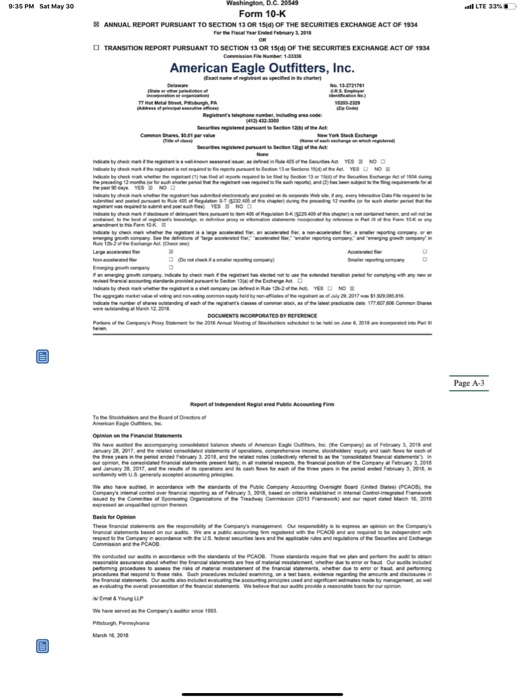

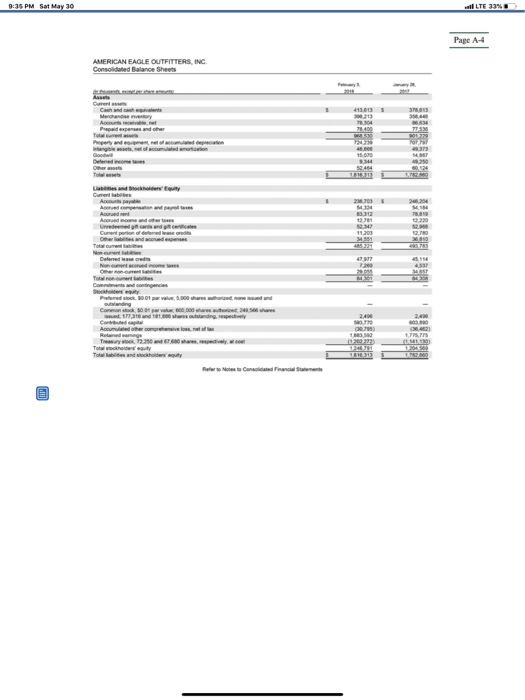

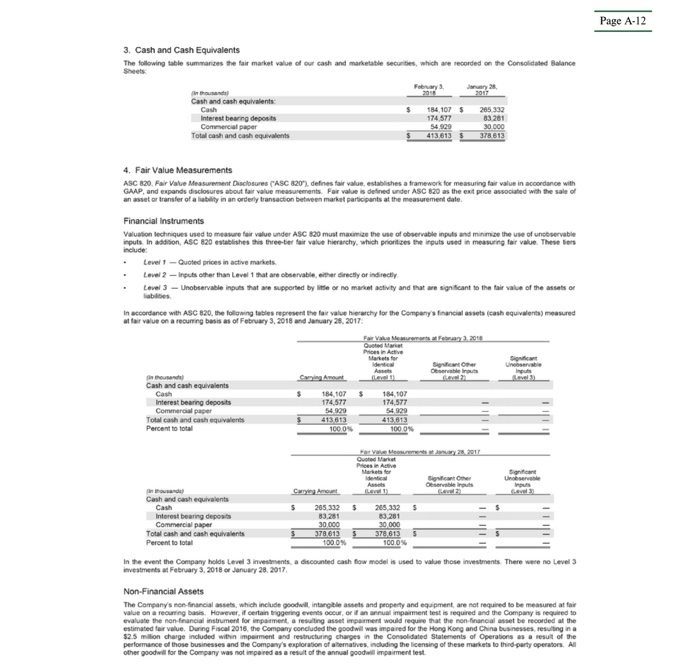

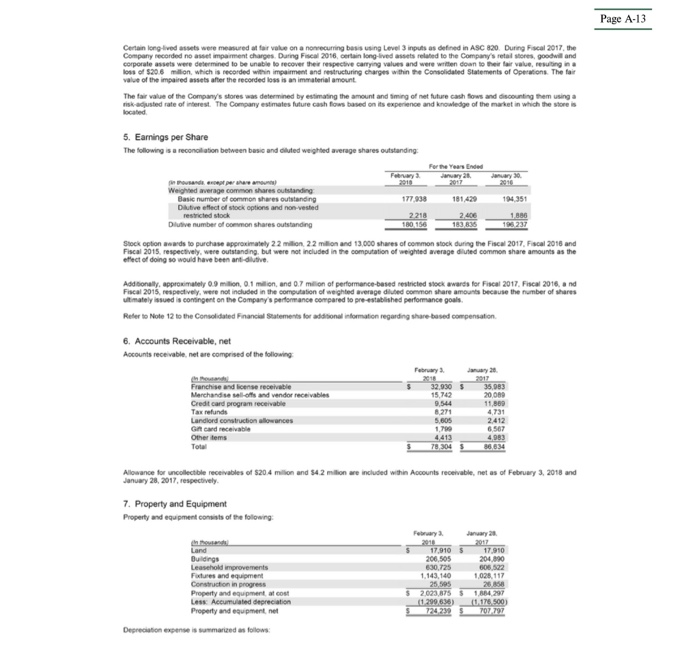

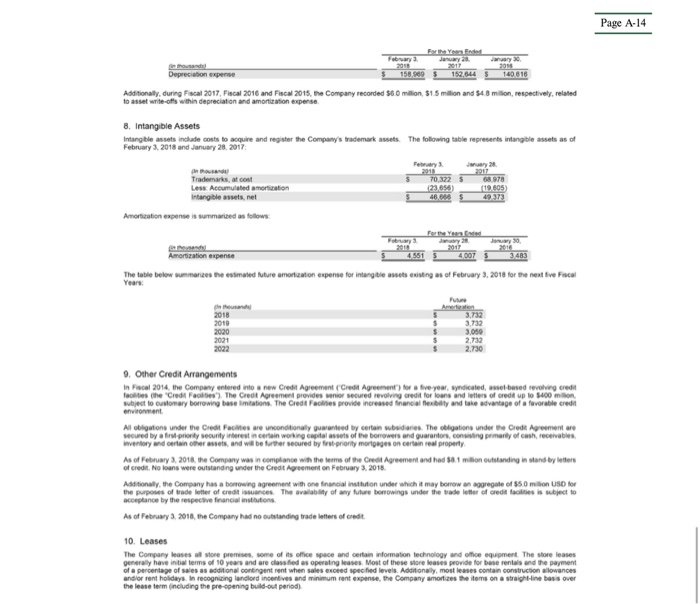

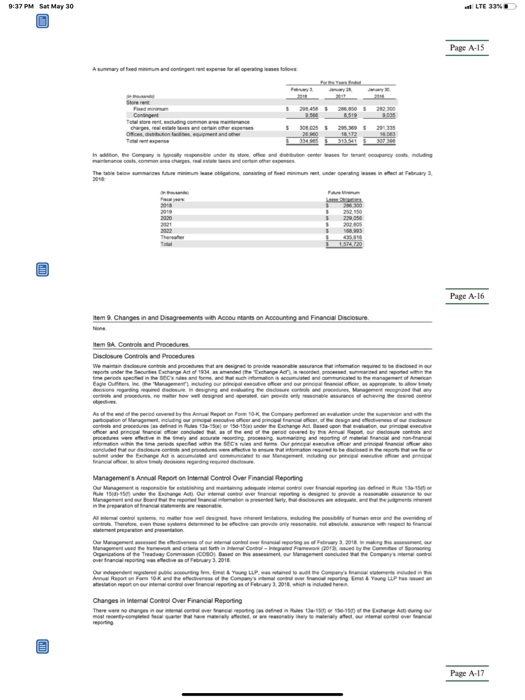

AP1-4 Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Which company reports higher total assets? 2. Which company reports higher total liabilities? Does this always mean this company has a higher chance of not being able to repay its debt and declare bankruptcy? Explain. 3. What relevant information do total assets and total liabilities provide to creditors deciding whether to lend money to American Eagle versus Buckle? 4. Which company reports higher net income? Does this always mean this company's operations are more profitable? Explain. 5. What relevant information does net income provide to investors who are deciding whether to invest in American Eagle versus Buckle? 9:35 PM Sat May 30 all F % Washington, DC. 20548 Form 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Year End February, 2018 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 OF THE SECURITIES EXCHANGE ACT OF 1994 American Eagle Outfitters, Inc. tract name of registrant specified in the charter D ERS TT Hot Mettere g. New Yorge e prengte mended Indicate by the mannen Region 24 of the chale Indice by check where Russell Ecom Yangout company indicate by the man the rest has elected the wiedras turting andere provided predicted the change Act Indimely check whether the committed in detar YES NO Indem ember her ending dah of their commodo et Commen them DOCUMENTS INCORPORATED WY REFERENCE Portero e Capanement 2018 en Mading of the scheduled to be held on June 6, 2018 e retet Page 3 Report of independent Registered Paccounting Form American Eagle Outline Opinion on the Financial Statements We have to the connected news American Eagle Oures, ethe Company February 2018 Juary 28, 2017, and the red cared weens the tree years the period andedrary 3, 2018, and the role ollectively referred to as the code nacement ured many web. 2018 and ary 28, 2017 and the results of sprins discushows that the hears the periode Feb 3, 2018 We also have died in ordance with the standarde of the puble Company Accounting Oversight Board United PCOS Comme 2.29 und by the comme Sponsoring March 2018 These financialmente the responsibility of the Company's management. Our responsibility financement med en die Wewe regard to be independent spect to the Company cordance with the US. del lions of the Securities and share Comission and the PCROB We conducted on windende standards of the PCADR Those standards in het weer and performed Performing procedures to less themes of material watent of the financement, whether due to enor or fraud wd performing procedures a respond to thoses such procedures included camining on severaging the more and disco the financial statements Our wadi oncluded willing the counting principles and and significant estimates made by management, we wm& YUP We served as the Company's done Psburgh Penye 9:35 PM Sat May 30 LTE NO Page 14 AMERICAN EAGLE OUTFITTERS, INC Consolidated Balance Sheets 5 37, Cente Cash and cheques Merchandise invertory Aurel Prepaid expenses and other Tom angeel, retol comited unto 413,613 104 7.400 37 15.00 2.44 52.464 Othere Lies and Stockholders will Current labels And concerten und Andred income and others Uredit cards and rates ME 30 33.312 13 20 12.750 3551 4777 51 Deferred me credite Non comentare comes O non current MOST Soldes Peredok 0.0 5.000 here who need and Commands of people who shares w 18 standing 249 13 1 FPS 146 Total where out Total abilities and her soul Refer to test Consolidated and the 9:35 PM Sat May 30 all 11 Page AS AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Operations how Total true Cost of including certain buying company and a 200 2242 SO 540 men andre har Depreciation and mortation Opening inom 1421 37.15 8309 37 1221 comment Discontinued operations net ofta 4 $ 117 can contingco Discontinued certos 112 135 1165 19 come per common shart Income from continuing Die net come per here Weighted average common shares standing-basic 43 18 9:35 PM Sat May 30 all f| Page 16 AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Comprehensive Income 2015 Other comprehensive and for Ghosh Comprehranom SGP Refer to House Consolidated Financial Statement 9:35 PM Sat May 30 LTE SINE Page A-7 AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Stockholders' Equity ht . 33 ST ra No 04 100.000 177.316 standing 001 w woning of value 28 2017.000 hores de 500 valore common wary 31, 2015. The Company has 5.000 hored one or afstanding, 30.01 par prutened lock for a periode presented 72.280 hares hare and shares bary 2, 2018 January 28, 2017 January 30, 2016 respectively. During 2017, 2016, and aca2015. 2. 2.206 where and 1.306 has respectively, were from many stock for the 9:37 PM Sat May 30 4 1 1 Page 18 AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Cash Flows TE De 3.3 TO NE MM KE 19 SCH WEE 200 www Com when www WE . Cash and throwing Refer to Nos Consolidated ancial Statement Page A-9 AMERICAN EAGLE OUTFITTERS, INC. Notes to Consolidated Financial Statements For the Year Ended February 3, 2018 1. Business Operations American Eagle Oufters, Inc. (the Company o "NEO, Inc."), a Delaware corporation, operates under the American Eagle Oufters ('AEC") and Aerie by American Eagle Outfitters('here" brands Founded in 1977 AEO, Inc. is a leading multi-brand specialty retailer that operates more than 1,000 retail stores in the US and internationally online at www.ce.com and www.derie.com and international store locations managed by third party operators. Through its portfolio of brands, the Company offers high quality, on-trend clothing, accessories and personal care products at affordable prices. The Company's online business, AEO Direct, ships to 81 countries worldwide In Fiscal 2015 AEO Inc. acquired Telgate Clothing Company (Taigate"), which owns and operates Tailgate, vintage, sports-inspired apparel brand with a college town store concept, and Todd Snyder New York, a premium menswear brand. Merchandise Mix The following table seats forth the approximate consolidated percentage of total net revenue from continuing operations ambutable to each 37 Men's apparel and cessories Women's apparel and accessories (excluding Aerie) Aerie Total 53 135 100 1009 9 100% 2. Summary of Significant Accounting Policies Principles of Consolidation The Consolidated Financial Statements include the accounts of the Company and its wholly owned subsidiaries. Al intercompany transactions and balances have been eliminated in consolidation At February 3, 2018, the Company operated in one reportable segment The Company ested its 77 brand in 2012. These Consolidated Financial Statements reflect the results of this as discontinued operations for al periods presented Fiscal Year Our fiscal year ands on the Saturday nearest to January 31 As used herein, Fiscal 2018 refers to the 52-week period ending February 2, 2019 Fiscal 2017 refers to the s3 week period ended February 3, 2018. Fiscal 2016" and "Focal 2015 refer to the 52-week periods ended January 28, 2017 and January 30, 2016, respectively