Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AP 2 1 - 3 ( Registration Requirements and GST Collectible ) After years of study, Martin believes that he has developed a process for

AP Registration Requirements and GST Collectible

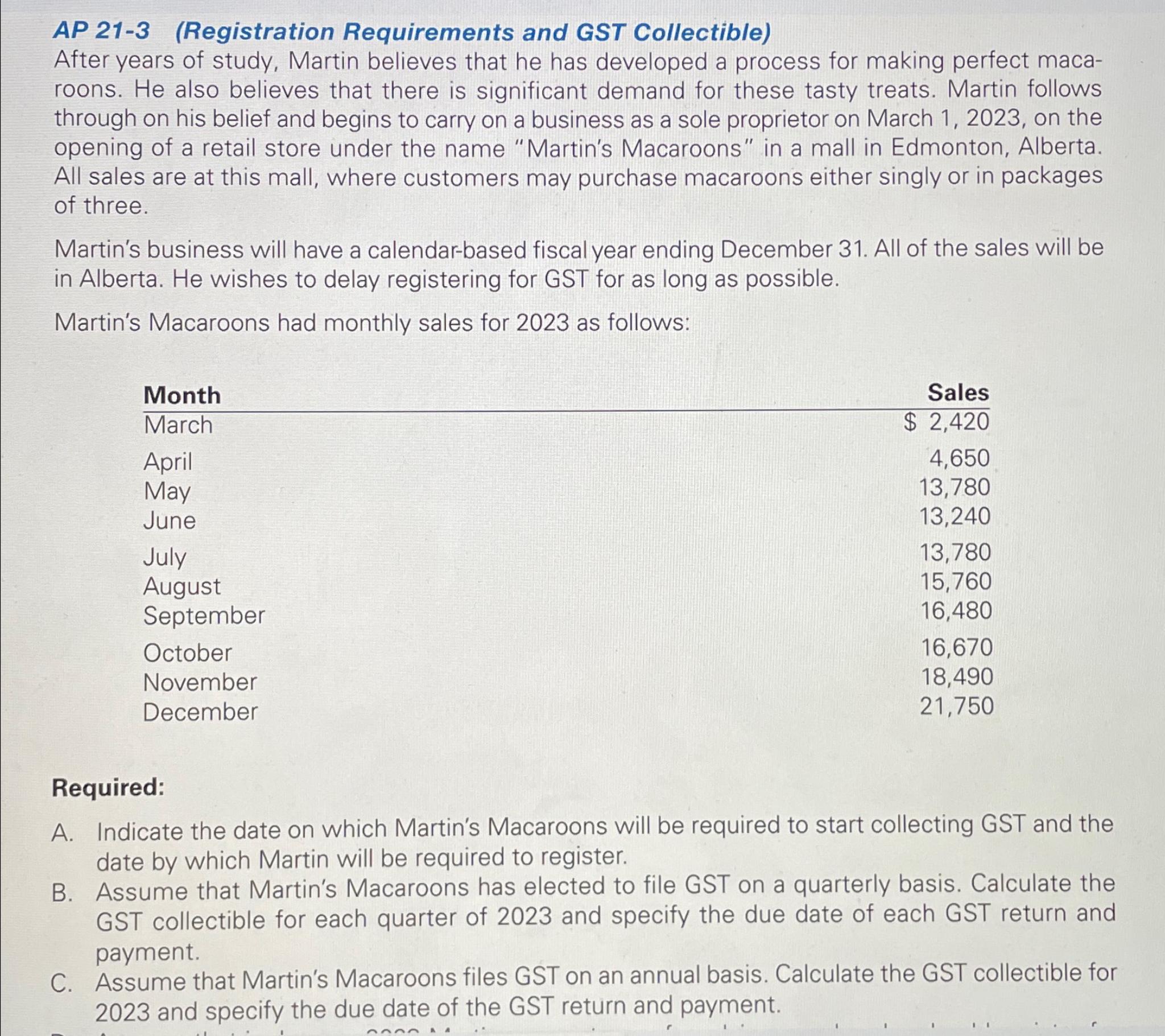

After years of study, Martin believes that he has developed a process for making perfect macaroons. He also believes that there is significant demand for these tasty treats. Martin follows through on his belief and begins to carry on a business as a sole proprietor on March on the opening of a retail store under the name "Martin's Macaroons" in a mall in Edmonton, Alberta. All sales are at this mall, where customers may purchase macaroons either singly or in packages of three.

Martin's business will have a calendarbased fiscal year ending December All of the sales will be in Alberta. He wishes to delay registering for GST for as long as possible.

Martin's Macaroons had monthly sales for as follows:

tableMonthSalesMarch$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started