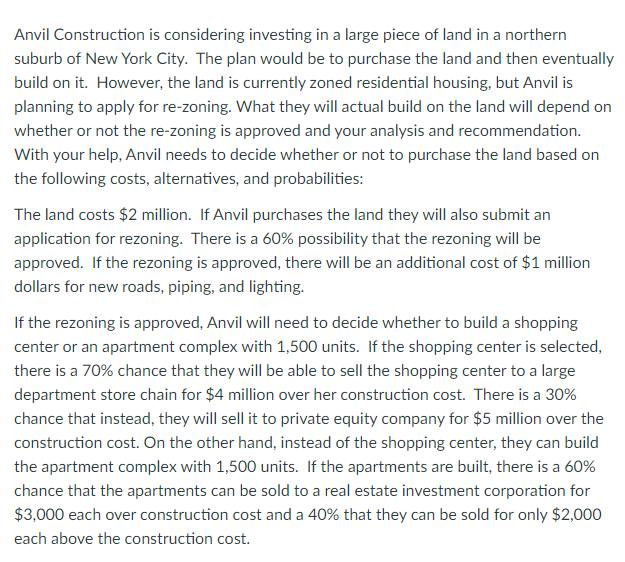

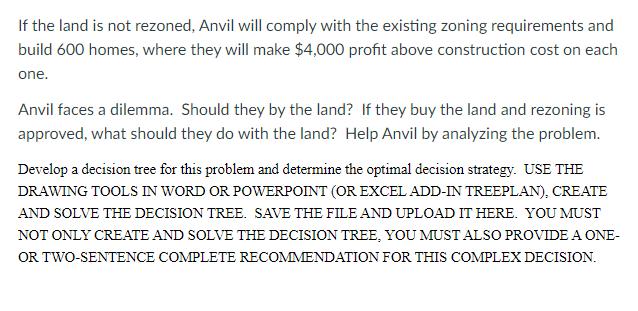

Anvil Construction is considering investing in a large piece of land in a northern suburb of New York City. The plan would be to

Anvil Construction is considering investing in a large piece of land in a northern suburb of New York City. The plan would be to purchase the land and then eventually build on it. However, the land is currently zoned residential housing, but Anvil is planning to apply for re-zoning. What they will actual build on the land will depend on whether or not the re-zoning is approved and your analysis and recommendation. With your help, Anvil needs to decide whether or not to purchase the land based on the following costs, alternatives, and probabilities: The land costs $2 million. If Anvil purchases the land they will also submit an application for rezoning. There is a 60% possibility that the rezoning will be approved. If the rezoning is approved, there will be an additional cost of $1 million dollars for new roads, piping, and lighting. If the rezoning is approved, Anvil will need to decide whether to build a shopping center or an apartment complex with 1,500 units. If the shopping center is selected, there is a 70% chance that they will be able to sell the shopping center to a large department store chain for $4 million over her construction cost. There is a 30% chance that instead, they will sell it to private equity company for $5 million over the construction cost. On the other hand, instead of the shopping center, they can build the apartment complex with 1,500 units. If the apartments are built, there is a 60% chance that the apartments can be sold to a real estate investment corporation for $3,000 each over construction cost and a 40% that they can be sold for only $2,000 each above the construction cost. If the land is not rezoned, Anvil will comply with the existing zoning requirements and build 600 homes, where they will make $4,000 profit above construction cost on each one. Anvil faces a dilemma. Should they by the land? If they buy the land and rezoning is approved, what should they do with the land? Help Anvil by analyzing the problem. Develop a decision tree for this problem and determine the optimal decision strategy. USE THE DRAWING TOOLS IN WORD OR POWERPOINT (OR EXCEL ADD-IN TREEPLAN), CREATE AND SOLVE THE DECISION TREE. SAVE THE FILE AND UPLOAD IT HERE. YOU MUST NOT ONLY CREATE AND SOLVE THE DECISION TREE, YOU MUST ALSO PROVIDE A ONE- OR TWO-SENTENCE COMPLETE RECOMMENDATION FOR THIS COMPLEX DECISION.

Step by Step Solution

★★★★★

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Payoff is in million Expected Monetary Value EMV are calculated below If land is rezoned then EM...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started