Anwser all questions and Show work

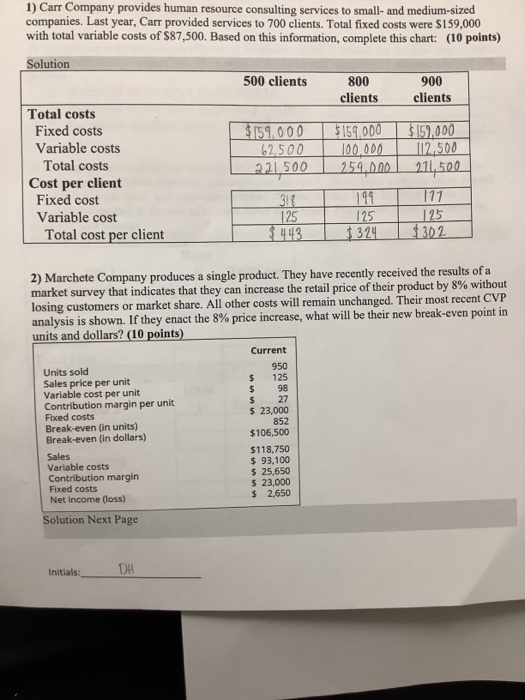

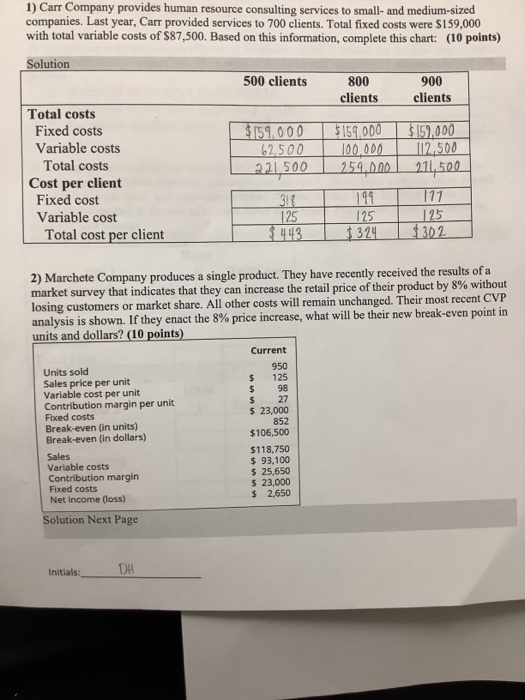

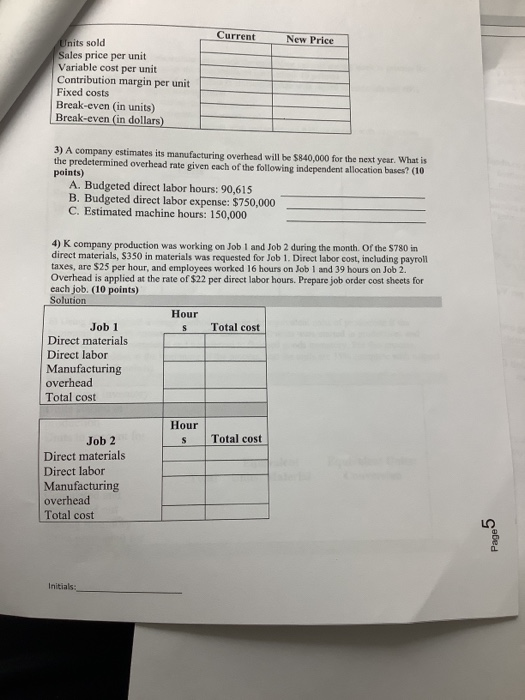

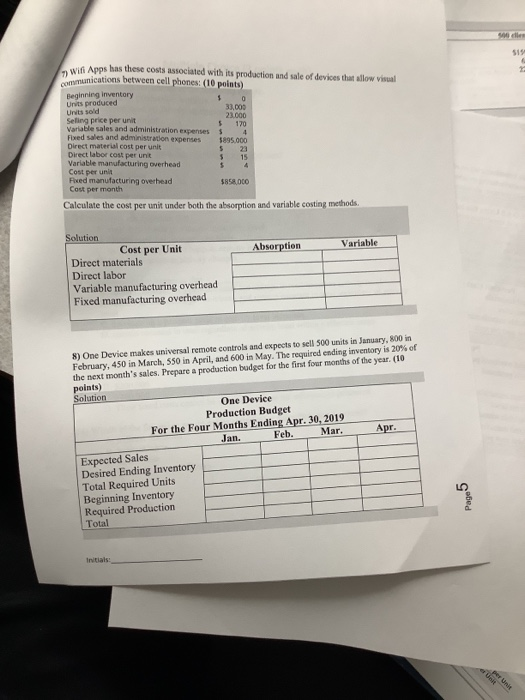

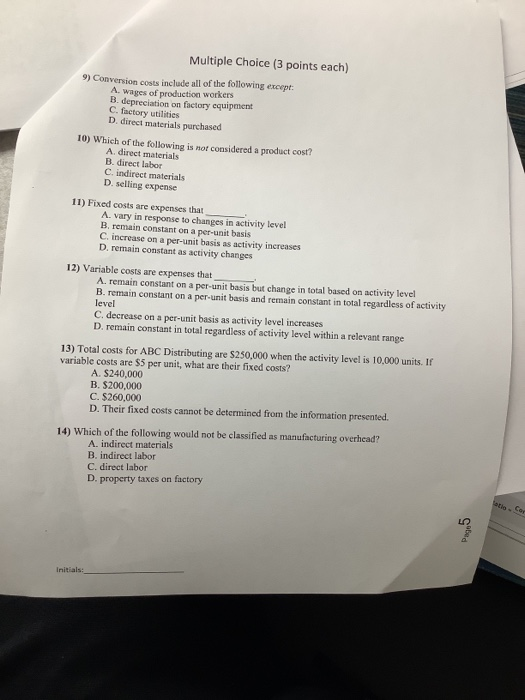

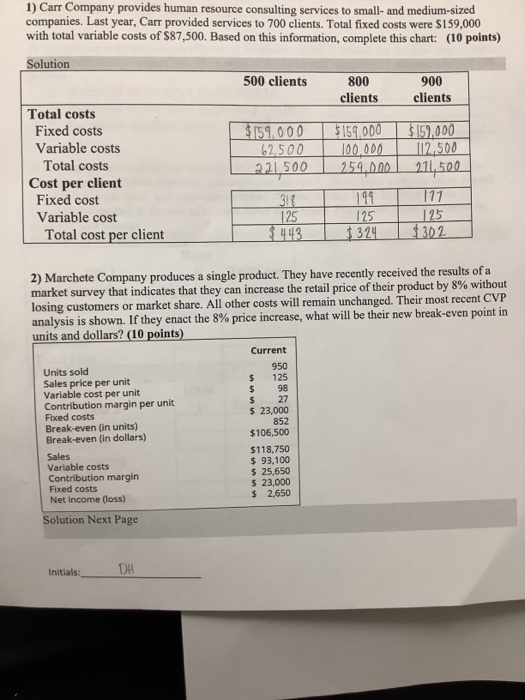

1 Carr Company provides human resource consulting services to small and medium-sized companies. Last year, Carr provided services to 700 clients. Total fixed costs were $159,000 with total variable costs of $87,500. Based on this information, complete this chart: (10 points) Solution 500 clients 800 clients 900 clients Total costs Fixed costs Variable costs Total costs Cost per client Fixed cost Variable cost Total cost per client $ 159,000 62.500 22500 $159.000 100000 254.000 $159.000 12.500 211,500 111 312_ 199 $ 443 125 1 324 125 $302 2) Marchete Company produces a single product. They have recently received the results of a market survey that indicates that they can increase the retail price of their product by 8% without losing customers or market share. All other costs will remain unchanged. Their most recent CVP analysis is shown. If they enact the 8% price increase, what will be their new break-even point in units and dollars? (10 points) Current Units sold 950 Sales price per unit $ 125 Variable cost per unit $ 98 Contribution margin per unit Fixed costs $ 23,000 Break-even (in units) Break-even (in dollars) $106,500 Sales $118,750 Variable costs $ 93,100 Contribution margin $ 25,650 Fixed costs $ 23,000 Net Income (loss) $ 2,650 27 852 Solution Next Page Initials: Current New Price Units sold Sales price per unit Variable cost per unit Contribution margin per unit Fixed costs Break-even in units) Break-even (in dollars) 3) A company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following independent allocation bases? (10 points) A Budgeted direct labor hours: 90,615 B. Budgeted direct labor expense: $750,000 C. Estimated machine hours: 150,000 4) K company production was working on Job 1 and Job 2 during the month of the S780 in direct materials, $350 in materials was requested