Question

ANY HELP WOULD BE GREAT!!! THANK YOU!!! Natalie is struggling to keep up with the recording of her accounting transactions. She is spending a lot

ANY HELP WOULD BE GREAT!!! THANK YOU!!!

ANY HELP WOULD BE GREAT!!! THANK YOU!!!

Natalie is struggling to keep up with the recording of her accounting transactions. She is spending a lot of time marketing and selling mixers and giving her cookie classes. Her friend John is an accounting student who runs his own accounting service. He has asked Natalie if she would like to have him do her accounting.

John and Natalie meet and discuss her business. John suggests that he do the tasks listed below for Natalie.

- Hold cash until there is enough to be deposited. (He would keep the cash locked up in his vehicle). He would also take all of the deposits to the bank at least twice a month.

- Write and sign all of the checks.

- Record all of the deposits in the accounting records.

- Record all of the checks in the accounting records.

- Prepare the monthly bank reconciliation.

- Transfer all of Natalies manual accounting records to his computer accounting program. (John would maintain all of the accounting information that he keeps for his clients on his laptop computer.)

- Prepare monthly financial statements for Natalie to review.

- Write himself a check every month for the work he has done for Natalie.

For Part I of the assignment, identify the weaknesses in internal control that you see in the system that John is recommending. Can you suggest any improvements if Natalie hires John to do the accounting?

Part I should be a minimum of two pages in length. Please use APA format. While there are no required resources, please be sure that any sources used have proper citations.

