Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anyone cans help me with my task Practice 1: Capital Budgeting 1. Flora Berhad is in the process of choosing one of the two equal-risk,

Anyone cans help me with my task

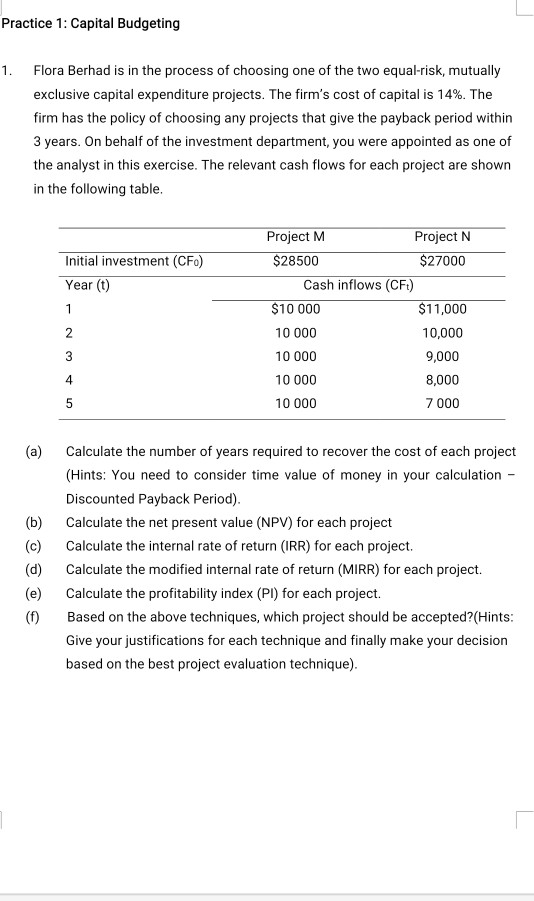

Practice 1: Capital Budgeting 1. Flora Berhad is in the process of choosing one of the two equal-risk, mutually exclusive capital expenditure projects. The firm's cost of capital is 14%. The firm has the policy of choosing any projects that give the payback period within 3 years. On behalf of the investment department, you were appointed as one of the analyst in this exercise. The relevant cash flows for each project are shown in the following table Initial investment (CF) Year (t) 1 Project M Project N $28500 $27000 Cash inflows (CFt) $10 000 $11,000 10 000 10,000 10 000 9,000 10 000 8,000 10 000 7 000 2 3 4 5 (a) (b) (c) (d) (e) () Calculate the number of years required to recover the cost of each project (Hints: You need to consider time value of money in your calculation - Discounted Payback Period). Calculate the net present value (NPV) for each project Calculate the internal rate of return (IRR) for each project. Calculate the modified internal rate of return (MIRR) for each project. Calculate the profitability index (Pl) for each project. Based on the above techniques, which project should be accepted?(Hints: Give your justifications for each technique and finally make your decision based on the best project evaluation technique)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started