Answered step by step

Verified Expert Solution

Question

1 Approved Answer

anyone know how to do it? thanks a nsider a portfolio with a 65% allocation to stocks and 35% to bonds. The portfo sa market

anyone know how to do it? thanks

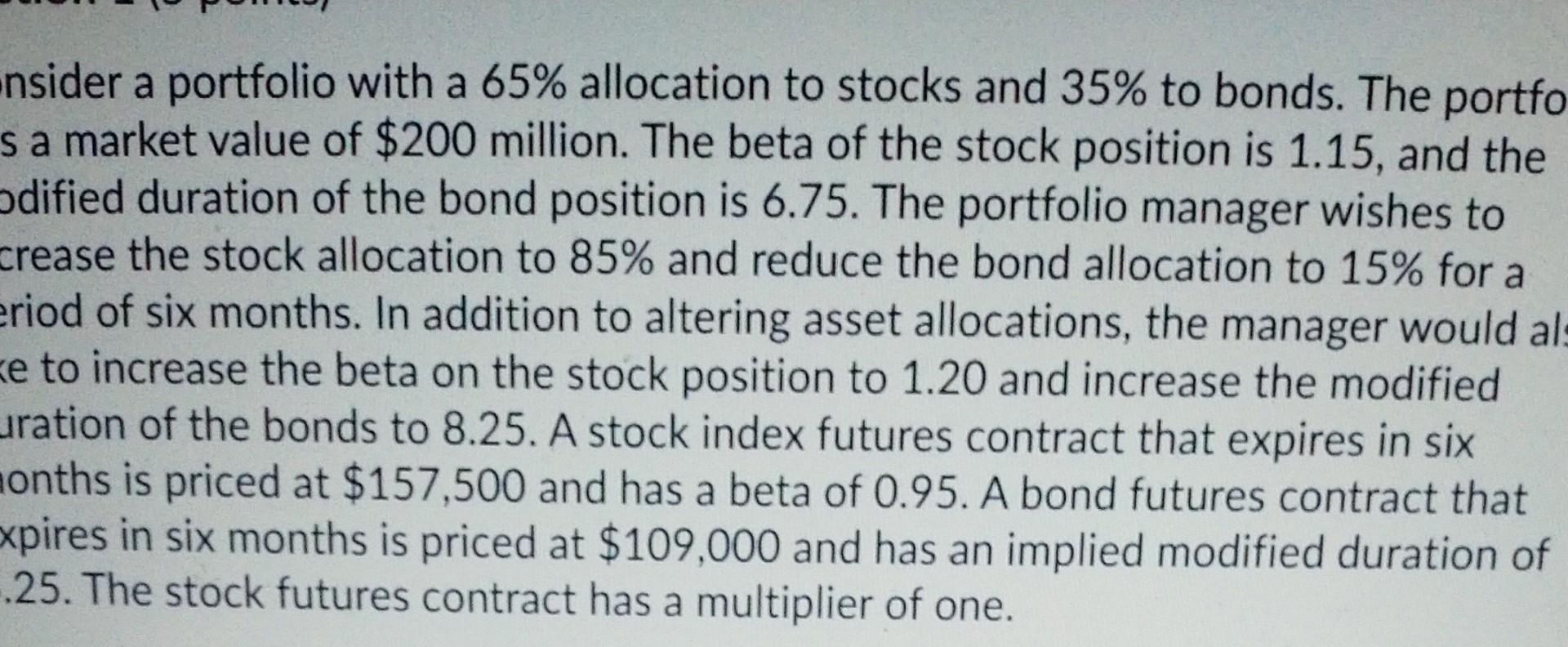

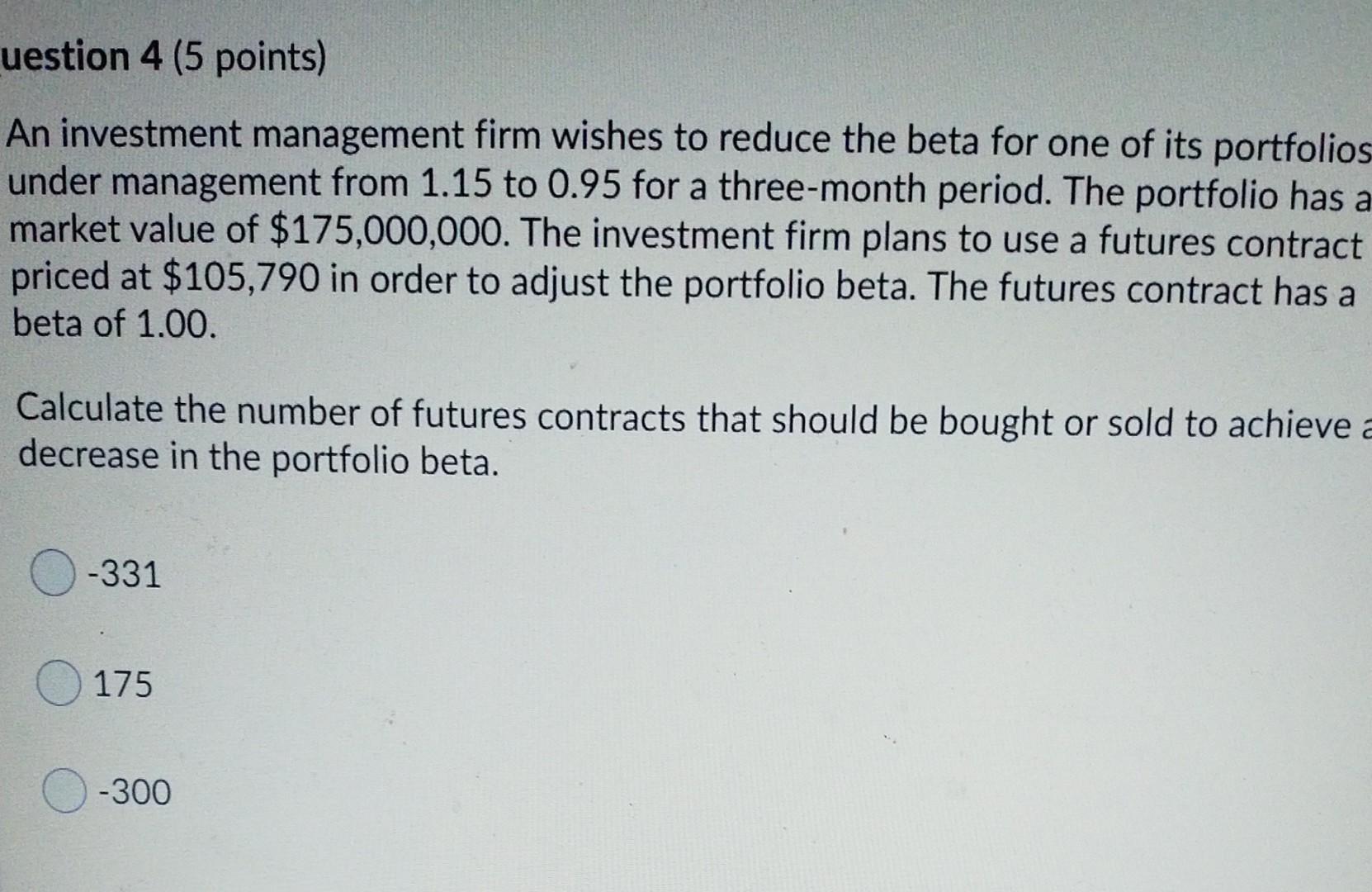

a nsider a portfolio with a 65% allocation to stocks and 35% to bonds. The portfo sa market value of $200 million. The beta of the stock position is 1.15, and the odified duration of the bond position is 6.75. The portfolio manager wishes to crease the stock allocation to 85% and reduce the bond allocation to 15% for a eriod of six months. In addition to altering asset allocations, the manager would als ke to increase the beta on the stock position to 1.20 and increase the modified uration of the bonds to 8.25. A stock index futures contract that expires in six onths is priced at $157,500 and has a beta of 0.95. A bond futures contract that xpires in six months is priced at $109,000 and has an implied modified duration of 25. The stock futures contract has a multiplier of one. a uestion 4 (5 points) An investment management firm wishes to reduce the beta for one of its portfolios under management from 1.15 to 0.95 for a three-month period. The portfolio has a market value of $175,000,000. The investment firm plans to use a futures contract priced at $105,790 in order to adjust the portfolio beta. The futures contract has a beta of 1.00. Calculate the number of futures contracts that should be bought or sold to achieve a decrease in the portfolio beta. -331 175 -300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started