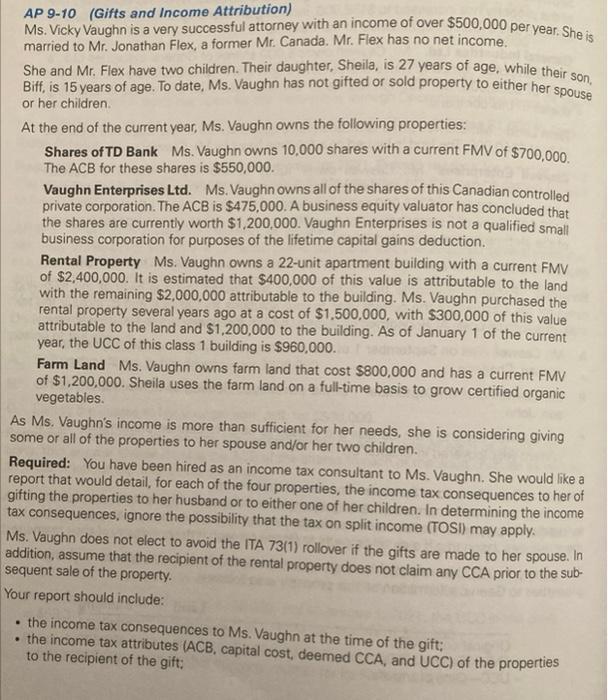

AP 9-10 (Gifts and Income Attribution) Ms. Vicky Vaughn is a very successful attorney with an income of over $500,000 per year. She is married to Mr. Jonathan Flex, a former Mr. Canada. Mr. Flex has no net income. She and Mr. Flex have two children. Their daughter, Sheila, is 27 years of age, while their son, Biff, is 15 years of age. To date, Ms. Vaughn has not gifted or sold property to either her spouse or her children. At the end of the current year, Ms. Vaughn owns the following properties: Shares of TD Bank Ms. Vaughn owns 10,000 shares with a current FMV of $700,000. The ACB for these shares is $550,000. Vaughn Enterprises Ltd. Ms. Vaughn owns all of the shares of this Canadian controlled private corporation. The ACB is $475,000. A business equity valuator has concluded that the shares are currently worth $1,200,000. Vaughn Enterprises is not a qualified small business corporation for purposes of the lifetime capital gains deduction. Rental Property Ms. Vaughn owns a 22-unit apartment building with a current FMV of $2,400,000. It is estimated that $400,000 of this value is attributable to the land with the remaining $2,000,000 attributable to the building. Ms. Vaughn purchased the rental property several years ago at a cost of $1,500,000, with $300,000 of this value attributable to the land and $1,200,000 to the building. As of January 1 of the current year, the UCC of this class 1 building is $960,000. Farm Land Ms. Vaughn owns farm land that cost $800,000 and has a current FMV of $1,200,000. Sheila uses the farm land on a full-time basis to grow certified organic vegetables. As Ms. Vaughn's income is more than sufficient for her needs, she is considering giving some or all of the properties to her spouse and/or her two children. Required: You have been hired as an income tax consultant to Ms. Vaughn. She would like a eport that would detail, for each of the four properties, the income tax consequences to her of jifting the properties to her husband or to either one of her children. In determining the income ax consequences, ignore the possibility that the tax on split income (TOSI) may apply. Us. Vaughn does not elect to avoid the ITA 73(1) rollover if the gifts are made to her spouse. In ddition, assume that the recipient of the rental property does not claim any CCA prior to the subequent sale of the property. our report should include: - the income tax consequences to Ms. Vaughn at the time of the gift; - the income tax attributes (ACB, capital cost, deemed CCA, and UCC) of the properties to the recipient of the gift