Estimates The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (GAP) contingent stets and tables at the date of the financial itements and the reported amounts of revenues and expenses during the reporting period. Actuel fet could differ from those estimates on an ongoing bass, our management reviews its estimates based on currently available Information Charges in facts and cumstances may result in revised estimates Cash and Cash Equivalents The Company considers all highly squid investments purchased with a remaning maturity of three months or less to be cash equivalents. A of February 3, 2018 and January 28, 2017, the Company had no short term investments Refer to Note 3 to the Consolidated Prancis Statements for information regarding cash and cashegvalents and investments Merchandise Inventory Merchandise inventory is valued at the lower of average cost or market utilizing the retail method. Average cost includes merchandise design and sourcing costs and related expenses. The Company records merchandise recepts at the time which bottle and risk of loss for the merchandise transfers to the Company The Company reviews to inventory levels to identify slow moving merchandise and generally uses markdowns to clear merchandise. Additionally, the Company estimates a markdown reserve for ture planned permanent markdowns related to current inventory Markdowns may occur when inventory exceeds customer demand for reasons of style seasonal adaptation changes in customer preference, lack of consumer acceptance of fashion tems, competition, or if it is determined that the wentory in Mock will not solat is currently ticketed price. Such markdowns may have a material adverse impact on caminos, depending on the extent and amount of inventory affected. The Company to estimates a shrinkage reserve for the period between the last physical count and the balance sheet date. The estimate for the shrinkage reserve, based on historical results can be affected by changes in merchandise me and changes in actual shrinkage trends Page A-10 Buildings Property and Equipment Property and equipment is recorded on the basis of cost with depreciation computed utlizing the straight ine method over the assets estimated useful lives. The useful lives of our masses of assets are as follows: Leasehold improvements Lesser of 10 years or the term of the lease Fatures and equipment Information technology 3-5 years As of February 3, 2018, the weighted average remaining use ite of our assets is approximately 8.1 years. In accordance with ASC 300. Property. Plant and Equipment, the Company's management evaluates the value of leasehold improvements and store fixtures associated with retail stores, which have been open for a period of time sufficient to reach maturity. The Company evaluates long-lived assets for impairment at the individual store level which is the lowest level at which individual cash flows can be identified impairment losses are recorded on long-lived assets used in operations when events and circumstances indicate that the assets might be impaired and the undiscounted mpaired assets are adjusted to their estimated for value and an impairment loss is recorded separately as a component of operating income under loss on impairment of assets. During Fiscal 2017 and Fiscal 2015, the Company recorded no asset impairment charges During Fiscal 2016, the Company recorded pre-tax asset impairment charges of $20.8 million that included 57.2 million for the impairment of all Company owned retail stores in the United Kingdom, Hong Kong and China. This amount is included within impairment and restructuring charges in the consolidated Statements of Operations. These charges were the result of business performance and exploring an initiative to convert these markets to licensed partnerships Retail stores in these markets no longer are able to generate sufficient cash flow over the expected remaining lease term to recover the carrying value of the respective stores assets. Additionally, the Company recorded $10.8 milion of impairment charges related to non store corporate assets that support the United Kingdom, Hong Kong and China Company owned retail store and e-commerce operations and $2.5 milion of goodwill impairment for the China and Hong Kong retail operations When the Company closes, remodels or relocates a store prior to the end of its lease term, the remaining netbook value of the assets related to the store is recorded as a write-off of assets within depreciation and amortization expense Refer to Note 7 to the Consolidated Financial Statements for additional information regarding property and equipment and Note 15 for additional information regarding impairment charges Goodwill The Company's goodwill is primarily related to the acquisition of its importing operations. Canadian, Hong Kong and China businesses and the quisition of Tailgate and Todd Snyder. In accordance with ASC 350 Intangibles Goodwill and Other CASC 350), the Company valuates goodwill for possible impairment on at least an annual basis and last performed an annual impaiment tests of February 3, 2018. As a result, there were no mpairments recorded during Focal 2017. During Fiscal 2016, the Company concluded the goodwill was impared for the Hong Kong and China businesses, resulting in a $2.5 milion charge included within moment and restructuring charges in the Consolidated Statements of Operations a result of the Company's plans to convert these markets to licensed partnerships Aloer goodwill for the Company was not impaired as a result of the annual goodwill imparment test Intangible Assets Intangible assets are recorded on the basis of cost with amortization computed aing the straight line method over the assets estimated useful lives. The Company's intang ble assets, which primarily include trademark assets, are amonised over 15 to 25 years The Company evaluates intangible sets for impairment in accordance with ASC 350 when events or circumstances indicate that the carrying value of the asset may not be recoverable. Such an evaluation includes the estimation of undiscounted future cash flows to be generated by those assets. If the sum of the estimated future undiscounted cash flows is less than the carrying amounts of the assets, then the assets are impared and are adjusted to the estimated fair value. No wang ble asset imparment charges were recorded for a periods presented Refer to Note 3 to the Consolidated Financial Statements for additional information regarding intangible assets. Revenue Recognition Revenue is recorded for store sales upon the purchase of merchandise by customers. The Company's e-commerce operation records revenue upon the estimated customer receipt date of the merchandise Shipping and handling revenues are included in total net revenue Sales tax collected from customers is excluded from revenue and is included as part of scored income and others on the Company's Consolidated Balance Sheets Revenue is recorded net of estimated and actual sales retums and deductions for coupon redemptions and other promotions. The company records the impact of adustments to stratum reserve quarterly within total net revenue and cost of sales. The sales returreserve reflects an