Part II

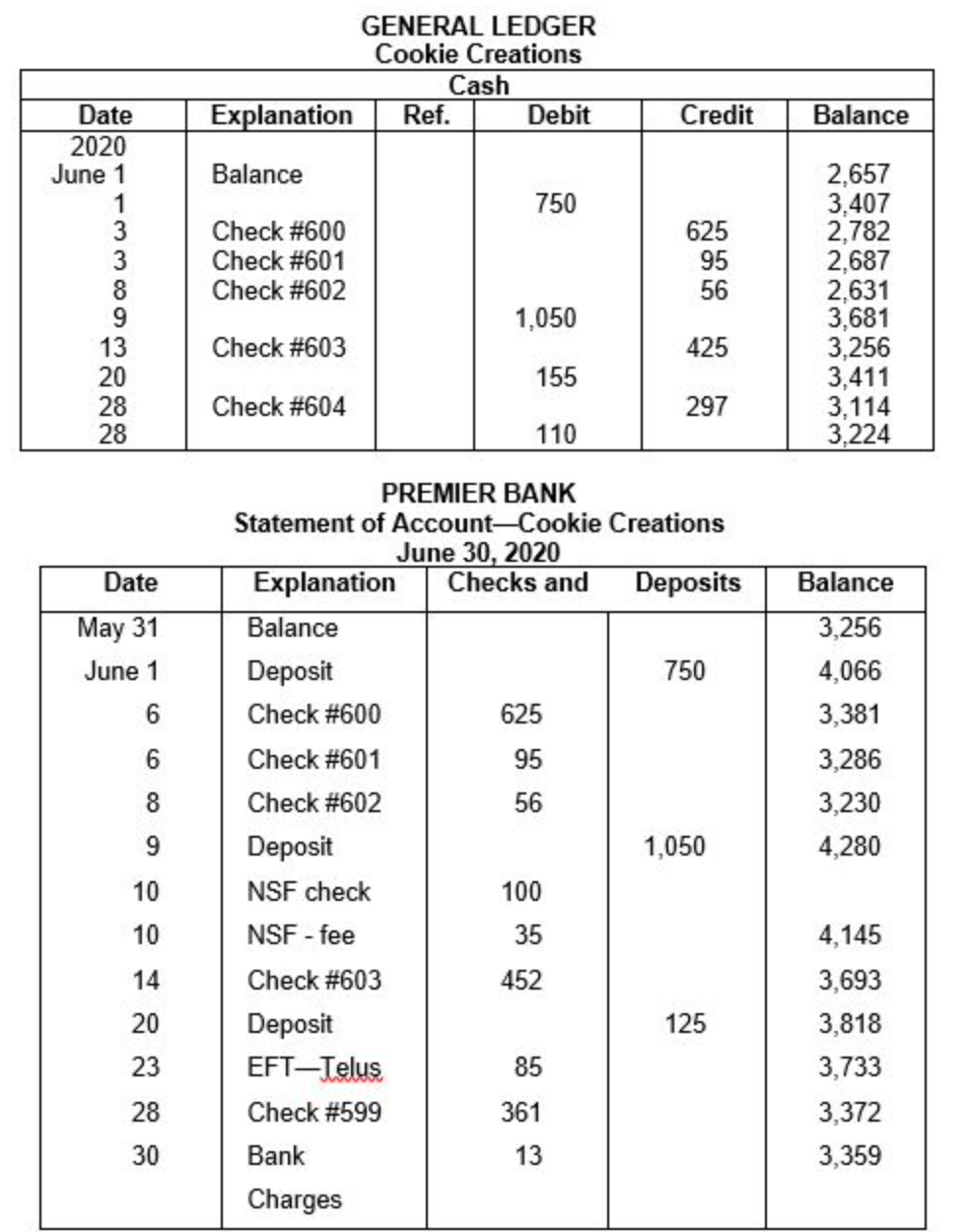

Natalie decides that she cannot afford to hire John to do her accounting. One way that she can ensure that her cash account does not have any errors and is accurate and up-to-date is to prepare a bank reconciliation at the end of each month. Natalie would like you to help her. She asks you to prepare a bank reconciliation for June 2020 using the information below.

Additionally, take the following information into account.

- On May 31, there were two outstanding checks: #595 for $238 and #599 for $361.

- Premier Bank made a posting error to the bank statement: Check #603 was issued for $425, not $452.

- The deposit made on June 20 was for $125, which Natalie received for teaching a class. Natalie made an error in recording this transaction.

- The electronic funds transfer (EFT) was for Natalies cell phone use. Remember that she uses this phone only for business.

- The NSF check was from Ron Black. Natalie received this check for teaching a class to Rons children. Natalie contacted Ron, and he assured her that she will receive a check in the mail for the outstanding amount of the invoice and the NSF bank charge.

For Part II of the assignment, complete the tasks below.

- Prepare Cookie Creations bank reconciliation for June 30.

- Prepare any necessary adjusting entries at June 30.

- If a balance sheet is prepared for Cookie Creations at June 30, what balance will be reported as cash in the Current Assets section?

Part II can be completed in either Word or Excel. If you are completing Part II using Word, submit Parts I and II in one Word document. If you are completing Part II using Excel, upload Part I as a Word document and Part II as an Excel spreadsheet in Blackboard.

GENERAL LEDGER Cookie Creations Cash Explanation Ref. Debit Credit Balance Balance 750 Date 2020 June 1 1 3 3 8 9 13 20 28 28 Check #600 Check #601 Check #602 625 95 56 1,050 2,657 3,407 2,782 2,687 2,631 3,681 3,256 3,411 3,114 3,224 Check #603 425 155 Check #604 297 110 Date May 31 June 1 6 6 8 PREMIER BANK Statement of Account-Cookie Creations June 30, 2020 Explanation Checks and Deposits Balance Deposit 750 Check #600 625 Check #601 95 Check #602 56 Deposit 1,050 NSF check 100 NSF - fee 35 Check #603 452 Deposit 125 EFT-Telus 85 Check #599 361 Bank 13 Charges Balance 3,256 4,066 3,381 3,286 3,230 4,280 9 10 10 14 20 23 28 30 4,145 3,693 3,818 3,733 3,372 3,359 GENERAL LEDGER Cookie Creations Cash Explanation Ref. Debit Credit Balance Balance 750 Date 2020 June 1 1 3 3 8 9 13 20 28 28 Check #600 Check #601 Check #602 625 95 56 1,050 2,657 3,407 2,782 2,687 2,631 3,681 3,256 3,411 3,114 3,224 Check #603 425 155 Check #604 297 110 Date May 31 June 1 6 6 8 PREMIER BANK Statement of Account-Cookie Creations June 30, 2020 Explanation Checks and Deposits Balance Deposit 750 Check #600 625 Check #601 95 Check #602 56 Deposit 1,050 NSF check 100 NSF - fee 35 Check #603 452 Deposit 125 EFT-Telus 85 Check #599 361 Bank 13 Charges Balance 3,256 4,066 3,381 3,286 3,230 4,280 9 10 10 14 20 23 28 30 4,145 3,693 3,818 3,733 3,372 3,359Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started