Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Any help would be appreciate. Thank you! can you cancel the question and i will upload/ask it again with better pictures? 1. Calculate the following

Any help would be appreciate. Thank you!

can you cancel the question and i will upload/ask it again with better pictures?

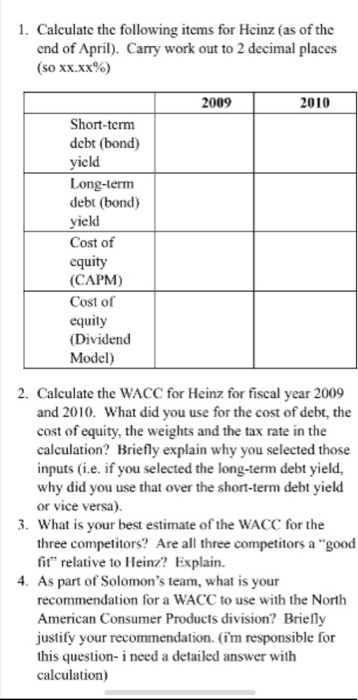

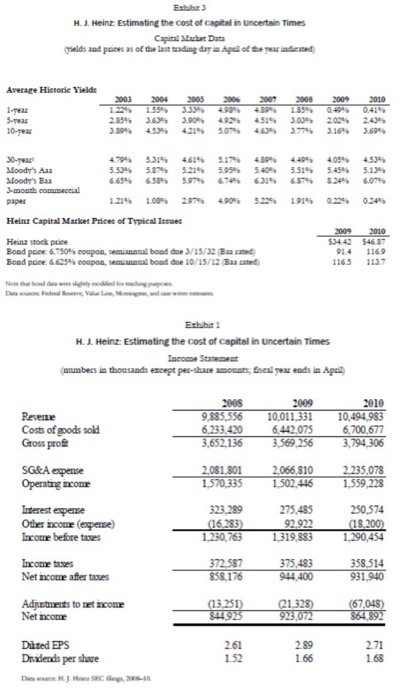

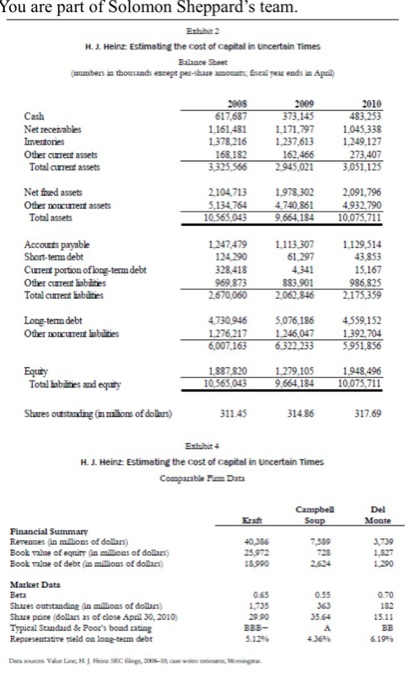

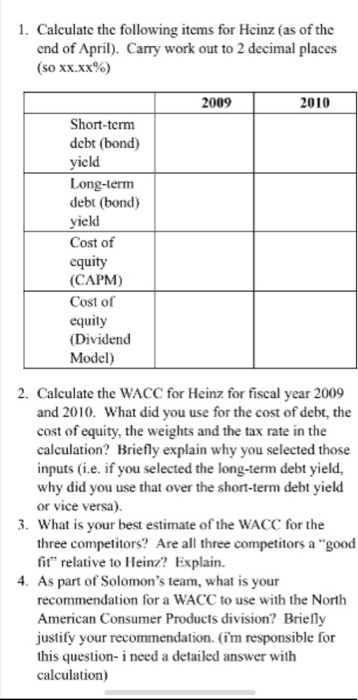

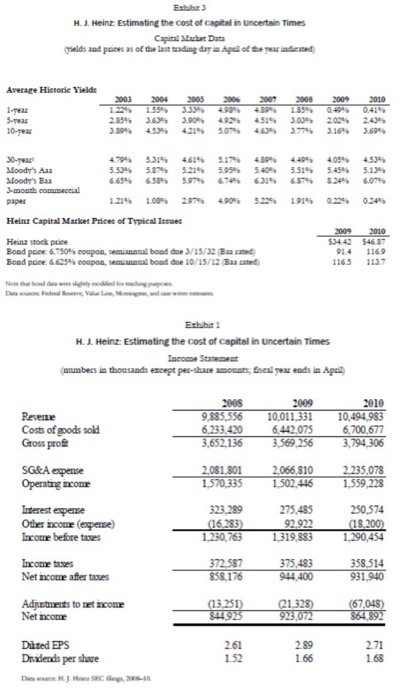

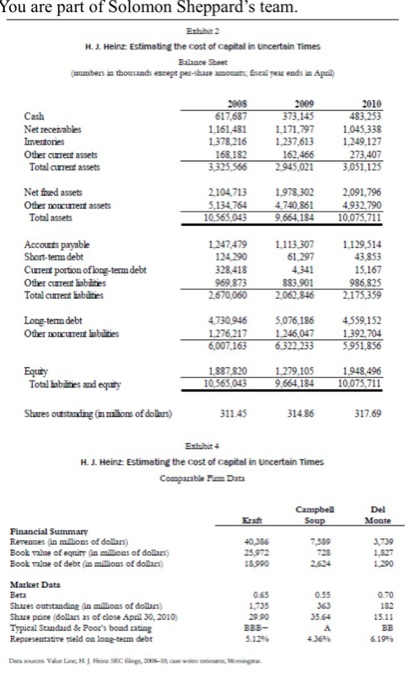

1. Calculate the following items for Heinz (as of the end of April). Carry work out to 2 decimal places (50 xx.xx%) 2009 2010 Short-term debt (bond) yield Long-term debt (bond) yield Cost of equity (CAPM) Cost of equity (Dividend Model) 2. Calculate the WACC for Heinz for fiscal year 2009 and 2010. What did you use for the cost of debt, the cost of equity, the weights and the tax rate in the calculation? Briefly explain why you selected those inputs (i.e. if you selected the long-term debt yield, why did you use that over the short-term debt yield or vice versa). 3. What is your best estimate of the WACC for the three competitors? Are all three competitors a "good fit" relative to Heinz? Explain. 4. As part of Solomon's team, what is your recommendation for a WACC to use with the North American Consumer Products division? Briefly justify your recommendation. (i'm responsible for this question- i need a detailed answer with calculation) Eshit 3 H. J. Heinz Estimating the cost of capital in Uncertain Times Capital Market Data Fields and prices as of the last trading day in Apel of the year indicated Average Historie Yielde 2003 2004 2005 2006 2007 2008 2009 2010 2.85 492, 4514 Sear 10-year 3.99 3.60 3.90 4534219 3.034 3. 30-reart Moody's Aaa Moody's Baa J-month commercial paper 4.79% 5.53 6.659 3.39% 5.3 658 4.61% 5.21 5.9 5.17% 5.95 6.7 4.30% 5.40 6.319 40% 5.45 4,40% 5.51% 6.57% 191% 4.33% 5.139 6.079 1.21% 1.09% 2.97% 490% 22% Heinz Capital Market Prices of Typical Issues Heing stock price Bond price: 6.750% coupon, semiannual bond de 3/15/32 Baated Bond price: 6.625 coupon, seminal bond de 10/15/12 Based 2009 2010 $34 42 546 37 91.4 1169 1165113.7 Dus Faded RVM Exhibiti H. J. Heinz: Estimating the cost of capital in Uncertain Times Income Statement numbers in thousands except pes-share amounts, Escal year ends in April Revente Costs of goods sold Gross profit 2008 9.885.556 6.233.420 3,652,136 2009 10,011,331 6.442.075 3,569,256 2010 10,494.983 6,700.677 3,794, 306 SG&A expense Operating income 2.081.801 1,570,335 2,066,810 1,502.446 2.235,078 1,559,228 Interest expense Other income (expense) Income before taxes 323,289 (16.283) 1,230,763 275,485 92.922 1,319,883 250,574 (18,200) 1,290,454 Income taxes Net income after taxes 372.587 858176 375.483 944.400 358,514 931.940 (67,048) Adjustments to net icon Net income (13.251) $44925 Q1.328) 923,072 864 892 2.71 Dited EPS Dividends per share E H.J. HSC in 305-30 2.61 1.52 2.89 166 168 D You are part of Solomon Sheppard's team. H... Heinz Estimating the cost of capital in uncertain Times numbers in thousands scept pec-base calea din Apel 2008 Cash Netreceables 1.161.481 1378.216 168.182 3325,566 373.145 1.171.797 1.237,613 162.466 2.945,021 2010 483.253 1.045 338 1.249,127 273,407 3.051135 Other creat assets Total areassets Netfied assets Other o ne assets Total assets 2.104713 5.134764 105651043 1.978 302 4.740 961 9,664.184 2.091,796 4 932.790 10,075,711 Accounts payable Short-term debt Current portion of long-term debt Other current abilities Total amet labuities 1247479 124 290 328 418 969.873 2.670,060 1.113.307 61.297 4341 883 901 2,062,846 1,129,514 43.853 15.167 986,825 2,175,359 Long-term debt Other Boncurrent abilities 4730946 1.276.217 6.007.163 5,076,186 1.246,047 6.322.233 4,559,152 1.392,704 5951,856 Equity Total abilities and equity 1.887820 10.565,043 1.279.105 9.664,184 1.948.496 10.075,711 Shares outstanding in millions of dollars) 311.45 314.86 317.69 Exhibit H.. Heinz: Estimating the cost of capital in Uncertain Times Comparable Ties Data Campbell Soup 40.356 Financial Summary Ro mbons of dollars Book of loss of dollars Book of debt in millions of dollars 15.990 Market Data 053 1.735 2920 Share o n e in milions of dollars Share pice does as of close Apol 30, 2010) Typical Standard & Poor's boating Represent e d on long-term diebt 1. Calculate the following items for Heinz (as of the end of April). Carry work out to 2 decimal places (50 xx.xx%) 2009 2010 Short-term debt (bond) yield Long-term debt (bond) yield Cost of equity (CAPM) Cost of equity (Dividend Model) 2. Calculate the WACC for Heinz for fiscal year 2009 and 2010. What did you use for the cost of debt, the cost of equity, the weights and the tax rate in the calculation? Briefly explain why you selected those inputs (i.e. if you selected the long-term debt yield, why did you use that over the short-term debt yield or vice versa). 3. What is your best estimate of the WACC for the three competitors? Are all three competitors a "good fit" relative to Heinz? Explain. 4. As part of Solomon's team, what is your recommendation for a WACC to use with the North American Consumer Products division? Briefly justify your recommendation. (i'm responsible for this question- i need a detailed answer with calculation) Eshit 3 H. J. Heinz Estimating the cost of capital in Uncertain Times Capital Market Data Fields and prices as of the last trading day in Apel of the year indicated Average Historie Yielde 2003 2004 2005 2006 2007 2008 2009 2010 2.85 492, 4514 Sear 10-year 3.99 3.60 3.90 4534219 3.034 3. 