estimate of sales returns based on projected merchandise returns determined through the use of historical average ratum percentage 2011 Beginning balance Returns Provision Ending balance (103.393) 104471 97410 303 100.710) 0001D Revenue is not recorded on the purchase of Cards A current abity is recorded upon purchase and revenue is recognized when the gift card is redeemed for merchandise. Additionally, the Company recognizes revenue on vedeemed of cards based on an estimate of the amounts that will not be redeemed cont card breakage') determined through historical redemption trends on card breakage revenue is recognized in proportion to actual gift card redemptions as a component of total net revenue. For further information on the Company gift card program, refer to the on Cards caption below Page A-11 The Company recognizes royalty revenue penerated from its license or franchise agreements based upon a percentage of merchandise sales by the license franchisee. This revenue is recorded as a component of total net revenue when eamed Cost of Sales, Including Certain Buying, Occupancy and Warehousing Expenses Cost of sales consists of merchandise costs, including design, sourcing, importing and inbound freight costs, as well as markdowns, shrinkage and certain promotional costs (colectively "merchandise costs") and buying occupancy and warehousing costs. Design costs are related to the Company's Design Center operations and include compensation, travel and entertainment, supplies and samples for our design teams, as well as rent and depreciation for our Design Center. These costs are included in cost of sales as the respective inventory is sold Buying occupancy and warehousing costs consist of compensation, employee benefit expenses and travel and entertainment for our buyers and certain senior merchandising executives, rent and utilities related to our stores, corporate headquarters, distribution centers and other office space freight from our distribution centers to the stores compensation and supplies for our distribution centers, including purchasing, receiving and inspection costs, and shipping and handling costs related to our e-commerce operation. Gross profit is the difference between total net revenue and cost of sales Selling General and Administrative Expenses Selling general and administrative expenses consist of compensation and employee beneft expenses, including salaries, Incentives and related benefits associated with our stores and corporate headquarters. Selling general and administrative expenses also include advertising costs supplies for our stores and home office, communication costs, travel and entertainment, leasing costs and services purchased Selling general and buyers and our distribution centers as these amounts are recorded in cost of sales. Additionally, seling, general and administrative expenses do not include rent and uties related to our stores, operating costs of our distribution centers, and shipping and handling costs related to our e-commerce operations Advertising Costs Certain advertising costs, including direct mail, in-store photographs and other promotional costs are expensed when the marketing campaign commences As of February 3, 2018 and January 28, 2017, the Company had prepaid advertising expense of 566 million and $84 million respectively. Al other advertising costs we expensed as incurred. The Company recognised $1298 milion $124.5 million and $104.1 milion in advertising expense during Fra 2017 Fiscal 2016 and Fiscal 2015, respectively Store Pre-Opening Costs Store pre-opening costs consist primarily of rent, advertising, supplies and payroll expenses. These costs are expensed as incurred Other (Expense) Income,Net Other expense income, net condits primarily of lowances for uncollectible receivables, foreign currency transaction pantom, interest Income expense and realized investment gains.es Gift Cards The value of art card is recorded as a current ability upon purchase and revenue is recognized when the card is redeemed for merchandise. The Company estimates of card breakage and recognizes revenue in proportion to actual card redemptions as a component of total net revenue. The Company determines an estimated gift card breakage rate by continuously evaluating historical redemption date and the time when there is a remote Relhood that of card will be redeemed The Company recorded gift card breakage of $10.1 milion 59.1 milion and 582 milion during Fiscal 2017 Fiscal 2016 and Fiscal 2015, respectively Page A-13 Certain long-lived assets were measured at far value on a nonrecurring basis using Level 3 inputs as defined in ASC 320. During Fiscal 2017, the Company recorded no asset impairment charges. During Fiscal 2016, certain long-lived assets related to the Company's retail stores, goodwill and corporate assets were determined to be unable to recover their respective carrying values and were written down to their fair value, resulting in a loss of $20.6 million, which is recorded within impairment and restructuring charges within the Consolidated Statements of Operations. The fair value of the impaired assets after the recorded loss is an immaterial amount. The fair value of the Company's stores was determined by estimating the amount and timing of net future cash flows and discounting them using a risk adjusted rate of interest. The Company estimates future cash flows based on its experience and knowledge of the market in which the store is located 5. Earnings per Share The following is a reconciliation between basic and diluted weighted average shares outstanding For the Year Ended February January 26 January 30 nousands or share amounts 2016 2017 2016 Weighted average common shares outstanding Basic number of common shares outstanding 177938 181429 194351 Dilutive effect of stock options and non vested restricted stock 2218 2406 1.888 Ditive number of common shares outstanding 180,156 Stock option awards to purchase approximately 22 million 22 million and 13,000 shares of common stock during the Fiscal 2017, Fiscal 2018 and Fiscal 2015, respectively, were outstanding, but were not included in the computation of weighted average diluted common share amounts as the effect of doing so would have been anti-dutive Additionally, approximately 0.9 million 0.1 million, and 0.7 million of performance-based restricted stock awards for Fiscal 2017 Fiscal 2016, and Fiscal 2015, respectively, were not included in the computation of weighted average diluted common share amounts because the number of shares ultimately issued is contingent on the Company's performance compared to pre-established performance goals. Refer to Note 12 to the Consolidated Financial Statements for additional information regarding share based compensation 6. Accounts Receivable, net Accounts receivable, neture comprised of the following February 32.930 5 15,742 Franchise and license receivable Marchand te melloff and vendor receivables Credit card program receivable Tax refunds Landlord construction allowances Gand receivable Other tems Total 35,083 20.000 11.00 4.731 2,412 6.567 8.271 5.605 1.790 78.3045 January 28, 2017, respectively Alowance for uncollectible receivables of $20.4 million and 542 million we