Answered step by step

Verified Expert Solution

Question

1 Approved Answer

anyone know how to do it? thanks Question 6 (5 points) Muun Financial is a three year old financial company specializing in commercial a banking.

anyone know how to do it? thanks

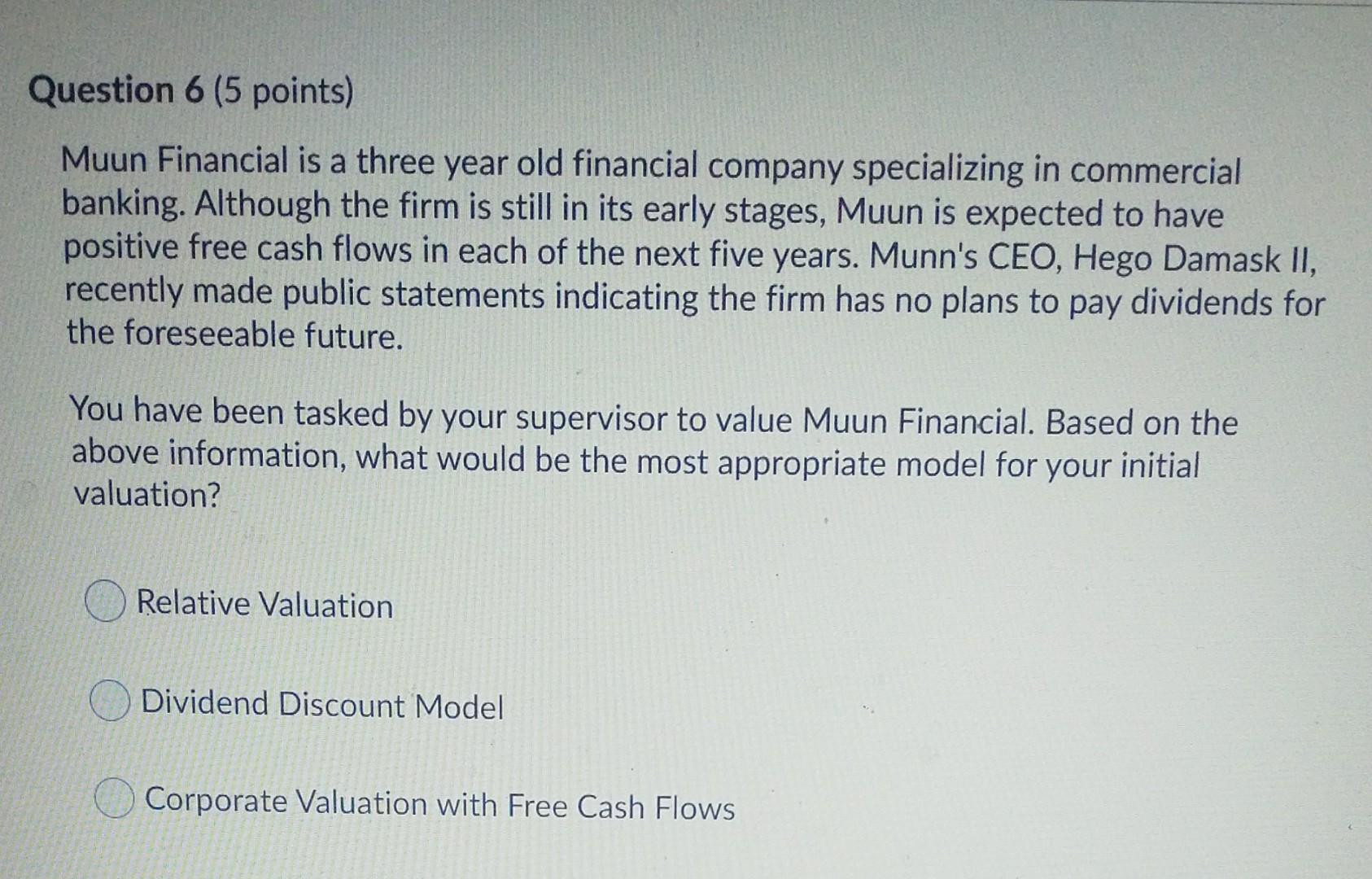

Question 6 (5 points) Muun Financial is a three year old financial company specializing in commercial a banking. Although the firm is still in its early stages, Muun is expected to have positive free cash flows in each of the next five years. Munn's CEO, Hego Damask II, recently made public statements indicating the firm has no plans to pay dividends for the foreseeable future. You have been tasked by your supervisor to value Muun Financial. Based on the above information, what would be the most appropriate model for your initial valuation? Relative Valuation Dividend Discount Model Corporate Valuation with Free Cash FlowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started