30-reart Moody's Aaa Moody's Baa J-month commercial paper 4.79% 5.53 6.659 3.39% 5.3 658 4.61% 5.21 5.9 5.17% 5.95 6.7 4.30% 5.40 6.319 40% 5.45 4,40% 5.51% 6.57% 191% 4.33% 5.139 6.079 1.21% 1.09% 2.97% 490% 22% Heinz Capital Market Prices of Typical Issues Heing stock price Bond price: 6.750% coupon, semiannual bond de 3/15/32 Baated Bond price: 6.625 coupon, seminal bond de 10/15/12 Based 2009 2010 $34 42 546 37 91.4 1169 1165113.7 Dus Faded RVM Exhibiti H. J. Heinz: Estimating the cost of capital in Uncertain Times Income Statement numbers in thousands except pes-share amounts, Escal year ends in April Revente Costs of goods sold Gross profit 2008 9.885.556 6.233.420 3,652,136 2009 10,011,331 6.442.075 3,569,256 2010 10,494.983 6,700.677 3,794, 306 SG&A expense Operating income 2.081.801 1,570,335 2,066,810 1,502.446 2.235,078 1,559,228 Interest expense Other income (expense) Income before taxes 323,289 (16.283) 1,230,763 275,485 92.922 1,319,883 250,574 (18,200) 1,290,454 Income taxes Net income after taxes 372.587 858176 375.483 944.400 358,514 931.940 (67,048) Adjustments to net icon Net income (13.251) $44925 Q1.328) 923,072 864 892 2.71 Dited EPS Dividends per share E H.J. HSC in 305-30 2.61 1.52 2.89 166 168 D You are part of Solomon Sheppard's team. H... Heinz Estimating the cost of capital in uncertain Times numbers in thousands scept pec-base calea din Apel 2008 Cash Netreceables 1.161.481 1378.216 168.182 3325,566 373.145 1.171.797 1.237,613 162.466 2.945,021 2010 483.253 1.045 338 1.249,127 273,407 3.051135 Other creat assets Total areassets Netfied assets Other o ne assets Total assets 2.104713 5.134764 105651043 1.978 302 4.740 961 9,664.184 2.091,796 4 932.790 10,075,711 Accounts payable Short-term debt Current portion of long-term debt Other current abilities Total amet labuities 1247479 124 290 328 418 969.873 2.670,060 1.113.307 61.297 4341 883 901 2,062,846 1,129,514 43.853 15.167 986,825 2,175,359 Long-term debt Other Boncurrent abilities 4730946 1.276.217 6.007.163 5,076,186 1.246,047 6.322.233 4,559,152 1.392,704 5951,856 Equity Total abilities and equity 1.887820 10.565,043 1.279.105 9.664,184 1.948.496 10.075,711 Shares outstanding in millions of dollars) 311.45 314.86 317.69 Exhibit H.. Heinz: Estimating the cost of capital in Uncertain Times Comparable Ties Data Campbell Soup 40.356 Financial Summary Ro mbons of dollars Book of loss of dollars Book of debt in millions of dollars 15.990 Market Data 053 1.735 2920 Share o n e in milions of dollars Share pice does as of close Apol 30, 2010) Typical Standard & Poor's boating Represent e d on long-term diebt Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started