included within Accounts receivable, net as of February 3, 2018 and 7. Property and Equipment Property and equipment consists of the following: February Land 17.9105 17.910 Buildings 206.505 204.890 Leasehold improvements 630,725 608.522 Fixtures and equipment 1.143,140 1,028, 117 Construction in progress 25,595 Property and equipment at cost $ 2.023,875 $ 1.884.297 Less Accumulated depreciation 1 299,6) 1.176.500) Property and equipment, net 7242395 707-797 Depreciation expense is summarized as follows: Page A-14 January Depreciation expense 158.500 152.6445 140.618 Additionally, during Fiscal 2017. Fiscal 2016 and Fiscal 2015, the Company recorded 56 million $1.5 million and 54.8 million, respectively related to asset write-offs within depreciation and amortization expense 8. Intangible Assets Intangible assets include costs to acquire and register the Company's trademark assets. The following table represents intangible assets as of February 3, 2018 and January 28, 2017 Perry Trademarks, at cost 70.322 68.970 Less Accumulated amortization 23.656) (19.605 Intangibles, net Amortization expense is summarized as follows: Jay Jaya Amortization expense 4551 The table below summarizes the estimated future amortization expense for intangiblesses existing us of February 3, 2018 for the next five Focal Years 3.732 2018 2010 2020 2021 2022 $ 2,732 2.730 9. Other Credit Arrangements In Focal 2014, the Company entered into a new Credit Agreement (Credit Agreement) for a five-year, Wyndicated, sel based revolving credi subject to customary borrowing base imations. The Credit Facines provide increased financial flexibility and take advantage of a favorable credit environment All obligations under the Credit Facilities are unconditionally guaranteed by certain wbudaries. The obligations under the Credit Agreementare sored by a priority security interest in certain working capital assets of the borrowers and quarantorsconing primarily of cash receivables wventory and certain the asses, and will be further secured by first priority mortgages on certain real property As of February 3, 2018, the Company was in compliance with the terms of the Credit Agreement and had 38.1 milion outstanding in stand by letters of credit. No loans were outstanding under the Credit Agreement on February 3, 2018 Additionally, the Company has a borrowing agreement with one financial instrution under which it may bomow an aggregate of $50 million USD for the purposes of trade letter of credit suunces. The valability of my future borrowings under the trade letter of credit facilities is subject to acceptance by the respective financial institutions As of February 3, 2018, the Company had no outstanding trade letters of credit 10. Leases The Company lases al store premises, some of its office space and certain information technology and office equipment. The store leases generally have intial terms of 10 years and are classified as operating leases. Most of these store lases provide for base rentals and the payment of a percentage of sales as additional contingent rent when sales exceed specified levels. Additionally, mostlease contain construction allowances and/or rent holidays. In recognizing landlord incentives and minimum rent expense, the Company amortizes the items on a straight line basis over the lease term including the pre-opening build-out period) LTE SONO Page A-15 Page A-16 www.welt werden 9:37 PM Sat May 30 17 Away of five minimum and contingenter expense oral operating follows 2020 Contingent 351 he was Tolstoerent.excluding common mantenance Contribution to soment and other 21 182 The table below me one of fundinum rent under spring in het February 2018 2018 202.00 350 Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Item SA Control and Procedures Disclosure Controls and Procedures We maman dedicate and procedura digree to provide remote chat information required be direcionad now reports under the Securities Change Act of 1934. amanded the change for recorded red and reported within the time periode specified in the normand Necmited and committed to the management of American Engle Ourense Managemelding opel doctoging dado and our profinancial offers to allow timely Secondo Manager contandreres no me how well egned and prod. can provide bewe of cheming the wed As of the end of the period covered by the Report on Fom. To the Company performed to under the end participation of argument including principal activelor and precipiant of the dough and effects of our core cards and procedures in defined in 1985 156 157 under the change Act. Bened upon the evaluation, our principali oor and principalance of concluded that of the end of the period covered by the Annual Report our core control and cedures were often they when cing mating and reporting of material financial Come Our live mation endere to our Management de Management's Annual Report on internal Control Over Financial Reporting Our Management is responsible for thing and maintaining adequate to control over and reporting Rule 155 de changed out when cover foregoing Management de Bordele Alwernal controle, no matter how well desgrad have herenmationencluding the po cert Therefore, come Management and the news and enteret for in grand France 2013 Operations of the Treaty Como Cosos Based Our independent registered pole mingin. Emel & Young Pened to the Company's financements included in the Anul Report on Form 10 and the other of the company's porting Emot & Young LLP son report on our internal control over for reporting of February 2018 wichs de foran Changes in Internal Control Over Financial Reporting na reporting as defined in 13-106-10 of the Exchange Aung Page A-17 Page A-17 Report of Independent Registered Public Accounting Firm To the Stockholders and the Board of Directors of American Eagle Outfiters, Inc. Opinion on Internal Control over Financial Reporting We have audited American Eagle Outfitters, Inc.'s internal control over financial reporting as of February 3, 2018, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) (the COSO criteria). In our opinion, American Eagle Outfitters, Inc. (the Company maintained in all material respects, effective internal control over financial reporting as of February 3, 2018, based on the Cos criteria We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) PCAOB), the consolidated balance sheets of the Company as of February 3, 2018 and January 28, 2017, the related consolidated statements of operations, comprehensive income, stockholders' equity and cash flows for each of the three years in the period ended February 3, 2018, and the related notes and our report dated March 16, 2018 expressed an unqualified opinion thereon. Basis for Opinion The Company's management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting included in the accompanying Management's Annual Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company's internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the US federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion Definition and Limitations of Internal Control Over Financial Reporting A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company, (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company, and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements Because of its inherent limitations, Internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. is/Ernst & Young LLP Pittsburgh, Pennsylvania March 16, 2018 8:41 PM Sat May 30 - 11 Page B-2 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC. 20549 FORM OK ANNUAL REPORT RRSUANT TO SECTION DORING OF THE SECURITIES EXCHANGE ACT OF 1654 TRANSITION REPORT REANT TO SECTION DORIRE OF THE SECURITIES EXCHANGE ATOM THE BUCKLE. INC. GRST 20 W Street, Kany, herkes w Page B-3 MEMES FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM malo new he is focal policy di calos beach of the faca yani pe cel diary. 