Answered step by step

Verified Expert Solution

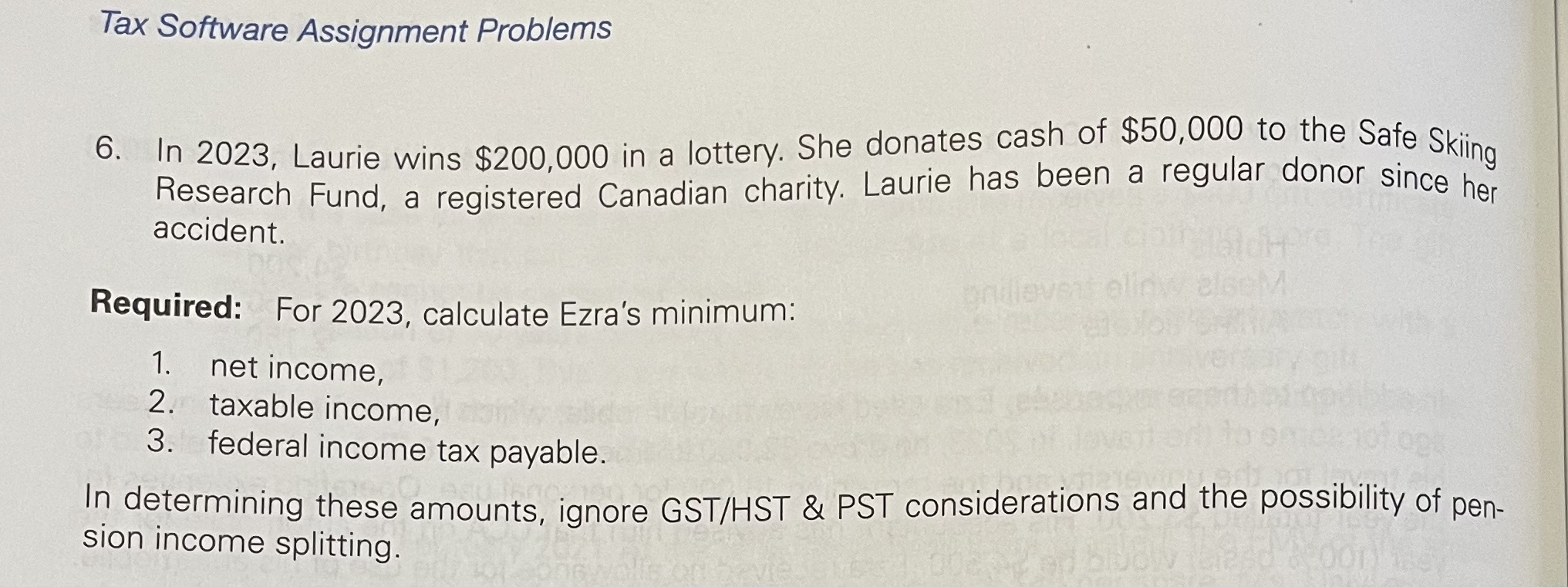

Question

1 Approved Answer

AP 4 - 8 ( Comprehensive Federal Income Tax Payable ) Ezra Pinnock is 7 3 years old and is an engineering professor at a

AP Comprehensive Federal Income Tax Payable

Ezra Pinnock is years old and is an engineering professor at a major Canadian university. He is in good health and lives in Toronto in a large house he inherited from his mother.

Employment Information

Ezra's gross salary for was $ As the result of negotiations by his union, he was entitled to receive an additional $ in salary related to his employment in However, this adjustment will not be paid to him until January

In Ezra's employer deducted El contributions of $ Because of his age and the fact that he is collecting CPP benefits, Ezra no longer has to make CPP contributions.

Ezra's employer sponsors an employee pension plan that qualifies as an RPP Because Ezra no longer contributes to this plan, when he reached age he was required to start withdrawals from the RPP In he received $ of pension income from the plan.

As much of Ezra's employment involves distance education, he is required by his employer to maintain an office in his home. This home office occupies of the space in his residence and is viewed as his principal place of business. The expenses associated with this residence are as follows:

tableElectricity$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started