Answered step by step

Verified Expert Solution

Question

1 Approved Answer

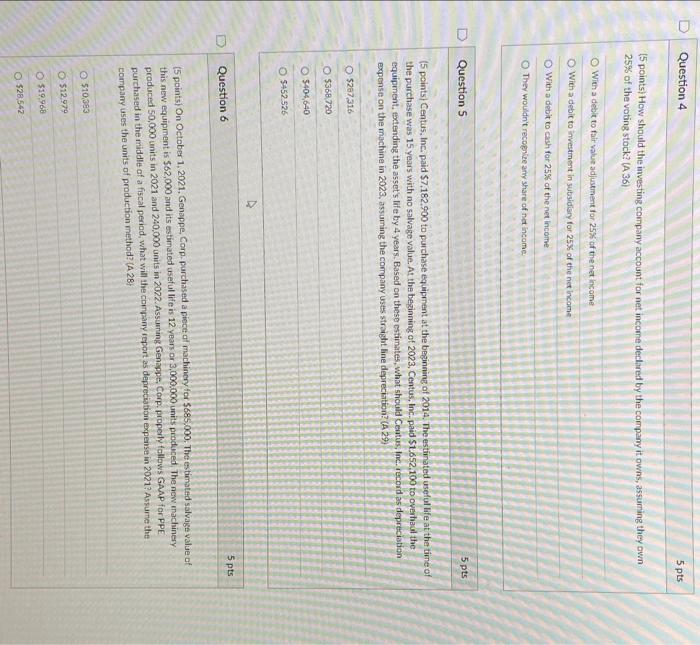

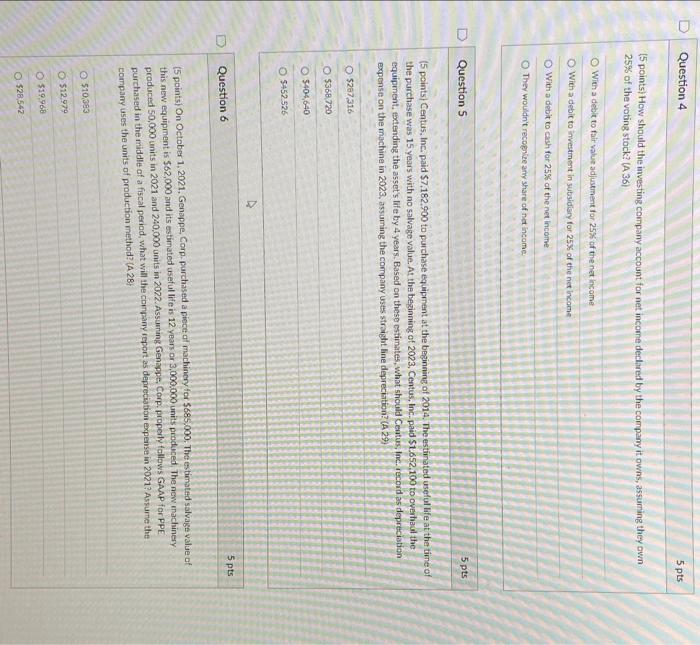

any help woupd be so awesome!! (5 points) How should the imvesting company account for net income declined by the company it owns, assuming they

any help woupd be so awesome!!

(5 points) How should the imvesting company account for net income declined by the company it owns, assuming they own 25% of the voting stock? (A 36) With a debit to fair value adjustment for 25% of the net income With a debit to investinent in subsidisry for 25 S of the net income With a debit to cash for 25% of the net income They wouldn't recoperize any share of nat income. Question 5 5 pts (5 points) Centus, Inc, paid $7,182,900 to purchase equipment at the beginning of 2014 , The estinated useful life at the time of the purchase was 15 years with no salvage value. At the beginning of 2023, Centus, Inc-paid $1.652,100 to 0verhaul the equipment, extending the asset's life by 4 years. Based on these cstimates, what should Centus, Inc. record as deprecistion expense on the machine in 2023, assuming the company usts straigt line depreciation? (A 29) $267316 $368720 5404,640 $452.526 Question 6 5 pts (5 paints) On October 1, 2021, Genappe, Corp. purchased a piect al machinery for $685,000, The estimated salvaige value of this new equipment is $62,000 and its estimated useful life is 12 year or 3,000,000 units penduced. The ncw machinery produced 50,000 units in 2021 and 240,000 units in 2022 . Assuming Genappe, Corp. properly follows GAAP for PPE purchased in the middle of a fiscal period, what will the company report as depreciabon expense in 2021? Asturne the company uses the units of production method? (A,2B} 510,393 512.979 529,968 $28,542

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started