Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Any help will be great. Please provide the calculations too. P9-8 Allocations using simplified costing versus activity-based costing Williams and DiMaggio, architects, have been using

Any help will be great. Please provide the calculations too.

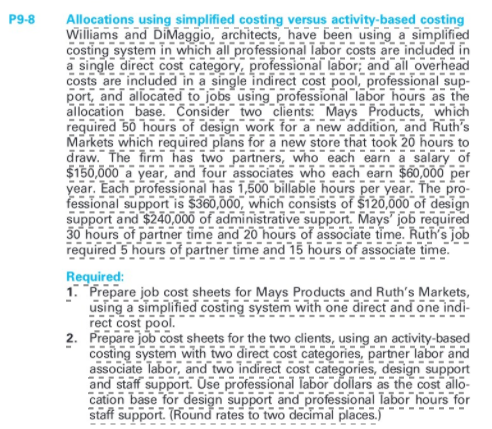

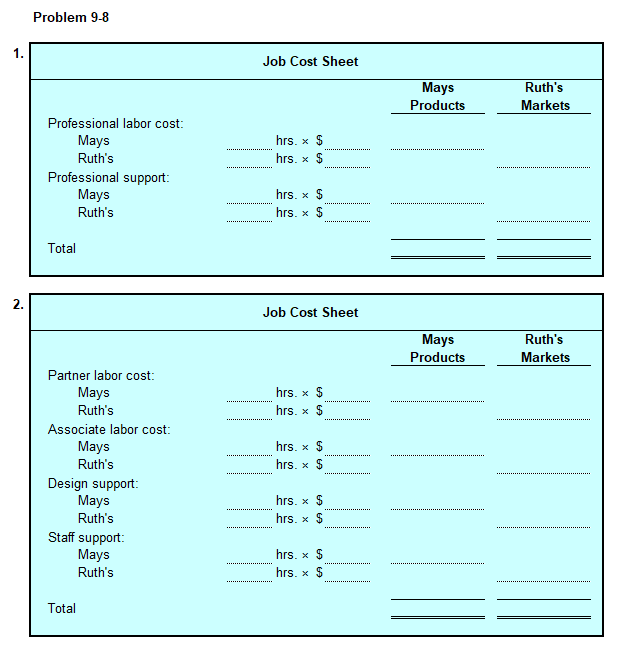

P9-8 Allocations using simplified costing versus activity-based costing Williams and DiMaggio, architects, have been using a simplified costing system in which all professional labor costs are included in a single direct cost category, professional labor and all overhead costs are included in a single indirect cost pool, professional sup- port, and allocated to jobs using professional labor hours as the allocation base. Consider two clients: Mays Products, which required 50 hours of design work for a new addition, and Ruth's Markets which required plans for a new store that took 20 hours to draw. The firm has two partners, who each earn a salary of $150,000 a year, and four associates who each earn $60,000 per year. Each professional has 1,500 billable hours per year. The pro- fessional support is $360,000, which consists of $120,000 of design support and $240,000 of administrative support, Mays' job required 30 hours of partner time and 20 hours of associate time. Ruth's job required 5 hours of partner time and 15 hours of associate time. Required: 1. Prepare job cost sheets for Mays Products and Ruth's Markets, using a simplified costing system with one direct and one indi- rect cost pool. 2. Prepare job cost sheets for the two clients, using an activity-based costing system with two direct cost categories, partner labor and associate labor, and two indirect cost categories, design support support Ose professional labor dollars as the cost allo- cation base for design support and professional labor hours for staff support. (Round rates to two decimal places. Problem 9-8 1. Job Cost Sheet Mays Products Ruth's Markets hrs. * $ hrs. * $ Professional labor cost: Mays Ruth's Professional support: Mays Ruth's hrs. x $ hrs. x $ Total 2. Job Cost Sheet Mays Products Ruth's Markets hrs. x $ hrs. * $ hrs. x $ hrs. x Partner labor cost: Mays Ruth's Associate labor cost: Mays Ruth's Design support: Mays Ruth's Staff support: Mays Ruth's hrs. * $ hrs x S hrs. * $ hrs. * $ TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started