Answered step by step

Verified Expert Solution

Question

1 Approved Answer

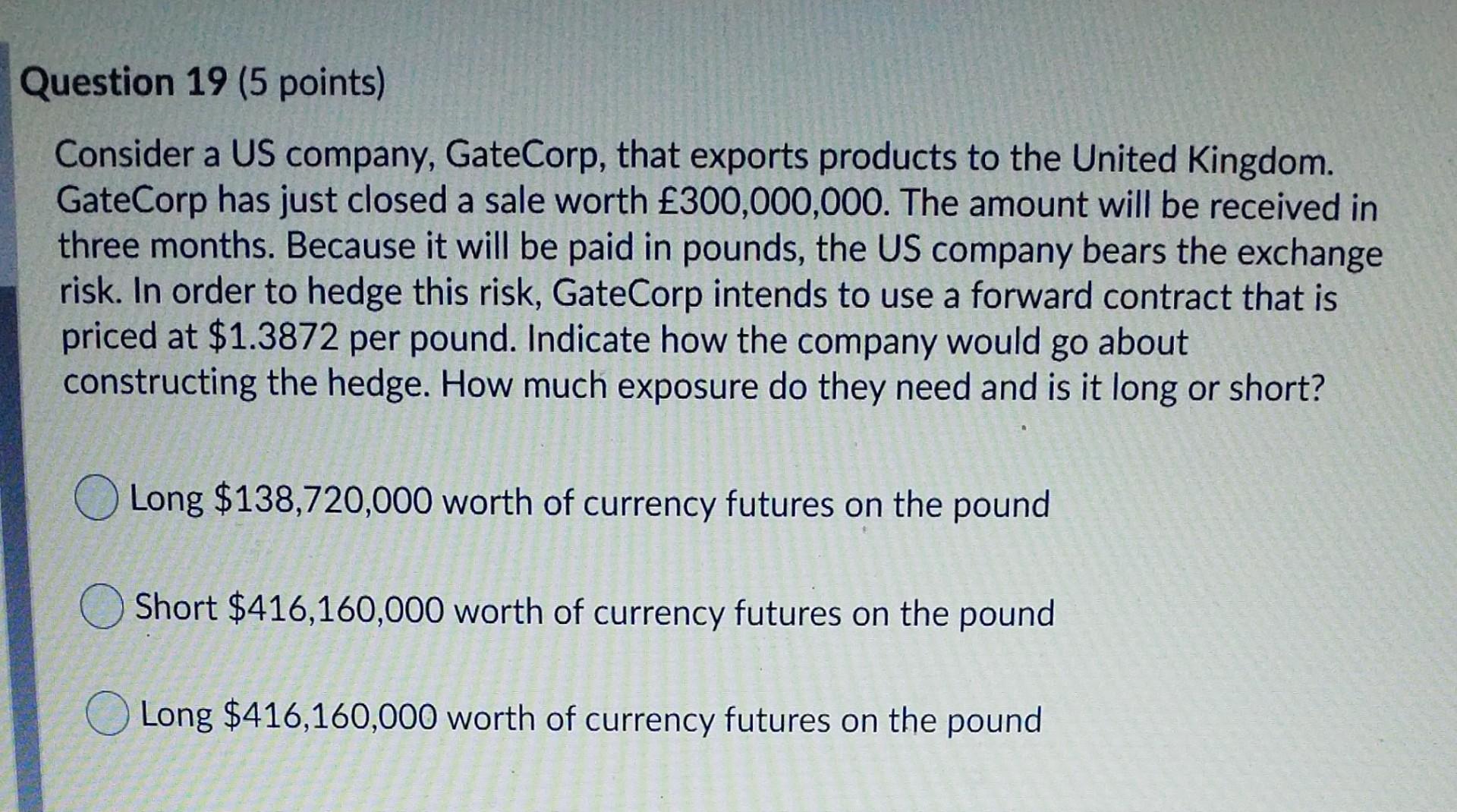

anyone know how to do it? thanks Question 19 (5 points) Consider a US company, GateCorp, that exports products to the United Kingdom. GateCorp has

anyone know how to do it? thanks

Question 19 (5 points) Consider a US company, GateCorp, that exports products to the United Kingdom. GateCorp has just closed a sale worth 300,000,000. The amount will be received in three months. Because it will be paid in pounds, the US company bears the exchange risk. In order to hedge this risk, GateCorp intends to use a forward contract that is priced at $1.3872 per pound. Indicate how the company would go about constructing the hedge. How much exposure do they need and is it long or short? Long $138,720,000 worth of currency futures on the pound Short $416,160,000 worth of currency futures on the pound Long $416,160,000 worth of currency futures on the poundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started