Answered step by step

Verified Expert Solution

Question

1 Approved Answer

anyone know how to do it? thanks Question 7 (5 points) Carvahall Inc. specializes in the industrial production of man made gem stones usi their

anyone know how to do it? thanks

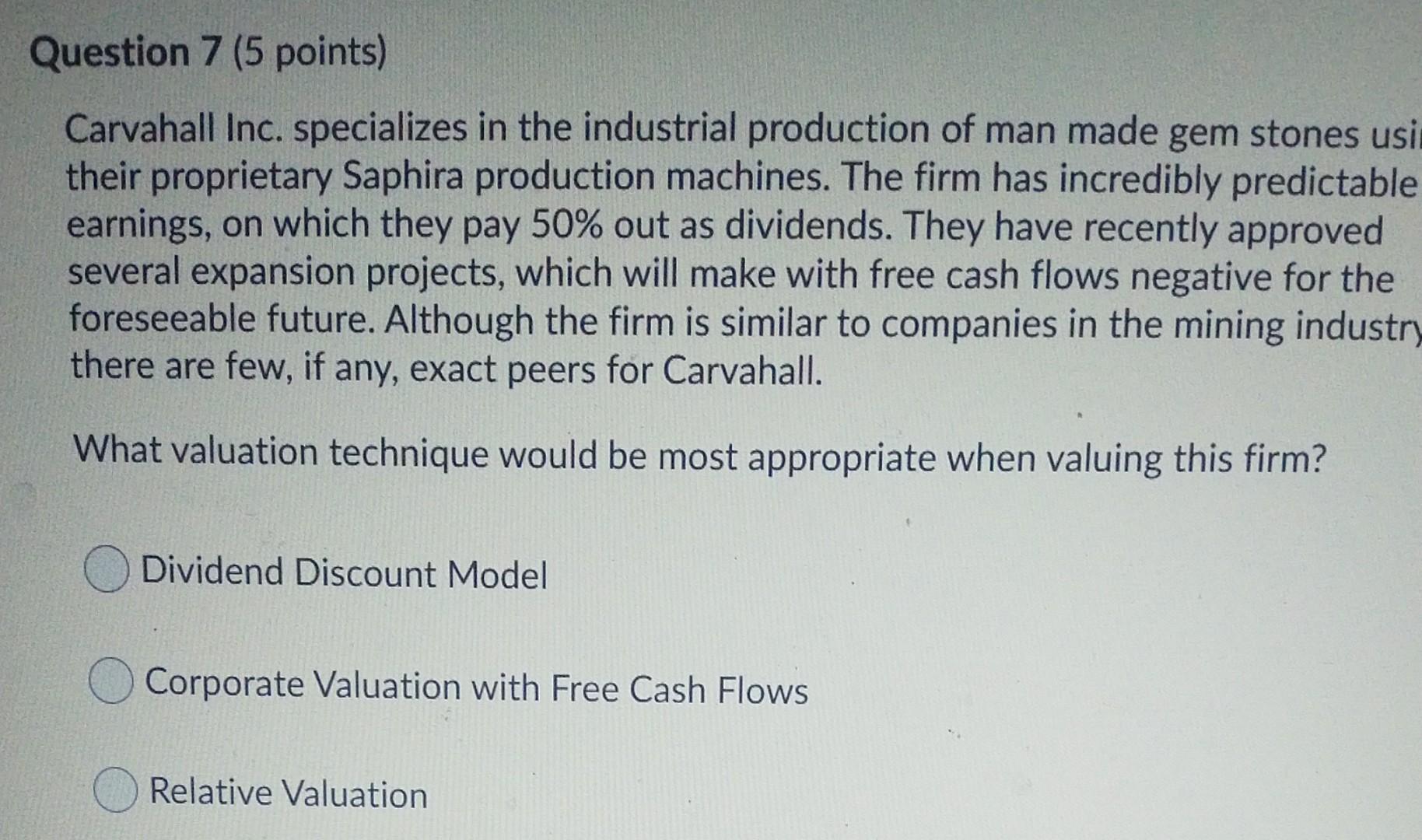

Question 7 (5 points) Carvahall Inc. specializes in the industrial production of man made gem stones usi their proprietary Saphira production machines. The firm has incredibly predictable earnings, on which they pay 50% out as dividends. They have recently approved several expansion projects, which will make with free cash flows negative for the foreseeable future. Although the firm is similar to companies in the mining industry , there are few, if any, exact peers for Carvahall. What valuation technique would be most appropriate when valuing this firm? Dividend Discount Model Corporate Valuation with Free Cash Flows Relative ValuationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started