for Job 1. Direct labor cost, including payroll taxes, are $25 per hour, and employees worked 16 hours on Job 1 and 39 hours on Job 2. Overhead is applied at the rate of $22 per direct labor hours. Prepare job order cost sheets for each job. (10 points) Solution Hour Job 1 Total cost Direct materials Direct labor Manufacturing overhead Total cost Hour S Total cost Job 2 Direct materials Direct labor Manufacturing overhead Total cost Page 5 Initials: Given the following information, determine the equivalent units of ending work in process for materials and conversion under the weighted average method: (8 points) beginning inventory of 4,000 units is 100% complete with regard to materials and 60% complete with regard to conversion 23,000 units were started during the period 18,500 units were completed and transferred ending inventory is 100% complete with materials and 63% complete with conversion Solution Units Beginning inventory Started in production Units to account for Materials Conversion Equivalent Units Transferred out Ending inventory Units accounted for 6) Using the weighted average method, compute the equivalent units of production if the beginning inventory consisted of 20,000 units: 55,000 units were started in production, and 57,000 units were completed and transferred to finished goods inventory. For this process, materials are added at the beginning of the process, and the units are 35% complete with respect to conversion. (7 points) Solution Beginning inventory Units started in production Units to account for Equivalent Total Units: Material Equivalent Units: Conversion Completed and transferred out Ending inventory Units accounted for Goed Initials Wifi Apps has these costs associated with its production and sale of devices that allow visual unications between cell phones: (10 points) Beginning inventory Urvis produced 33.000 Units sold 21.000 Selling price per unit Varuble sales and administration expenses S 4 Fixed sales and administration expenses 3895.000 Direct material cost per unit 5 23 Direct labor cost per unit Variable manufacturing overhead