Answered step by step

Verified Expert Solution

Question

1 Approved Answer

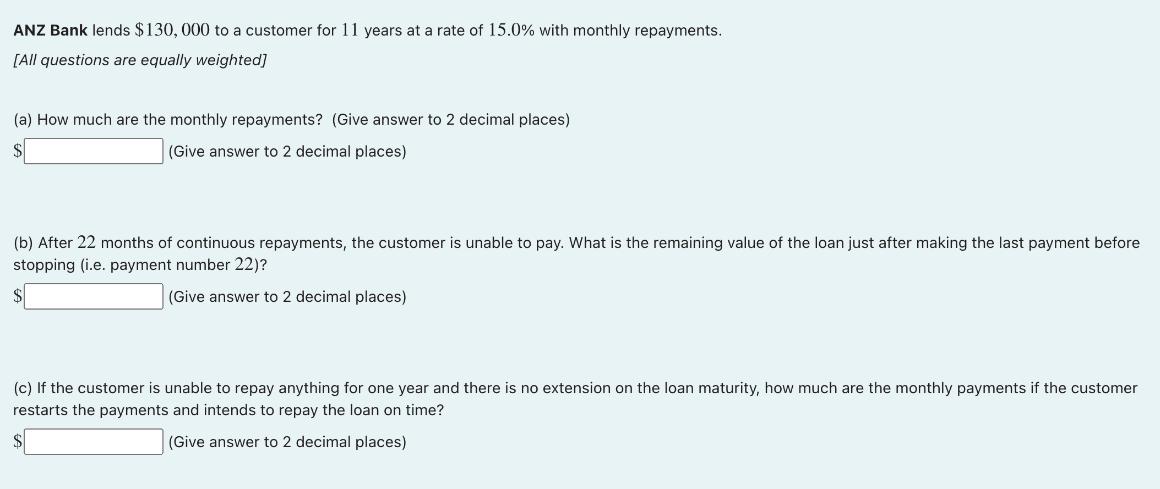

ANZ Bank lends $130,000 to a customer for 11 years at a rate of 15.0% with monthly repayments. [All questions are equally weighted] (a)

ANZ Bank lends $130,000 to a customer for 11 years at a rate of 15.0% with monthly repayments. [All questions are equally weighted] (a) How much are the monthly repayments? (Give answer to 2 decimal places) (Give answer to 2 decimal places) (b) After 22 months of continuous repayments, the customer is unable to pay. What is the remaining value of the loan just after making the last payment before stopping (i.e. payment number 22)? (Give answer to 2 decimal places) (c) If the customer is unable to repay anything for one year and there is no extension on the loan maturity, how much are the monthly payments if the customer restarts the payments and intends to repay the loan on time? (Give answer to 2 decimal places)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the monthly repayments we can use the formula for the present value of an annuity PV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started