Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AP 6-7 (Sole Proprietorship-Business Income with CCA) Karla Sandone is a successful photographer who specializes in photographs and videos of beloved pets. She operates

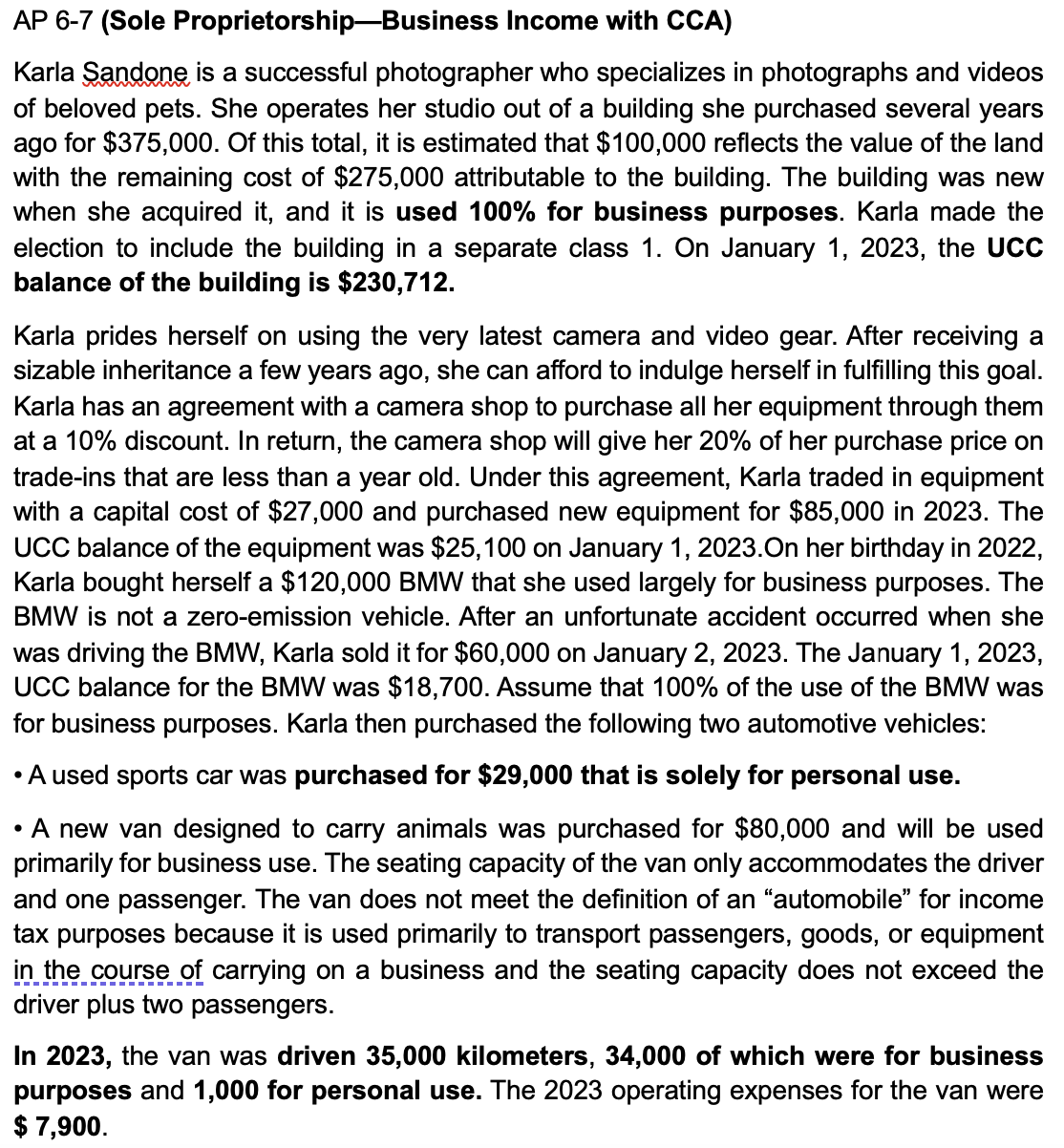

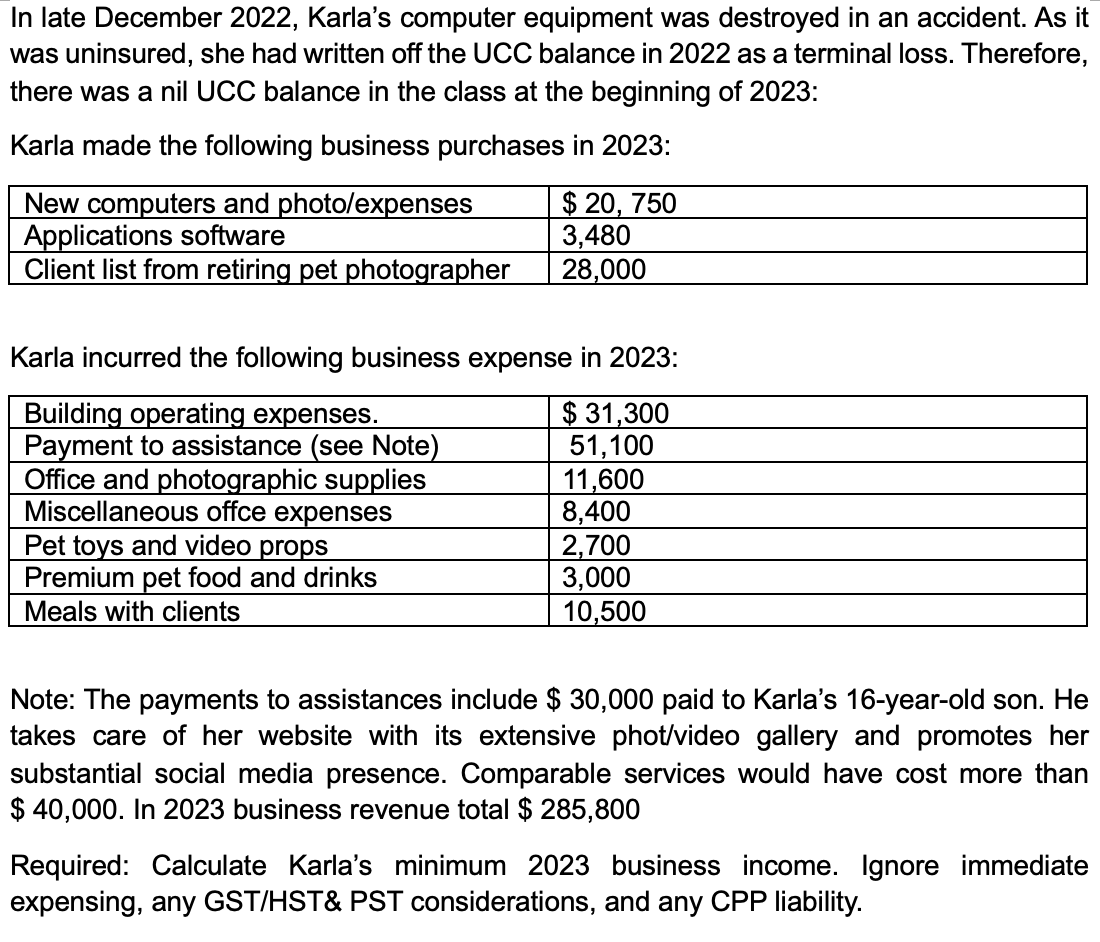

AP 6-7 (Sole Proprietorship-Business Income with CCA) Karla Sandone is a successful photographer who specializes in photographs and videos of beloved pets. She operates her studio out of a building she purchased several years ago for $375,000. Of this total, it is estimated that $100,000 reflects the value of the land with the remaining cost of $275,000 attributable to the building. The building was new when she acquired it, and it is used 100% for business purposes. Karla made the election to include the building in a separate class 1. On January 1, 2023, the UCC balance of the building is $230,712. Karla prides herself on using the very latest camera and video gear. After receiving a sizable inheritance a few years ago, she can afford to indulge herself in fulfilling this goal. Karla has an agreement with a camera shop to purchase all her equipment through them at a 10% discount. In return, the camera shop will give her 20% of her purchase price on trade-ins that are less than a year old. Under this agreement, Karla traded in equipment with a capital cost of $27,000 and purchased new equipment for $85,000 in 2023. The UCC balance of the equipment was $25,100 on January 1, 2023. On her birthday in 2022, Karla bought herself a $120,000 BMW that she used largely for business purposes. The BMW is not a zero-emission vehicle. After an unfortunate accident occurred when she was driving the BMW, Karla sold it for $60,000 on January 2, 2023. The January 1, 2023, UCC balance for the BMW was $18,700. Assume that 100% of the use of the BMW was for business purposes. Karla then purchased the following two