Cost per unit Fixed manufacturing overheid $85.000 Cost per month Calculate the cost per unit under both the absorption and variable costing methods. Absorption Variable Solution Cost per Unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead 8) One Device makes universal remote controls and expects to sell 500 units in January, 800 in February, 450 in March, 550 in April, and 600 in May. The required ending inventory is 20% of the next month's sales. Prepare a production budget for the first four months of the year. (10 points) Solution One Device Production Budget For the Four Months Ending Apr. 30, 2019 Jan. Feb. Mar. Apr. Expected Sales Desired Ending Inventory Total Required Units Beginning Inventory Required Production Page 5 Total Initials: Multiple Choice (3 points each) 9) Conversion costs include all of the following except A. wages of production workers B. depreciation on factory equipment C. factory utilities D. direct materials purchased 10) Which of the following is not considered a product cost? A direct materials B. direct labor C. indirect materials D. selling expense 11) Fixed costs are expenses that A. vary in response to changes in activity level B. remain constant on a per-unit basis C. increase on a per-unit basis as activity increases D. remain constant as activity changes 12) Variable costs are expenses that A. remain constant on a per-unit basis but change in total based on activity level B. remain constant on a per-unit basis and remain constant in total regardless of activity level C. decrease on a per-unit basis as activity level increases D. remain constant in total regardless of activity level within a relevant range 13) Total costs for ABC Distributing are $250,000 when the activity level is 10.000 units. If variable costs are $5 per unit, what are their fixed costs? A S240,000 B. $200,000 C. $260,000 D. Their fixed costs cannot be determined from the information presented. 14) Which of the following would not be classified as manufacturing overhead? A. indirect materials B. indirect labor C. direct labor D. property taxes on factory Sod