Answered step by step

Verified Expert Solution

Question

1 Approved Answer

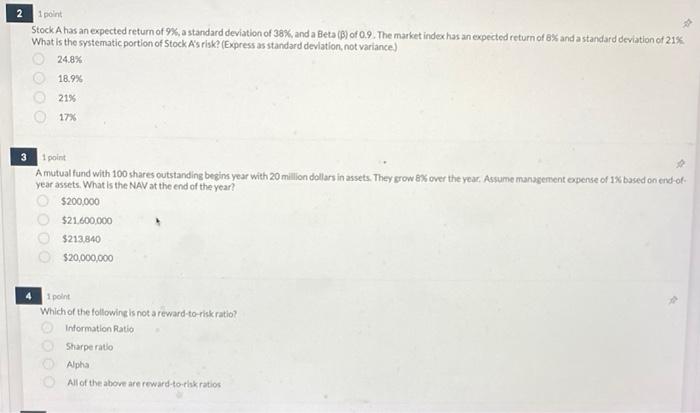

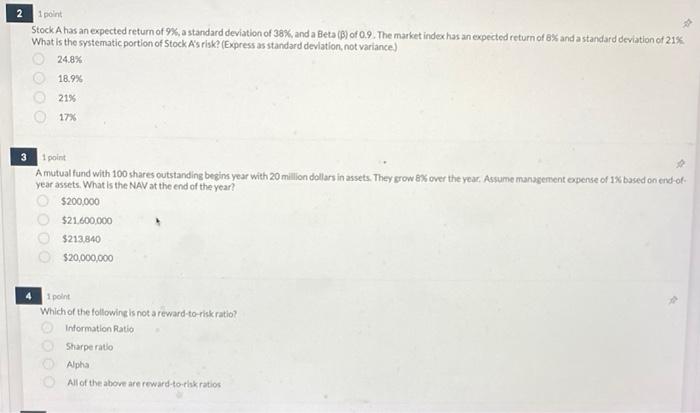

any help! Stock. A has an expected return of 9% a standard deviation of 38% and a Beta ($) of 0.9. The market index has

any help!

Stock. A has an expected return of 9% a standard deviation of 38% and a Beta (\$) of 0.9. The market index has an expected return of B\% and a standard deviation of 21 sk What is the systematic portion of Stock A's risk? (Express as standard deviation, not variance) 24.8% 18.956 21% 17% 1 goint Amutual fund with 100 shares outstanding beging year with 20 million dollars in assets. They grow 8 sover the year, Assume manasensent eyense of 1 Kosed on end-ofyear assets. What is the NAV at the end of the year? $200,000 $21,600000 $213.840 $20,000,000 4 I point Which of the followingis not a reward-to-risk ratio? Information Ratio Starperatio Alpha All of the abowe are reward-torisk ration

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started