2008, my w We beweee with them of the Company commented bol were per Oy The mother RO was ich fil 8:42 PM Sat May 30 vl 12 Page 3-4 THE BONE, INC CONSOLIDATED BALANCE SHEETS Forum way CURRENT ASSETS PROPERTY AND VEM INVESTMENTS OSTS BERRED RINTABLETY C. p. www.my ... 9:42 PM Sat May 30 l 12 Page B-S THE BUONLEINE CONSOLIDATED STATEMENTS OF INCOME J. SALES, NT, SL, Sporty COST OF SALIS. . ST 23 INCOME FROM OPERATORS IN 151 ONIC 31 INCOME MORE INCOME TALES IN PROVISION FOR INCOME TAXES NET INCOME EARNINOS PARE 200 9:42 PM Sat May 30 LTE 32NO Page B-6 THE BLIND CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Thelma Forway COME INCOME TAX uns 9:42 PM Sat May 30 l 12 Page B-7 THE BUNE INC CONSOLIDATE STATEMENTS OF STOCKHOLDERS' EQUITY in Than ExpeShare and Share IN Page B-10 de France, the A er the GEW D. PROPERTY AND EQUIPMENT February January 28, 2015 2017 Land Building and improvements 42 Office equipment Truvialis zil 2016 20:55 Lenched in me 166564 Pure and fixtures 102,019 183,046 Shipping og 2.267 E FINANCING ARRANGEMENTS The Company has available as accurod line of credit of $25,00 with Wells Fargo Bank, NA, for operating moods and others of credit. The line of credit agreement has an expiration date of July 31, 2019 and provides that $10,000 of the 50.000 line is available for of credit. Being under the line of credit provide for interest to be paid at a rate based on LIBOR. The Company has from time to time, borrowed against these lines of credit. There were to busk borrowings of Phy, 2018 and January 28, 2017. There were no bunk borrowing during fiscal 2017, 2016, and 2015. The Company had outstanding loties of credit totaling S137) and 51,7% as ofruary 3, 2018 and Jomary 28, 2017, compostely H. COMMITMENTS AND CONTINGENCIES Leases. The Company conducts its operations in lowed facilities under numerous scalable operating less expiring at various dates through focal 2008 Most of the Company's stres have lowetomer approximately ten years and generally de containewal option. Most la mente contain tenant improvement ances, rend holidays, rent escalatice cles, and contingent rent provision for purposes of recogniring lewe incentives and minim releme stige the Company enters expense on the combate of the . of the reconds contingent real Bibility on the colidited belowe sheets and the componding rentapeme when weefed levels have been by protulle to be achieved Operating how to rental we fix final 2017 2016 2015 2,154 8.819.867.121, respectively. Most of the payment we owed communal plus permetgefales in een of a pied mount. Pentagons for final 2017, 2016 and 2015 were $2.130,52,000, and 54,334, respectively Total future minimum rental commitments under the operating tones with remaining lae torms in een of one year of Foruary 2018 es follow Minimum Rental heal Year Commitments 2011 2000 1,037 2001 Thewler 1234 Lipatie Prime to time, the Company is involved in the relating to comertising out of its operation in the malerweise. As of the date of the comidate willement, the Company was told in my lewending that we expected individually or in the wee to be material effect on the Company's commodated results of operation francia peste Sevwly fader. On June 16, 2017, the Company wewed at the com www that it was a victime data wity incident in which a criminal www.height wete, il Company formed at the payment diferem were idented with a fera of malincok, which enably TW Company in the citieve become the winte calcunity ments, and will work vilunity to pee this matter to resolution used on the forme investigation, the Company Ichives that wil only me, mal wees, physical des were obtained by the criminally responsible. There is so evidence that the bottle.com website or buckle.com passwore imported cepted then the payment and brands and cooperated fully with the card brands, their force experts, dowcament during the investigation. At this time, it is not possible to really estimate the amount of any potential, fines paties, other labilities in contine 9:46 PM Sat May 30 ai E3. Page B-11 K EARNINGS PER SHARE The following the provides a clic etwa hasi and God camins persone February 3, 2011 www. few Navod DES L SEGMENT INFORMATION The Carpany is a state of her price wall townThe Cente Company operated 657 secated in the hottested Stewaficheruary The following is in the Company's major productie pe of the Copy's twee February Merchandise Groep Accoria 91 Foto 6129:23 13 15 Tool Page B-12 MMS-CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE MEMSA-CONTROLS AND PROCEDURES The Company of indepesume designed to probleme materiali required to be ind indeel is welcome management in any met. As of the effect of the of the Company's die idee is Rules to the Edge Act of 1934 echter produsele code the period owned by report. This was performed the per te pare Chief Estive Officer Chief Fileerd en het in de Chile Officer and Chief Financial Officer ved Company's disclosed process of the end of the periood by this wonde ooikle required to be disclosed by the Company in the Company the files onder die Frage is luding is Cael Executive Ord met een dergeling die diectivele pode me ache is nowded, pronominal gened with the time periode pealed by SEC Change in lateral Control Over Pincial Reporting. There were no changes in the Company's med erfacial reporting the accur during the Currahlatal pai tat are not lostat,aaatty lathy eatile aalaattaai Menapomer Report an Internal Control Over Financial Reporting Management of the Company is responsible for citing and maintaining de memal control oversialpering as defined in Rules 1-10 and 18-18 under the Securities Badge Act of 1934. The Company stolpe con withouting pipe wally opted the indeed American All conte com outros dogodbe o limitation. There are two tomed be with peetto facilement propted price Management has anced coction of the Company's mal como local de Committee of Sporting Cry CCOS) of the Tray Commentaire Chartermark wment of a comel verficial reporting, maled that the Copyrig chryI The Condpendent produits conting fim. Uklonite & Toe Led e do Cey 1 a LTE IIKTI Pape B-12 ------- 9:46 PM Sat May 30 IET IS WITH ACCONTANTS ON ACCOUNTING AND FINANCIAL ESCLARE NIA - CONTELS AT TM Cana aries - , ya para teral ( - Self The paal y tas, alas a Traise ur stand the ana Carat al ET REPORT OF INDEPENDENT REGISTERED RAL ACCOUNTING FIRM We are also a famil -- lar riamm TM ate Scouting AB We are all in one with the share the real world st alaatthamaialairaanai Ampaalai pat openis nilals - - EL Page B-13 AP1-4 Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Which company reports higher total assets? 