any possible help?

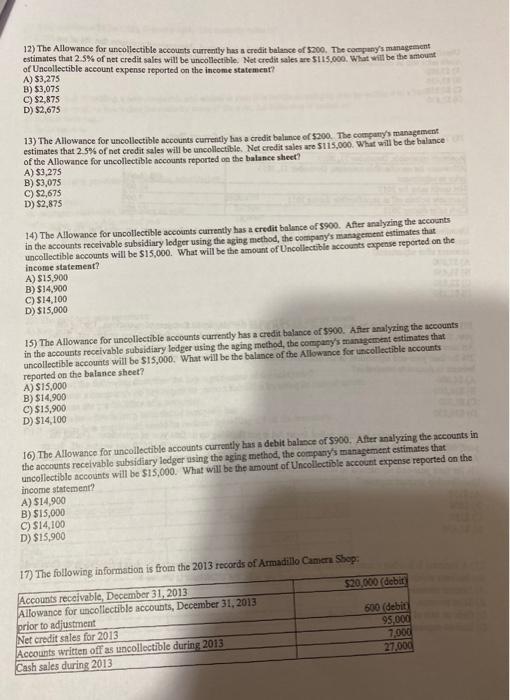

12) The Allowance for uncollectible accounts currently has a credit balance of 5200. The company's management estimates that 2.5% of net credit sales will be uncollectible. Net credit sales are $115.000. What will be the mount of Uncollectible account expense reported on the income statement? A) $3,275 B) 53,075 C) $2,875 D) $2.675 13) The Allowance for uncollectible accounts currently has a credit balance of $200. The company's management estimates that 2.5% of net credit sales will be uncollectible. Net credit sales are $115.000. What will be the balance of the Allowance for uncollectible nocounts reported on the balance sheet? A) $3,275 B) $3,075 C) $2,675 D) $2,875 14) The Allowance for uncollectible accounts currently has a credit balance of $900. After analyzing the accounts in the accounts receivable subsidiary ledger using the aging method, the company's management estimates that uncollectible accounts will be $15,000. What will be the amount of Uncollectible accounts expense reported on the income statement? A) $15.900 B) $14.900 C) $14,100 D) $15,000 15) The Allowance for uncollectible accounts currently has a credit balance of $900. After analyzing the accounts in the accounts receivable subsidiary ledger using the aging method, the company's management estimates that uncollectible accounts will be $15,000. What will be the balance of the Allowance for collectible accounts reported on the balance sheet? A) $15,000 B) $14,900 C) $15.900 D) $14,100 16) The Allowance for uncollectible accounts currently has a debit balance of $900. After analyzing the accounts in the accounts receivable subsidiary ledger using the aging method, the company's management estimates that uncollectible accounts will be $15,000. What will be the amount of Uncollectible account expense reported on the income statement? A) $14,900 B) $15,000 C) $14,100 D) $15.900 17) The following information is from the 2013 records of Armadillo Camera Shop: Accounts receivable, December 31, 2013 $20.000 (debit Allowance for collectible accounts, December 31, 2013 prior to adjustment 600 (debit Net credit sales for 2013 95.000 Accounts written off as tincollectible during 2013 7.000 Cash sales during 2013 27,000