Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AP 15-10 (Salary vs. Dividends-Required Amount) Simon Fahrquest is the sole shareholder of Dawg Ltd., a successful business that was incorpo- rated a number

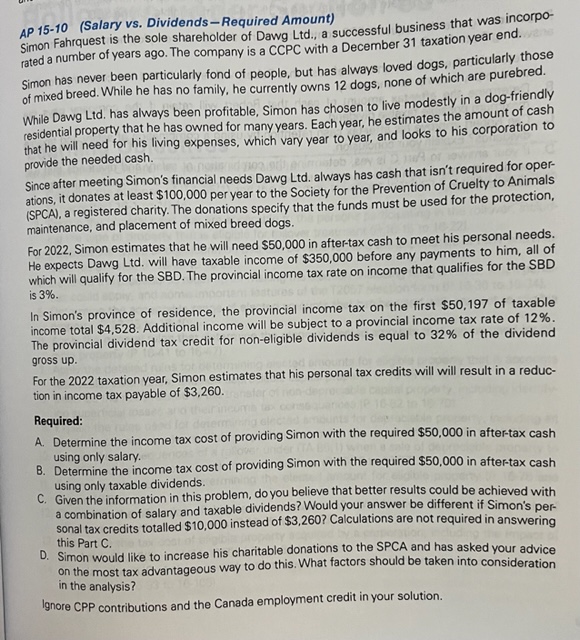

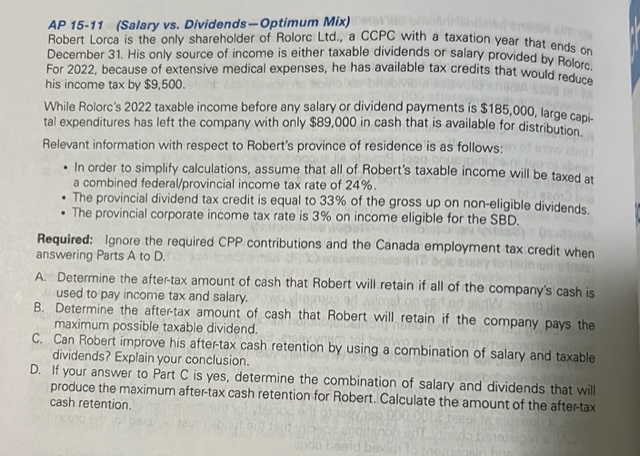

AP 15-10 (Salary vs. Dividends-Required Amount) Simon Fahrquest is the sole shareholder of Dawg Ltd., a successful business that was incorpo- rated a number of years ago. The company is a CCPC with a December 31 taxation year end. Simon has never been particularly fond of people, but has always loved dogs, particularly those of mixed breed. While he has no family, he currently owns 12 dogs, none of which are purebred. While Dawg Ltd. has always been profitable, Simon has chosen to live modestly in a dog-friendly residential property that he has owned for many years. Each year, he estimates the amount of cash that he will need for his living expenses, which vary year to year, and looks to his corporation to provide the needed cash. 102 Since after meeting Simon's financial needs Dawg Ltd. always has cash that isn't required for oper- ations, it donates at least $100,000 per year to the Society for the Prevention of Cruelty to Animals (SPCA), a registered charity. The donations specify that the funds must be used for the protection, maintenance, and placement of mixed breed dogs. For 2022, Simon estimates that he will need $50,000 in after-tax cash to meet his personal needs. He expects Dawg Ltd. will have taxable income of $350,000 before any payments to him, all of which will qualify for the SBD. The provincial income tax rate on income that qualifies for the SBD is 3%. In Simon's province of residence, the provincial income tax on the first $50,197 of taxable income total $4,528. Additional income will be subject to a provincial income tax rate of 12%. The provincial dividend tax credit for non-eligible dividends is equal to 32% of the dividend gross up. For the 2022 taxation year, Simon estimates that his personal tax credits will will result in a reduc- tion in income tax payable of $3,260. Required: A. Determine the income tax cost of providing Simon with the required $50,000 in after-tax cash using only salary. B. Determine the income tax cost of providing Simon with the required $50,000 in after-tax cash using only taxable dividends. C. Given the information in this problem, do you believe that better results could be achieved with a combination of salary and taxable dividends? Would your answer be different if Simon's per- sonal tax credits totalled $10,000 instead of $3,260? Calculations are not required in answering this Part C. D. Simon would like to increase his charitable donations to the SPCA and has asked your advice on the most tax advantageous way to do this. What factors should be taken into consideration in the analysis? Ignore CPP contributions and the Canada employment credit in your solution. AP 15-11 (Salary vs. Dividends-Optimum Mix) Robert Lorca is the only shareholder of Rolorc Ltd., a CCPC with a taxation year that ends on December 31. His only source of income is either taxable dividends or salary provided by Rolorc. For 2022, because of extensive medical expenses, he has available tax credits that would reduce his income tax by $9,500. While Rolorc's 2022 taxable income before any salary or dividend payments is $185,000, large capi- tal expenditures has left the company with only $89,000 in cash that is available for distribution. Relevant information with respect to Robert's province of residence is as follows: In order to simplify calculations, assume that all of Robert's taxable income will be taxed at a combined federal/provincial income tax rate of 24%. The provincial dividend tax credit is equal to 33% of the gross up on non-eligible dividends. The provincial corporate income tax rate is 3% on income eligible for the SBD. . Required: Ignore the required CPP contributions and the Canada employment tax credit when answering Parts A to D. A. Determine the after-tax amount of cash that Robert will retain if all of the company's cash is used to pay income tax and salary. plinw B. Determine the after-tax amount of cash that Robert will retain if the company pays the maximum possible taxable dividend. C. Can Robert improve his after-tax cash retention by using a combination of salary and taxable dividends? Explain your conclusion. D. If your answer to Part C is yes, determine the combination of salary and dividends that will produce the maximum after-tax cash retention for Robert. Calculate the amount of the after-tax cash retention.

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION AP 1510 A Determine the income tax cost of providing Simon with the required 50000 in aftertax cash using only salary Salary paid to Simon 50...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started