2. Which company reports higher total liabilities? Does this always mean this company has a higher chance of not being able to repay its debt and declare bankruptcy? Explain. 3. What relevant information do total assets and total liabilities provide to creditors deciding whether to lend money to American Eagle versus Buckle? 4. Which company reports higher net income? Does this always mean this company's operations are more profitable? Explain. 5. What relevant information does net income provide to investors who are deciding whether to invest in American Eagle versus Buckle? 9:35 PM Sat May 30 all F % Washington, DC. 20548 Form 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Year End February, 2018 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 OF THE SECURITIES EXCHANGE ACT OF 1994 American Eagle Outfitters, Inc. tract name of registrant specified in the charter D ERS TT Hot Mettere g. New Yorge e prengte mended Indicate by the mannen Region 24 of the chale Indice by check where Russell Ecom Yangout company indicate by the man the rest has elected the wiedras turting andere provided predicted the change Act Indimely check whether the committed in detar YES NO Indem ember her ending dah of their commodo et Commen them DOCUMENTS INCORPORATED WY REFERENCE Portero e Capanement 2018 en Mading of the scheduled to be held on June 6, 2018 e retet Page 3 Report of independent Registered Paccounting Form American Eagle Outline Opinion on the Financial Statements We have to the connected news American Eagle Oures, ethe Company February 2018 Juary 28, 2017, and the red cared weens the tree years the period andedrary 3, 2018, and the role ollectively referred to as the code nacement ured many web. 2018 and ary 28, 2017 and the results of sprins discushows that the hears the periode Feb 3, 2018 We also have died in ordance with the standarde of the puble Company Accounting Oversight Board United PCOS Comme 2.29 und by the comme Sponsoring March 2018 These financialmente the responsibility of the Company's management. Our responsibility financement med en die Wewe regard to be independent spect to the Company cordance with the US. del lions of the Securities and share Comission and the PCROB We conducted on windende standards of the PCADR Those standards in het weer and performed Performing procedures to less themes of material watent of the financement, whether due to enor or fraud wd performing procedures a respond to thoses such procedures included camining on severaging the more and disco the financial statements Our wadi oncluded willing the counting principles and and significant estimates made by management, we wm& YUP We served as the Company's done Psburgh Penye 9:35 PM Sat May 30 LTE NO Page 14 AMERICAN EAGLE OUTFITTERS, INC Consolidated Balance Sheets 5 37, Cente Cash and cheques Merchandise invertory Aurel Prepaid expenses and other Tom angeel, retol comited unto 413,613 104 7.400 37 15.00 2.44 52.464 Othere Lies and Stockholders will Current labels And concerten und Andred income and others Uredit cards and rates ME 30 33.312 13 20 12.750 3551 4777 51 Deferred me credite Non comentare comes O non current MOST Soldes Peredok 0.0 5.000 here who need and Commands of people who shares w 18 standing 249 13 1 FPS 146 Total where out Total abilities and her soul Refer to test Consolidated and the 9:35 PM Sat May 30 all 11 Page AS AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Operations how Total true Cost of including certain buying company and a 200 2242 SO 540 men andre har Depreciation and mortation Opening inom 1421 37.15 8309 37 1221 comment Discontinued operations net ofta 4 $ 117 can contingco Discontinued certos 112 135 1165 19 come per common shart Income from continuing Die net come per here Weighted average common shares standing-basic 43 18 9:35 PM Sat May 30 all f| Page 16 AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Comprehensive Income 2015 Other comprehensive and for Ghosh Comprehranom SGP Refer to House Consolidated Financial Statement 9:35 PM Sat May 30 LTE SINE Page A-7 AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Stockholders' Equity ht . 33 ST ra No 04 100.000 177.316 standing 001 w woning of value 28 2017.000 hores de 500 valore common wary 31, 2015. The Company has 5.000 hored one or afstanding, 30.01 par prutened lock for a periode presented 72.280 hares hare and shares bary 2, 2018 January 28, 2017 January 30, 2016 respectively. During 2017, 2016, and aca2015. 2. 2.206 where and 1.306 has respectively, were from many stock for the 9:37 PM Sat May 30 4 1 1 Page 18 AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Cash Flows TE De 3.3 TO NE MM KE 19 SCH WEE 200 www Com when www WE . Cash and throwing Refer to Nos Consolidated ancial Statement Page A-9 AMERICAN EAGLE OUTFITTERS, INC. Notes to Consolidated Financial Statements For the Year Ended February 3, 2018 1. Business Operations American Eagle Oufters, Inc. (the Company o "NEO, Inc."), a Delaware corporation, operates under the American Eagle Oufters ('AEC") and Aerie by American Eagle Outfitters('here" brands Founded in 1977 AEO, Inc. is a leading multi-brand specialty retailer that operates more than 1,000 retail stores in the US and internationally online at www.ce.com and www.derie.com and international store locations managed by third party operators. Through its portfolio of brands, the Company offers high quality, on-trend clothing, accessories and personal care products at affordable prices. The Company's online business, AEO Direct, ships to 81 countries worldwide In Fiscal 2015 AEO Inc. acquired Telgate Clothing Company (Taigate"), which owns and operates Tailgate, vintage, sports-inspired apparel brand with a college town store concept, and Todd Snyder New York, a premium menswear brand. Merchandise Mix The following table seats forth the approximate consolidated percentage of total net revenue from continuing operations ambutable to each 37 Men's apparel and cessories Women's apparel and accessories (excluding Aerie) Aerie Total 53 135 100 1009 9 100% 2. Summary of Significant Accounting Policies Principles of Consolidation The Consolidated Financial Statements include the accounts of the Company and its wholly owned subsidiaries. Al intercompany transactions and balances have been eliminated in consolidation At February 3, 2018, the Company operated in one reportable segment The Company ested its 77 brand in 2012. These Consolidated Financial Statements reflect the results of this as discontinued operations for al periods presented Fiscal Year Our fiscal year ands on the Saturday nearest to January 31 As used herein, Fiscal 2018 refers to the 52-week period ending February 2, 2019 Fiscal 2017 refers to the s3 week period ended February 3, 2018. Fiscal 2016" and "Focal 2015 refer to the 52-week periods ended January 28, 2017 and January 30, 2016, respectively Estimates The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (GAP) contingent stets and tables at the date of the financial itements and the reported amounts of revenues and expenses during the reporting period. Actuel fet could differ from those estimates on an ongoing