automotive vehicles: A used sports car was purchased for $29,000 that is solely for personal use. A new van designed to carry animals was purchased for $80,000 and will be used primarily for business use. The seating capacity of the van only accommodates the driver and one passenger. The van does not meet the definition of an "automobile" for income tax purposes because it is used primarily to transport passengers, goods, or equipment in the course of carrying on a business and the seating capacity does not exceed the driver plus two passengers. In 2023, the van was driven 35,000 kilometers, 34,000 of which were for business purposes and 1,000 for personal use. The 2023 operating expenses for the van were $ 7,900. In late December 2022, Karla's computer equipment was destroyed in an accident. As it was uninsured, she had written off the UCC balance in 2022 as a terminal loss. Therefore, there was a nil UCC balance in the class at the beginning of 2023: Karla made the following business purchases in 2023: New computers and photo/expenses Applications software Client list from retiring pet photographer $20, 750 3,480 28,000 Karla incurred the following business expense in 2023: Building operating expenses. Payment to assistance (see Note) Office and photographic supplies Miscellaneous offce expenses Pet toys and video props Premium pet food and drinks Meals with clients $ 31,300 51,100 11,600 8,400 2,700 3,000 10,500 Note: The payments to assistances include $ 30,000 paid to Karla's 16-year-old son. He takes care of her website with its extensive phot/video gallery and promotes her substantial social media presence. Comparable services would have cost more than $ 40,000. In 2023 business revenue total $ 285,800 Required: Calculate Karla's minimum 2023 business income. Ignore immediate expensing, any GST/HST& PST considerations, and any CPP liability.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started