bass, our management reviews its estimates based on currently available Information Charges in facts and cumstances may result in revised estimates Cash and Cash Equivalents The Company considers all highly squid investments purchased with a remaning maturity of three months or less to be cash equivalents. A of February 3, 2018 and January 28, 2017, the Company had no short term investments Refer to Note 3 to the Consolidated Prancis Statements for information regarding cash and cashegvalents and investments Merchandise Inventory Merchandise inventory is valued at the lower of average cost or market utilizing the retail method. Average cost includes merchandise design and sourcing costs and related expenses. The Company records merchandise recepts at the time which bottle and risk of loss for the merchandise transfers to the Company The Company reviews to inventory levels to identify slow moving merchandise and generally uses markdowns to clear merchandise. Additionally, the Company estimates a markdown reserve for ture planned permanent markdowns related to current inventory Markdowns may occur when inventory exceeds customer demand for reasons of style seasonal adaptation changes in customer preference, lack of consumer acceptance of fashion tems, competition, or if it is determined that the wentory in Mock will not solat is currently ticketed price. Such markdowns may have a material adverse impact on caminos, depending on the extent and amount of inventory affected. The Company to estimates a shrinkage reserve for the period between the last physical count and the balance sheet date. The estimate for the shrinkage reserve, based on historical results can be affected by changes in merchandise me and changes in actual shrinkage trends Page A-10 Buildings Property and Equipment Property and equipment is recorded on the basis of cost with depreciation computed utlizing the straight ine method over the assets estimated useful lives. The useful lives of our masses of assets are as follows: Leasehold improvements Lesser of 10 years or the term of the lease Fatures and equipment Information technology 3-5 years As of February 3, 2018, the weighted average remaining use ite of our assets is approximately 8.1 years. In accordance with ASC 300. Property. Plant and Equipment, the Company's management evaluates the value of leasehold improvements and store fixtures associated with retail stores, which have been open for a period of time sufficient to reach maturity. The Company evaluates long-lived assets for impairment at the individual store level which is the lowest level at which individual cash flows can be identified impairment losses are recorded on long-lived assets used in operations when events and circumstances indicate that the assets might be impaired and the undiscounted mpaired assets are adjusted to their estimated for value and an impairment loss is recorded separately as a component of operating income under loss on impairment of assets. During Fiscal 2017 and Fiscal 2015, the Company recorded no asset impairment charges During Fiscal 2016, the Company recorded pre-tax asset impairment charges of $20.8 million that included 57.2 million for the impairment of all Company owned retail stores in the United Kingdom, Hong Kong and China. This amount is included within impairment and restructuring charges in the consolidated Statements of Operations. These charges were the result of business performance and exploring an initiative to convert these markets to licensed partnerships Retail stores in these markets no longer are able to generate sufficient cash flow over the expected remaining lease term to recover the carrying value of the respective stores assets. Additionally, the Company recorded $10.8 milion of impairment charges related to non store corporate assets that support the United Kingdom, Hong Kong and China Company owned retail store and e-commerce operations and $2.5 milion of goodwill impairment for the China and Hong Kong retail operations When the Company closes, remodels or relocates a store prior to the end of its lease term, the remaining netbook value of the assets related to the store is recorded as a write-off of assets within depreciation and amortization expense Refer to Note 7 to the Consolidated Financial Statements for additional information regarding property and equipment and Note 15 for additional information regarding impairment charges Goodwill The Company's goodwill is primarily related to the acquisition of its importing operations. Canadian, Hong Kong and China businesses and the quisition of Tailgate and Todd Snyder. In accordance with ASC 350 Intangibles Goodwill and Other CASC 350), the Company valuates goodwill for possible impairment on at least an annual basis and last performed an annual impaiment tests of February 3, 2018. As a result, there were no mpairments recorded during Focal 2017. During Fiscal 2016, the Company concluded the goodwill was impared for the Hong Kong and China businesses, resulting in a $2.5 milion charge included within moment and restructuring charges in the Consolidated Statements of Operations a result of the Company's plans to convert these markets to licensed partnerships Aloer goodwill for the Company was not impaired as a result of the annual goodwill imparment test Intangible Assets Intangible assets are recorded on the basis of cost with amortization computed aing the straight line method over the assets estimated useful lives. The Company's intang ble assets, which primarily include trademark assets, are amonised over 15 to 25 years The Company evaluates intangible sets for impairment in accordance with ASC 350 when events or circumstances indicate that the carrying value of the asset may not be recoverable. Such an evaluation includes the estimation of undiscounted future cash flows to be generated by those assets. If the sum of the estimated future undiscounted cash flows is less than the carrying amounts of the assets, then the assets are impared and are adjusted to the estimated fair value. No wang ble asset imparment charges were recorded for a periods presented Refer to Note 3 to the Consolidated Financial Statements for additional information regarding intangible assets. Revenue Recognition Revenue is recorded for store sales upon the purchase of merchandise by customers. The Company's e-commerce operation records revenue upon the estimated customer receipt date of the merchandise Shipping and handling revenues are included in total net revenue Sales tax collected from customers is excluded from revenue and is included as part of scored income and others on the Company's Consolidated Balance Sheets Revenue is recorded net of estimated and actual sales retums and deductions for coupon redemptions and other promotions. The company records the impact of adustments to stratum reserve quarterly within total net revenue and cost of sales. The sales returreserve reflects an estimate of sales returns based on projected merchandise returns determined through the use of historical average ratum percentage 2011 Beginning balance Returns Provision Ending balance (103.393) 104471 97410 303 100.710) 0001D Revenue is not recorded on the purchase of Cards A current abity is recorded upon purchase and revenue is recognized when the gift card is redeemed for merchandise. Additionally, the Company recognizes revenue on vedeemed of cards based on an estimate of the amounts that will not be redeemed cont card breakage') determined through historical redemption trends on card breakage revenue is recognized in proportion to actual gift card redemptions as a component of total net revenue. For further information on the Company gift card program, refer to the on Cards caption below Page A-11 The Company recognizes royalty revenue penerated from its license or franchise agreements based upon a percentage of merchandise sales by the license franchisee. This revenue is recorded as a component of total net revenue when eamed Cost of Sales, Including Certain Buying, Occupancy and Warehousing Expenses Cost of sales consists of merchandise costs, including design, sourcing, importing and inbound freight costs, as well as markdowns, shrinkage and certain promotional costs (colectively "merchandise costs") and buying occupancy and warehousing costs. Design costs are related to the Company's Design Center operations and include compensation, travel and entertainment, supplies and samples for our design teams, as well as rent and depreciation for our Design Center. These costs are included in cost of sales as the respective inventory is sold Buying occupancy and warehousing costs consist of compensation, employee benefit expenses and travel and entertainment for our buyers and certain senior merchandising executives, rent and utilities related to our stores, corporate headquarters, distribution centers and other office space freight from our distribution centers to the stores compensation and supplies for our distribution centers, including purchasing, receiving and inspection costs, and shipping and handling costs related to our e-commerce operation. Gross profit is the difference between total net revenue and cost of sales Selling General and Administrative Expenses Selling general and administrative expenses consist of compensation and employee beneft expenses, including salaries, Incentives and related benefits associated with our stores and corporate headquarters. Selling general and administrative expenses also include advertising costs supplies for our stores and home office, communication costs, travel and entertainment, leasing costs and services purchased Selling general and buyers and our distribution centers as these amounts are recorded in cost of sales. Additionally, seling, general and administrative expenses do not include rent and uties related to our stores, operating costs of our distribution centers, and shipping and handling costs related to our e-commerce operations Advertising Costs Certain advertising costs, including direct mail, in-store photographs and other promotional costs are expensed when the marketing campaign commences As of February 3, 2018 and January 28, 2017, the Company had prepaid advertising expense of 566 million and $84 million respectively. Al other advertising costs we expensed as incurred. The Company recognised $1298 milion $124.5 million and $104.1 milion in advertising expense during Fra 2017 Fiscal 2016 and Fiscal 2015, respectively Store Pre-Opening Costs Store pre-opening costs consist primarily of rent, advertising, supplies and payroll expenses. These costs are expensed as incurred Other (Expense) Income,Net Other expense income, net condits primarily of lowances for uncollectible receivables, foreign currency transaction pantom, interest Income expense and realized investment gains.es Gift Cards The value of art card is recorded as a current ability upon purchase and revenue is recognized when the card is redeemed for merchandise. The Company estimates of card breakage and recognizes revenue in proportion to actual card redemptions as a component of total net revenue. The Company determines an estimated gift card breakage rate by continuously evaluating historical redemption date and the time when there is a remote Relhood that of card will be redeemed The Company recorded gift card breakage of $10.1 milion 59.1 milion and 582 milion during Fiscal 2017 Fiscal 2016 and Fiscal 2015, respectively Page A-13 Certain long-lived assets were measured at far value on a nonrecurring basis using Level 3 inputs as defined in ASC 320. During Fiscal 2017, the Company recorded no asset impairment charges. During Fiscal 2016, certain long-lived assets related to the Company's retail stores, goodwill and corporate assets were determined to be unable to recover their respective carrying values and were written down to their fair value, resulting in a loss of $20.6 million, which is recorded within impairment and restructuring charges within the Consolidated Statements of Operations. The fair value of the impaired assets after the recorded loss is an immaterial amount. The fair value of the Company's stores was determined by estimating the amount and timing of net future cash flows and discounting them using a risk adjusted rate of interest. The Company estimates future cash flows based on its experience and knowledge of the market in which the store is located 5. Earnings per Share The following is a reconciliation between basic and diluted weighted average shares outstanding For the Year Ended February January 26 January 30 nousands or share amounts 2016 2017 2016 Weighted average common shares outstanding Basic number of common shares outstanding 177938 181429 194351 Dilutive effect of stock options and non vested restricted stock 2218 2406 1.888 Ditive number of common shares outstanding 180,156 Stock option awards to purchase approximately 22 million 22 million and 13,000 shares of common stock during the Fiscal 2017, Fiscal 2018 and Fiscal 2015, respectively, were outstanding, but were not included in the computation of weighted average diluted common share amounts as the effect of doing so would have been anti-dutive Additionally, approximately 0.9 million 0.1 million, and 0.7 million of performance-based restricted stock awards for Fiscal 2017 Fiscal 2016, and Fiscal 2015, respectively, were not included in the computation of weighted average diluted common share amounts because the number of shares ultimately issued is contingent on the Company's performance compared to pre-established performance goals. Refer to Note 12 to the Consolidated Financial Statements for additional information regarding share based compensation 6. Accounts Receivable, net Accounts receivable, neture comprised of the following February 32.930 5 15,742 Franchise and license receivable Marchand te melloff and vendor receivables Credit card program receivable Tax refunds Landlord construction allowances Gand receivable Other tems Total 35,083 20.000 11.00 4.731 2,412 6.567 8.271 5.605 1.790 78.3045 January 28, 2017, respectively Alowance for uncollectible receivables of $20.4 million and 542 million we included within Accounts receivable, net as of February 3, 2018 and 7. Property and Equipment Property and equipment consists of the following: February Land 17.9105 17.910 Buildings 206.505 204.890 Leasehold improvements 630,725 608.522 Fixtures and equipment 1.143,140 1,028, 117 C